Discover this senior's ‘ultimate sacrifice’ for a $60,000 dream home

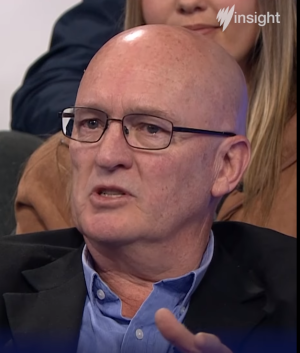

Owning a house is something that many take for granted, but Aussie senior Bruce Jackson knows firsthand just how precious it is.

When Bruce moved to Albury, New South Wales, from Sydney in 1984 at the age of 25, he set his sights on a $60,000 house and was determined to make it his own.

His dedication to his goal was nothing short of inspiring, with him revealing to SBS Insight that he had to scrimp and save to make his dream a reality.

At the time, Bruce earned an annual salary of $22,000 and had to dedicate 43 per cent of it to paying off his mortgage. His pay amounted to about $100 weekly, around $373 in today's money.

'You’d eat mince every night,' Bruce said. 'And you wouldn’t eat the quality mince. You’d eat the cheap mince.'

‘I never went on holidays. Never bought a new car. I got given a second-hand car at 17. It was a 17-year-old car then. I’ve still got it,’ Bruce explained. ‘Every spare cent went on paying off that mortgage.’

Aside from eating 'cheap mince' and foregoing the occasional holiday, Bruce also relied on other forms of income to help pay off his mortgage, having rented out the third bedroom of his house to a friend and frequently selling antique furniture in his spare time.

‘Anything that I made from that went straight on that home loan. I tried to pay it off as soon as possible because the interest rates by 1990 had gone to 17.5 per cent. So they just kept going up and up and up,’ he said.

Bruce later sold the house he bought for $60,000 for a whopping $550,000, a great return on investment.

In a modern comparison, Bruce's 23-year-old daughter recently experienced a more straightforward process of buying her own house.

‘She just stayed, living at home when she finished work,’ he shared. ‘And after two years, she said: “Dad, I might have enough for a deposit for a house.”’

Bruce said she found it to be much easier than he did back in 1984. ‘Just the other day, she said, “I don’t know what everyone’s going on about. It really wasn’t that hard.”’

However, Bruce pointed out that he had more struggles as a home buyer than his daughter.

‘When I bought my house, I was never able to pay rates on time. I was never able to pay for the electricity on time. I was always weeks over on electricity,’ he said.

‘Quite often, I’d have to borrow money off other people to cover that and then pay them back as soon as I had anything spare.’

Bruce also mentioned that certain benefits were not available to him then, such as the first homebuyer scheme and special assistance for essential service workers, which made it relatively easier for her.

These issues plague many millennials today, including freelance photographer Ashley Swallow, who noted that rising living costs have made it difficult to save for a deposit and a future family.

‘Owning a home [and] having a family is definitely something (my partner and I) want to do...but we want a house before we do that. I don’t want to be having my first child at 35. I don’t mind if I buy a house at 35,’ Ashley said.

‘It’s one of those things. It’s kind of held back at the moment because of financial situations,’ she shared.

Ashley shared that she spent her 20s travelling, and despite the pressure, she doesn’t regret her experiences and choice to pursue a career with irregular income.

‘I kind of lived my retirement younger than older. And I’m…ok with that,’ the 30-year-old added.

Another millennial, Xavier George, shared his frustration with the housing market. ‘It’s like, you can do all the right things. You can go to uni and get your degree, and you can get the specialist degree, and you can get promotions... And it kind of just doesn’t matter almost,’ he said.

Xavier has more than 30 per cent of his income allocated to rent while paying off a $100,000 HECS debt.

‘I’m earning more money now on paper than I used to. But I’m definitely not feeling like I earn more money. You know, the cost of life has just grown quicker than my income has,’ Xavier pointed out.

When asked what it will take for him to be a homeowner, Xavier bluntly replied: 'My parents dying, I think.'

‘You know, knock on wood. Sorry, mum. But that’s the windfall. I’m serious about that. That is actually the great tidemark of when a lot of people are going to be able to suddenly buy their own home,’ he explained.

An economist from the University of Sydney, Dr Gareth Bryant, contributed his insights in the episode. He highlighted that the problems millennials are currently facing in relation to buying their own home are very different from those of the older generations.

‘We are talking about two very different problems. In the late 1980s and early 1990s, it was an income problem of people being able to afford repayments. But because house prices were much lower, it wasn’t so much of a wealth problem,’ Dr Bryant stated.

He continued: ‘In the late 1990s, house prices were around 2-3 times average incomes depending on where in Australia you were. Now that figure is 7-10 times, meaning the problem is having enough wealth to get into the property market in the first place.’

‘Many Millennials could actually make mortgage repayments but struggle to get the deposit,’ he pointed out.

A recent survey by the University of Sydney for the Australian Government’s Australian Housing and Urban Research Institute (AHURI) found out that young people were doing ‘everything they could’ to save for a deposit on a house purchase.

This includes taking on extra hours and additional jobs, cutting back on spending, willingness to move to outer-suburban and regional areas. But Dr Bryant said that the millennials ‘still found themselves going backwards due to increasing house prices and rising rents’.

‘The smashed avo on toast cliche is most definitely a myth,’ he confirmed.

Dr Bryant also added that the younger generation, Gen Z, will have a harder time penetrating the housing market, and they could be a generation of lifetime renters.

You can watch a clip of the Insight episode here:

What do you think of this story, dear members? Did you have a similar experience to Bruce when you were buying your own home? Share your stories in the comments below!

When Bruce moved to Albury, New South Wales, from Sydney in 1984 at the age of 25, he set his sights on a $60,000 house and was determined to make it his own.

