SDC Rewards Member

Upgrade yours now

Email scam ruins mum's plans to leave her kids money - here's how to avoid the same fate

We all want to do right by our kids, especially as we get older. We want to make sure they're taken care of, and if we can manage it – leave them a little something to help them out in life.

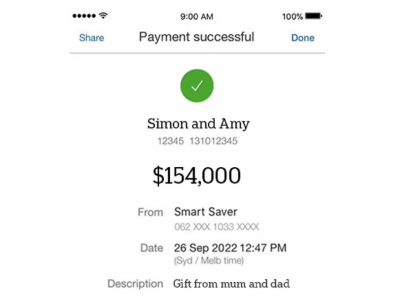

For one mother from Queensland's Sunshine Coast region, that dream turned into a nightmare when she was tricked out of $154,000 by an email phishing scheme.

Tricia Harding thought she was doing the right thing when she reached out to her children via email in April, letting them know that she and her husband had sold their house and wanted to share some of the money with their kids.

She asked them for their bank details so she could send the money over – but what she didn't know is that replies seeming to be from her son Simon and daughter Amy were not really from them at all…

A mum's plans to leave some money for her children were interrupted by email fraud. Credit: Barrier Reef Medical Centre. (Stock photo)

The email address was nearly identical to her children's, with just one extra letter added in each case.

The cybercriminal sent separate bank details supposedly from Simon and Amy (which were fake) to Ms Harding, and she transferred $154,000 into the crook's account without realising what had happened until her children told her the money still hadn't come through days later.

Her daughter Amy told her that she does not have a Commonwealth Bank account; thus, the one stated in the email could not have belonged to her.

Ms Harding said her heart sank after learning the full extent of what had happened, and she had no idea where all her money had gone.

The mum was devastated when she found out she had been scammed in an elaborate phishing scheme. Credit: Daily Mail.

Phishing is where a target or targets are contacted by email, telephone or text message by someone posing as someone else, such as someone they know or a legitimate institution.

The purpose is to lure the person being scammed into providing sensitive data such as banking and credit card details and passwords.

According to IDCare's David Lacey, Ms Harding's mental health, privacy, confidence, and sense of security online have all been severely compromised by this incident.

Using multi-factor authentication, choosing strong passwords, and routinely verifying blocked or deleted messages are just a few of the easy precautions that the security expert advised people to take to secure themselves online.

People who are victims of these crimes are at high risk of having their identity stolen again. Credit: Burst/Unsplash. (Stock photo)

Luckily for Ms Harding (though it still must have been an incredibly stressful experience), she eventually got all of her money back after five months – but not everyone is so lucky when it comes to these kinds of scams.

That's why we're sharing her story as a warning to our members, so you can avoid going through the same awful experience she did.

So, folks, if you're ever contacted out of the blue and asked for personal or financial information, always be vigilant and take the following steps to protect yourself from being scammed:

- Hang up the phone immediately if you're contacted by someone asking for personal or financial information. If you think the request may be legitimate, call the company or institution back yourself using a number you know to be real, such as one from their official website or a phone book.

- Be wary of any unsolicited emails or text messages you receive, even if they appear to be from a company or institution you know and trust. If you're unsure, don't click on any links or open any attachments – just delete them.

- Keep your anti-virus software up to date and run regular scans of your devices.

- Always log out completely and close all browsers when you finish your online banking or shopping sessions.

- Never give out your login details or password to anyone, even if they say they're from your bank or another trusted organisation.

- Use strong, unique passwords for each of your online accounts. A good password is at least eight characters long and contains a mix of upper and lower case letters, numbers and symbols.

- If you think you may have been the victim of a scam, report it to your bank or financial institution immediately.

Tip

Be vigilant by regularly searching for reports of similar frauds and schemes online; the Scam Watch forum on the SDC website is a good place to start!

Losing money to scammers is always a terrible experience, but it can be even worse when it's your life savings that are taken from you.

Members, we hope this story will remind you to be more careful with your personal information and to always double (and even triple) check the correct details before making an online purchase or monetary transfer.

Do you know of any other scam horror stories to share, or perhaps some additional advice that might be useful? Tell us in the comments section below!