Did the cost of your favourite chocolate just skyrocket? Here's the shocking reason why!

Chocolate lovers, brace yourselves for some not-so-sweet news: the delectable treats that once held a special place in our hearts are liable to burn a bigger hole in your pocket.

Your beloved chocolate is soon going to cost more.

Yes, you read that correctly. But before we plunge into this unfortunate turn of events, let's embark on a brief journey down cocoa lane.

The cocoa plant, our hero in this story, originally came from the lush tropical forests of South America, where it has been enjoyed for over four thousand years.

Little did they know then that it would become a beloved indulgence worldwide, especially among Australians.

Not only does it delight our taste buds, but it also comes with health benefits.

Dark chocolate, rich in cocoa, is known to be packed with antioxidants, can support heart health, and can even help with memory loss. You can read more about it here.

However, even the mightiest heroes can face challenges. Our hero, the cocoa bean, is under dire straits.

Because we've seen inflation in cocoa—a rise of about 25 per cent within the year, confectionery companies might be left with no choice but to skyrocket their prices.

The main culprit? Cocoa beans trading near decade-record highs with no expected recovery in near sight.

At the same time, unusually high rainfall in major cocoa-producing regions has resulted in significant flooding.

This has directly impacted the growth of this vital bean that underpins our favourite indulgences.

As noted by Rabobank analysts, even sugar, an essential part of our delightful chocolates, is now valued at staggeringly high levels.

To give you perspective, some of Australia’s favourite chocolate varieties have already seen price hikes of 10-20 per cent.

With price hikes becoming the unsavoury norm, many chocolate enthusiasts might find their sweet indulgences curtailed.

Pia Piggott, a Rabobank associate analyst, fears this trend will continue if these cost pressures persist.

Ivory Coast, contributing to over 40 per cent of worldwide cocoa production, has been particularly hard-hit by heavy rain and flooding, causing widespread decay and disease to besiege our cocoa heroes.

Most wholesale food prices have dropped over the past year, prompting calls for similar reductions to be echoed in supermarkets.

However, unpredictable weather and geopolitical disruptions are currently playing havoc with specific produce.

Take wheat prices, for instance, which spiked alarmingly last week with Russia opting for a disruptive geopolitics strategy.

Revealing the underbelly of our beloved chocolate industry is that the globally voluminous trade, valued over a staggering US$1 trillion, often oversteps into the realm of extensive deforestation in the Ivory Coast and Ghana.

In the face of these rising costs, Michael Harvey, Rabobank’s Senior Dairy and Food Retail Analyst, suggests downstream effects on the demand side ‘Because there is belt-tightening going on and there’s going to be reduced spending on discretionary products, that might mean a little less chocolate on the go and less impulse purchasing out and about.’

However, he assures us that a little bit of home-based chocolate indulgence is still within our reach.

Dear friends, fear not! Remember that good company and great chocolate are a pairing that remains unchallenged.

Share your thoughts and feelings about the rising cost of chocolate and how it might influence your chocolate-buying decisions in the future. Are there any alternative sweet treats you might consider in light of these price changes?

Your beloved chocolate is soon going to cost more.

Yes, you read that correctly. But before we plunge into this unfortunate turn of events, let's embark on a brief journey down cocoa lane.

The cocoa plant, our hero in this story, originally came from the lush tropical forests of South America, where it has been enjoyed for over four thousand years.

Little did they know then that it would become a beloved indulgence worldwide, especially among Australians.

Not only does it delight our taste buds, but it also comes with health benefits.

Dark chocolate, rich in cocoa, is known to be packed with antioxidants, can support heart health, and can even help with memory loss. You can read more about it here.

However, even the mightiest heroes can face challenges. Our hero, the cocoa bean, is under dire straits.

Because we've seen inflation in cocoa—a rise of about 25 per cent within the year, confectionery companies might be left with no choice but to skyrocket their prices.

The main culprit? Cocoa beans trading near decade-record highs with no expected recovery in near sight.

At the same time, unusually high rainfall in major cocoa-producing regions has resulted in significant flooding.

This has directly impacted the growth of this vital bean that underpins our favourite indulgences.

As noted by Rabobank analysts, even sugar, an essential part of our delightful chocolates, is now valued at staggeringly high levels.

To give you perspective, some of Australia’s favourite chocolate varieties have already seen price hikes of 10-20 per cent.

With price hikes becoming the unsavoury norm, many chocolate enthusiasts might find their sweet indulgences curtailed.

Pia Piggott, a Rabobank associate analyst, fears this trend will continue if these cost pressures persist.

Ivory Coast, contributing to over 40 per cent of worldwide cocoa production, has been particularly hard-hit by heavy rain and flooding, causing widespread decay and disease to besiege our cocoa heroes.

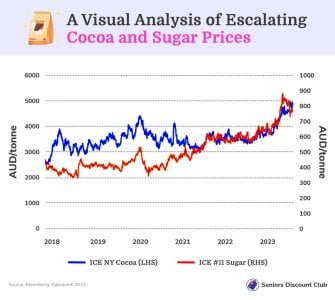

A Visual Analysis of Escalating Cocoa and Sugar Prices

The graph below displays a rise in global cocoa and sugar prices:Most wholesale food prices have dropped over the past year, prompting calls for similar reductions to be echoed in supermarkets.

However, unpredictable weather and geopolitical disruptions are currently playing havoc with specific produce.

Take wheat prices, for instance, which spiked alarmingly last week with Russia opting for a disruptive geopolitics strategy.

Revealing the underbelly of our beloved chocolate industry is that the globally voluminous trade, valued over a staggering US$1 trillion, often oversteps into the realm of extensive deforestation in the Ivory Coast and Ghana.

In the face of these rising costs, Michael Harvey, Rabobank’s Senior Dairy and Food Retail Analyst, suggests downstream effects on the demand side ‘Because there is belt-tightening going on and there’s going to be reduced spending on discretionary products, that might mean a little less chocolate on the go and less impulse purchasing out and about.’

However, he assures us that a little bit of home-based chocolate indulgence is still within our reach.

Key Takeaways

- Chocolate prices are on the rise as the cost of cocoa beans has increased by over 25 per cent in a year due to severe flooding in key growing regions.

- Notably, products like sugar, which are also key ingredients in chocolate, are presently trading at historically high levels, contributing to the price surge.

- Apart from rising input costs, changes in geopolitical dynamics and weather-related disruptions in food supply chains are affecting the price and availability of certain produce.

- Due to the tightened budgets and an uptick in the cost of living, there might be a decrease in chocolate consumption, particularly in discretionary purchases made on the go. However, indulgence in chocolate in home settings is expected to continue.

Dear friends, fear not! Remember that good company and great chocolate are a pairing that remains unchallenged.

Share your thoughts and feelings about the rising cost of chocolate and how it might influence your chocolate-buying decisions in the future. Are there any alternative sweet treats you might consider in light of these price changes?

Last edited: