Discover the Secret to Picking the Perfect Health Insurance for Seniors—What They Aren’t Telling You!

By

Seia Ibanez

- Replies 3

Navigating the labyrinth of health insurance options can be daunting at any age, but for our seasoned members over 60, the stakes are even higher. With the golden years often bringing more frequent visits to healthcare providers and a higher likelihood of needing medical procedures, choosing the right health insurance policy is not just a matter of cost—it's a matter of ensuring your peace of mind and well-being.

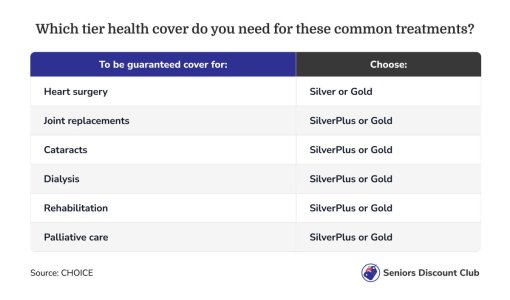

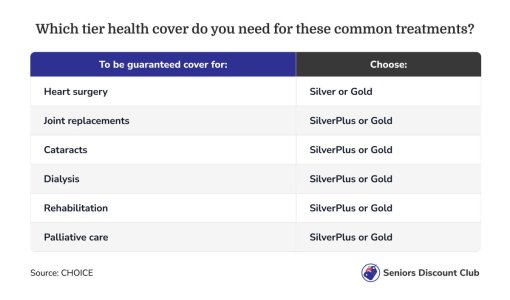

As we age, our health needs evolve, and so should our health insurance. It's crucial to have a policy that aligns with our current stage of life. For seniors, this often means considering coverage for treatments and surgeries that become more common as we get older, such as cataract surgery or joint replacements. These are typically covered by the more comprehensive top-tier Gold and Silver Plus policies.

Understanding the Tiers of Health Insurance

Health insurance policies in Australia are categorized into four main tiers: Basic, Bronze, Silver, and Gold. Each tier offers varying levels of coverage, with Basic providing the least and Gold offering the most comprehensive cover. Between these main tiers, there are also 'Plus' policies—Silver Plus, Bronze Plus, and Basic Plus—which include at least one service more than their standard counterparts.

For example, a Silver Plus policy might cover hip replacements or cataract surgery, which are usually reserved for Gold policies. It's important to note that while you might find cover for these treatments in lower-level tiers, it's not guaranteed.

The Statistics Speak: Why Seniors Need Adequate Cover

Statistics from the Australian Institute of Health and Welfare reveal that Australians aged 60–79 are the most frequent users of their hospital insurance. Moreover, over 65s, while only making up 15% of the population, account for over 40% of day and overnight hospital admissions. This highlights the importance of having a policy that adequately covers the treatments and surgeries seniors are more likely to need.

Choosing the Right Policy Level

To ensure you're covered for the more common surgeries for seniors, refer to the table below:

Considerations When Changing Tiers

If you're considering upgrading your policy, remember that a 12-month waiting period applies for conditions not covered by your old policy. Plan any required surgeries accordingly. Conversely, if you've had the treatments you need, you might think about downgrading your cover. However, weigh this decision carefully, as top-tier policies cover services that, while you may not need them now, could become necessary later in life.

The Excess Factor

Since 2019, health insurance reforms have allowed for a higher excess option—up to $750 per person and $1500 per couple/family—to help reduce premiums. An excess is what you pay out-of-pocket for a hospital visit, capped at once or twice per year. If you anticipate needing surgery soon, a policy with a lower excess might be more cost-effective despite higher premiums.

Day Surgery Considerations

For day surgeries, such as cataract surgery, seek a policy that doesn't charge an excess for same-day patients. Some health funds, including GMHBA, HCF, and Medibank, offer this benefit on certain policies.

Hospital Cover and Public Hospitals

While public hospitals in Australia provide excellent care for serious conditions, they often have long waiting times for elective surgeries. If you're over 65 and can afford private health insurance, it's generally advisable to maintain your cover.

The Benefits of Age

As you age, the value of your health insurance can increase. Once you hit 65, you're entitled to a higher government rebate, which helps reduce your premiums. This rebate increases again at age 70 and applies to the whole family or couples policy when one member is over 65.

Extras Cover: Is It Worth It?

Extras cover can be beneficial for budgeting purposes, as it reimburses a portion of expenses for services like dental and optical care. However, it's essential to assess whether the benefits received are worth the premiums paid. It may be more cost-effective to pay for these services out-of-pocket or to compare separate hospital and extras cover.

