Family struggles with ballooning $415,000 reverse mortgage after parent's death

By

- Replies 11

When it comes to financial planning and security, especially in our later years, we all hope to leave a legacy that benefits our loved ones, not a debt that burdens them.

However, a distressing story has emerged that serves as a cautionary tale for all of us, particularly those who are considering our financial options as we age.

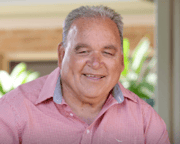

Mark, a 61-year-old schoolteacher, and his brother were left in a state of shock and financial distress after the passing of their 92-year-old father.

‘When Dad passed, it was $401,000 – so it’s gone up by nearly $15,000 since Dad passed, and it’s doing over $2500 a month in interest, and it’s increasing by,’ he said.

‘Neither my brother nor I can borrow that much at our age to prevent it.’

This type of loan, offered by St George Bank, allowed their parents to borrow against the equity in their home, with the debt to be repaid upon the sale of the property.

However, the interest accrued over time, and the loan grew far beyond what the family had anticipated.

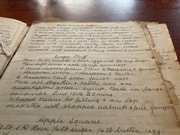

The situation became so dire that in his final days, Mark's father, overwhelmed by the debt, asked a granddaughter to find and destroy any documentation related to the loan, hoping to make the problem disappear somehow.

When Mark's father passed away, the loan stood at $401,000, increasing by over $2,500 monthly in interest.

The family found themselves in a race against time to sell the property before the debt consumed any potential profits.

‘It’s just ridiculous that those types of loans were allowed to happen in the first place, and they can’t put a stop to it,’ he said.

‘My brother is not the type of person to agitate, but that’s in my makeup. I hate injustices, and this is an injustice, and it just burns at me – not only that, it burns me financially.’

‘We are in an awkward position where we were trying to sell as we have to rush to find a buyer because if we don’t, it’s just eating money.’

Mark, who is nearing retirement, and his brother, who is 65, feel powerless to negotiate the 6.32 per cent interest rate or to stop the interest from accruing.

‘They could have bought a Ferrari with the loan amount now,’ he added.

‘The type of loan they don’t offer it anymore as they know it’s predatory.’

They are also facing delays in selling the home, which has been in their family for 100 years, as they wait for probate to be granted.

Mark has contacted the Australian Financial Complaints Authority (AFCA) in hopes of resolving the issue.

‘I don’t have much earning capacity. I’m trying to retire, and my brother is turning 65 and has even less capacity,’ he explained.

‘So we are not in a situation where we can get a loan from the bank. No one is going to touch us. The only thing would be to take an asset out against our house, which we own, but that puts us in a situation where we can’t retire.’

After media attention, St George Bank has agreed to wipe the interest from the date of his father's death and put it on hold for six months.

‘Our teams work closely with surviving family members or executors to help them understand the estate’s financial position and what’s required to move forward,’ they said.

What issues do predatory loans create in financial planning, and how can families manage unexpected debt after a loved one's death?

However, a distressing story has emerged that serves as a cautionary tale for all of us, particularly those who are considering our financial options as we age.

Mark, a 61-year-old schoolteacher, and his brother were left in a state of shock and financial distress after the passing of their 92-year-old father.

‘When Dad passed, it was $401,000 – so it’s gone up by nearly $15,000 since Dad passed, and it’s doing over $2500 a month in interest, and it’s increasing by,’ he said.

‘Neither my brother nor I can borrow that much at our age to prevent it.’

This type of loan, offered by St George Bank, allowed their parents to borrow against the equity in their home, with the debt to be repaid upon the sale of the property.

However, the interest accrued over time, and the loan grew far beyond what the family had anticipated.

The situation became so dire that in his final days, Mark's father, overwhelmed by the debt, asked a granddaughter to find and destroy any documentation related to the loan, hoping to make the problem disappear somehow.

When Mark's father passed away, the loan stood at $401,000, increasing by over $2,500 monthly in interest.

The family found themselves in a race against time to sell the property before the debt consumed any potential profits.

‘It’s just ridiculous that those types of loans were allowed to happen in the first place, and they can’t put a stop to it,’ he said.

‘My brother is not the type of person to agitate, but that’s in my makeup. I hate injustices, and this is an injustice, and it just burns at me – not only that, it burns me financially.’

‘We are in an awkward position where we were trying to sell as we have to rush to find a buyer because if we don’t, it’s just eating money.’

Mark, who is nearing retirement, and his brother, who is 65, feel powerless to negotiate the 6.32 per cent interest rate or to stop the interest from accruing.

‘They could have bought a Ferrari with the loan amount now,’ he added.

‘The type of loan they don’t offer it anymore as they know it’s predatory.’

They are also facing delays in selling the home, which has been in their family for 100 years, as they wait for probate to be granted.

Mark has contacted the Australian Financial Complaints Authority (AFCA) in hopes of resolving the issue.

‘I don’t have much earning capacity. I’m trying to retire, and my brother is turning 65 and has even less capacity,’ he explained.

‘So we are not in a situation where we can get a loan from the bank. No one is going to touch us. The only thing would be to take an asset out against our house, which we own, but that puts us in a situation where we can’t retire.’

After media attention, St George Bank has agreed to wipe the interest from the date of his father's death and put it on hold for six months.

‘Our teams work closely with surviving family members or executors to help them understand the estate’s financial position and what’s required to move forward,’ they said.

Key Takeaways

- A family is distressed after discovering an $85,000 reverse mortgage taken out by their parents ballooned to $415,000 due to accruing interest after their death.

- Mark, the deceased couple's son, is critical of the bank for allowing such 'predatory' loans and is overwhelmed by the financial and emotional toll of the situation.

- The family needs help to sell their inherited property quickly to prevent further erosion of its value due to the high interest rate on the mortgage.

- After intervention from news.com.au, St George Bank agreed to wipe the interest from the date of the father's death and put the loan on hold for six months.