His dedication to his goal was nothing short of inspiring, with him revealing to SBS Insight that he had to scrimp and save to make his dream a reality.

At the time, Bruce earned an annual salary of $22,000 and had to dedicate 43 per cent of it to paying off his mortgage. His pay amounted to about $100 weekly, around $373 in today's money.

'You’d eat mince every night,' Bruce said. 'And you wouldn’t eat the quality mince. You’d eat the cheap mince.'

‘I never went on holidays. Never bought a new car. I got given a second-hand car at 17. It was a 17-year-old car then. I’ve still got it,’ Bruce explained. ‘Every spare cent went on paying off that mortgage.’

Aside from eating 'cheap mince' and foregoing the occasional holiday, Bruce also relied on other forms of income to help pay off his mortgage, having rented out the third bedroom of his house to a friend and frequently selling antique furniture in his spare time.

‘Anything that I made from that went straight on that home loan. I tried to pay it off as soon as possible because the interest rates by 1990 had gone to 17.5 per cent. So they just kept going up and up and up,’ he said.

Bruce later sold the house he bought for $60,000 for a whopping $550,000, a great return on investment.

In a modern comparison, Bruce's 23-year-old daughter recently experienced a more straightforward process of buying her own house.

‘She just stayed, living at home when she finished work,’ he shared. ‘And after two years, she said: “Dad, I might have enough for a deposit for a house.”’

Bruce said she found it to be much easier than he did back in 1984. ‘Just the other day, she said, “I don’t know what everyone’s going on about. It really wasn’t that hard.”’

However, Bruce pointed out that he had more struggles as a home buyer than his daughter.

‘When I bought my house, I was never able to pay rates on time. I was never able to pay for the electricity on time. I was always weeks over on electricity,’ he said.

‘Quite often, I’d have to borrow money off other people to cover that and then pay them back as soon as I had anything spare.’

Bruce also mentioned that certain benefits were not available to him then, such as the first homebuyer scheme and special assistance for essential service workers, which made it relatively easier for her.

These issues plague many millennials today, including freelance photographer Ashley Swallow, who noted that rising living costs have made it difficult to save for a deposit and a future family.

‘Owning a home [and] having a family is definitely something (my partner and I) want to do...but we want a house before we do that. I don’t want to be having my first child at 35. I don’t mind if I buy a house at 35,’ Ashley said.

‘It’s one of those things. It’s kind of held back at the moment because of financial situations,’ she shared.

Ashley shared that she spent her 20s travelling, and despite the pressure, she doesn’t regret her experiences and choice to pursue a career with irregular income.

‘I kind of lived my retirement younger than older. And I’m…ok with that,’ the 30-year-old added.

Another millennial, Xavier George, shared his frustration with the housing market. ‘It’s like, you can do all the right things. You can go to uni and get your degree, and you can get the specialist degree, and you can get promotions... And it kind of just doesn’t matter almost,’ he said.

Xavier has more than 30 per cent of his income allocated to rent while paying off a $100,000 HECS debt.

‘I’m earning more money now on paper than I used to. But I’m definitely not feeling like I earn more money. You know, the cost of life has just grown quicker than my income has,’ Xavier pointed out.

When asked what it will take for him to be a homeowner, Xavier bluntly replied: 'My parents dying, I think.'

‘You know, knock on wood. Sorry, mum. But that’s the windfall. I’m serious about that. That is actually the great tidemark of when a lot of people are going to be able to suddenly buy their own home,’ he explained.

An economist from the University of Sydney, Dr Gareth Bryant, contributed his insights in the episode. He highlighted that the problems millennials are currently facing in relation to buying their own home are very different from those of the older generations.

‘We are talking about two very different problems. In the late 1980s and early 1990s, it was an income problem of people being able to afford repayments. But because house prices were much lower, it wasn’t so much of a wealth problem,’ Dr Bryant stated.

He continued: ‘In the late 1990s, house prices were around 2-3 times average incomes depending on where in Australia you were. Now that figure is 7-10 times, meaning the problem is having enough wealth to get into the property market in the first place.’

‘Many Millennials could actually make mortgage repayments but struggle to get the deposit,’ he pointed out.

A recent survey by the University of Sydney for the Australian Government’s Australian Housing and Urban Research Institute (AHURI) found out that young people were doing ‘everything they could’ to save for a deposit on a house purchase.

This includes taking on extra hours and additional jobs, cutting back on spending, willingness to move to outer-suburban and regional areas. But Dr Bryant said that the millennials ‘still found themselves going backwards due to increasing house prices and rising rents’.

‘The smashed avo on toast cliche is most definitely a myth,’ he confirmed.

Dr Bryant also added that the younger generation, Gen Z, will have a harder time penetrating the housing market, and they could be a generation of lifetime renters.

You can watch a clip of the Insight episode here:

Key Takeaways

- An Aussie senior, Bruce Jackson, shared his journey of becoming a homeowner in 1984, which involved significant personal sacrifices, including eating 'cheap mince' and never going on holidays.

- Bruce believes his 23-year-old daughter had an easier time entering the property market than he did in his time, despite current concerns over housing affordability.

- Millenials like Ashley Swallow have difficulty buying their own home. In the case of Ashley, she had to be held back due to other financial situations.

- Xavier George, a millennial, expresses frustration over current housing market conditions and fears that only a large unanticipated windfall, such as inheritance, might enable him to buy a home.

- Dr Gareth Bryant, a University of Sydney economist, notes the challenges facing millennials wanting to buy their first home are much different from those faced by the older generation, with housing prices now being 7-10 times average incomes compared to 2-3 times in the late 90s.

What do you think of this story, dear members? Did you have a similar experience to Bruce when you were buying your own home? Share your stories in the comments below!