Five-Step Action Plan

To ensure you're getting the best value and coverage for your needs, follow our five-step action plan:

1. Review your current health insurance policy and assess whether it meets your needs.

2. Compare your policy with other options on the market.

3. Check for any waiting periods that may apply if you switch policies or tiers.

4. Consider the cost of premiums versus potential out-of-pocket expenses.

5. Make an informed decision and switch if you find a better option.

Remember, a few minutes spent reviewing and comparing policies could save you hundreds of dollars per year while securing the coverage you need for a healthy and worry-free future.

We invite you to share your experiences and tips for choosing health insurance in the comments below. Your insights could help fellow members make informed decisions about their healthcare coverage.

As we age, our health needs evolve, and so should our health insurance. It's crucial to have a policy that aligns with our current stage of life. For seniors, this often means considering coverage for treatments and surgeries that become more common as we get older, such as cataract surgery or joint replacements. These are typically covered by the more comprehensive top-tier Gold and Silver Plus policies.

Understanding the Tiers of Health Insurance

Health insurance policies in Australia are categorized into four main tiers: Basic, Bronze, Silver, and Gold. Each tier offers varying levels of coverage, with Basic providing the least and Gold offering the most comprehensive cover. Between these main tiers, there are also 'Plus' policies—Silver Plus, Bronze Plus, and Basic Plus—which include at least one service more than their standard counterparts.

For example, a Silver Plus policy might cover hip replacements or cataract surgery, which are usually reserved for Gold policies. It's important to note that while you might find cover for these treatments in lower-level tiers, it's not guaranteed.

The Statistics Speak: Why Seniors Need Adequate Cover

Statistics from the Australian Institute of Health and Welfare reveal that Australians aged 60–79 are the most frequent users of their hospital insurance. Moreover, over 65s, while only making up 15% of the population, account for over 40% of day and overnight hospital admissions. This highlights the importance of having a policy that adequately covers the treatments and surgeries seniors are more likely to need.

Choosing the Right Policy Level

To ensure you're covered for the more common surgeries for seniors, refer to the table below:

Considerations When Changing Tiers

If you're considering upgrading your policy, remember that a 12-month waiting period applies for conditions not covered by your old policy. Plan any required surgeries accordingly. Conversely, if you've had the treatments you need, you might think about downgrading your cover. However, weigh this decision carefully, as top-tier policies cover services that, while you may not need them now, could become necessary later in life.

The Excess Factor

Since 2019, health insurance reforms have allowed for a higher excess option—up to $750 per person and $1500 per couple/family—to help reduce premiums. An excess is what you pay out-of-pocket for a hospital visit, capped at once or twice per year. If you anticipate needing surgery soon, a policy with a lower excess might be more cost-effective despite higher premiums.

Day Surgery Considerations

For day surgeries, such as cataract surgery, seek a policy that doesn't charge an excess for same-day patients. Some health funds, including GMHBA, HCF, and Medibank, offer this benefit on certain policies.

Hospital Cover and Public Hospitals

While public hospitals in Australia provide excellent care for serious conditions, they often have long waiting times for elective surgeries. If you're over 65 and can afford private health insurance, it's generally advisable to maintain your cover.

The Benefits of Age

As you age, the value of your health insurance can increase. Once you hit 65, you're entitled to a higher government rebate, which helps reduce your premiums. This rebate increases again at age 70 and applies to the whole family or couples policy when one member is over 65.

Extras Cover: Is It Worth It?

Extras cover can be beneficial for budgeting purposes, as it reimburses a portion of expenses for services like dental and optical care. However, it's essential to assess whether the benefits received are worth the premiums paid. It may be more cost-effective to pay for these services out-of-pocket or to compare separate hospital and extras cover.

Five-Step Action Plan

To ensure you're getting the best value and coverage for your needs, follow our five-step action plan:

1. Review your current health insurance policy and assess whether it meets your needs.

2. Compare your policy with other options on the market.

3. Check for any waiting periods that may apply if you switch policies or tiers.

4. Consider the cost of premiums versus potential out-of-pocket expenses.

5. Make an informed decision and switch if you find a better option.

Remember, a few minutes spent reviewing and comparing policies could save you hundreds of dollars per year while securing the coverage you need for a healthy and worry-free future.

Key Takeaways

- Top-tier Gold and Silver Plus health insurance policies are generally necessary for seniors to be guaranteed cover for common surgeries such as joint replacements and cataract surgery.

- Seniors should consider the waiting periods when upgrading their policies, especially if they foresee needing surgery in the near future, as there is typically a 12-month waiting period for new conditions.

- Older Australians are entitled to higher government rebates on their health insurance premiums as they age, which can make retaining health insurance more valuable.

- It's crucial for seniors to regularly review their health insurance policy to ensure it aligns with their current health needs, considering both hospital and extras cover, and to compare policies for potential savings.

We invite you to share your experiences and tips for choosing health insurance in the comments below. Your insights could help fellow members make informed decisions about their healthcare coverage.

Last edited: