Could your super be next on the chopping block? Here's what you need to know about the market plunge

By

- Replies 3

It looks like Australians' retirement savings are set to take a big hit this year. Superannuation funds are expected to plunge, making it only the fifth time in three decades that losses have been recorded in a financial year.

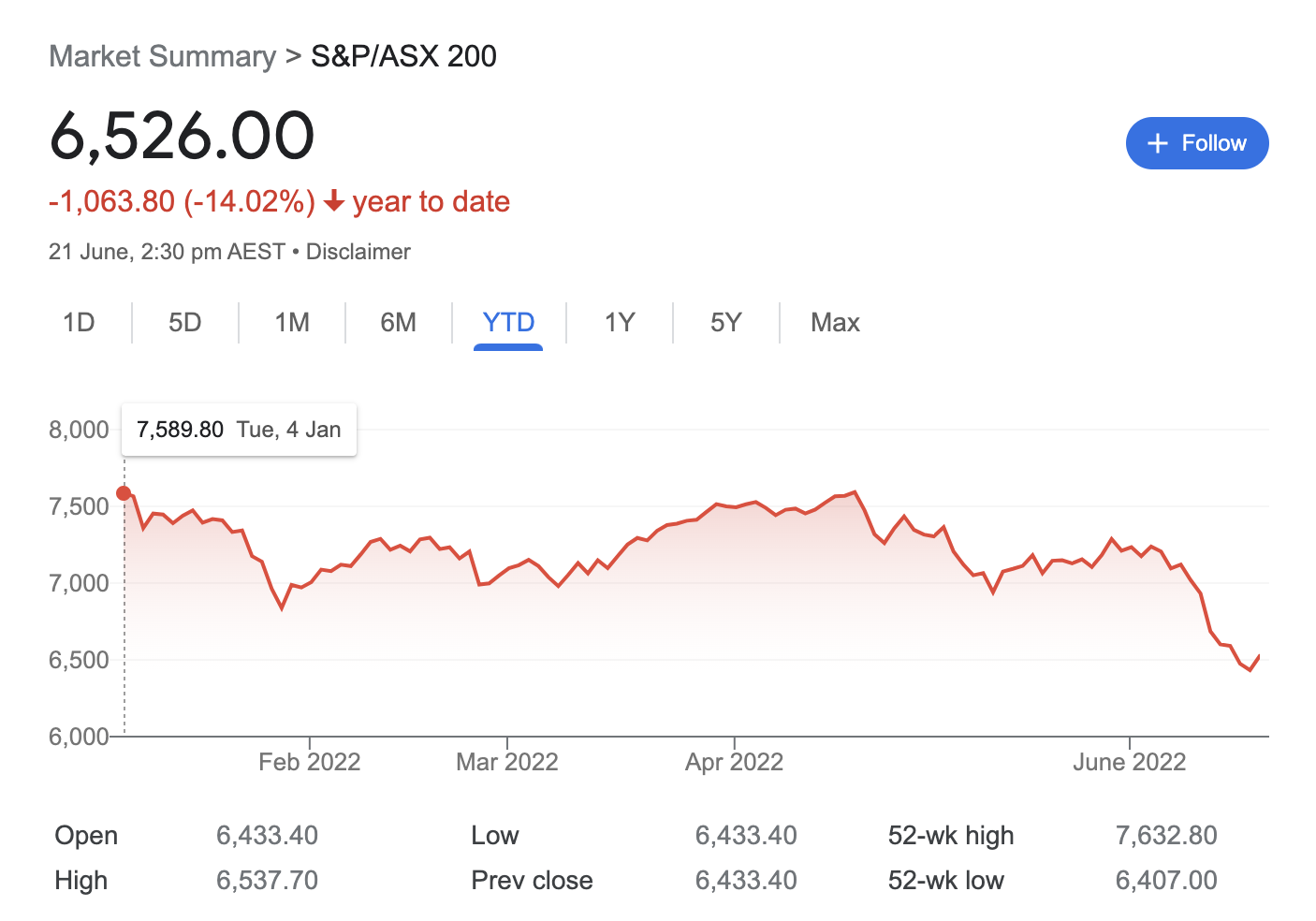

The downturn is being blamed on a massive fall in stock markets, both here in Australia and globally. The Australian stock market has plunged nearly 15% this year to date, with an estimated $270 billion of value wiped out.

The ASX has fallen 14% since January this year. Source: Google

Despite the difficult news, it's a good reminder to stay calm and not get too caught up in the ups and downs of the stock market. After all, our retirement savings are for the long term, not just for this year.

Independent financial advisor Nick Bruining said that retirees and workers should not overly worry about the state of the stock market as their superannuation will most likely bounce back over time.

He explained: "While the value of the shares may have fallen, the quality hasn't. And, eventually, values will come back up to reflect the quality of the assets."

Australians are advised to stay calm amidst the plummeting stock market and to be mindful that their superannuation will most probably bounce back over time. Credit: Shutterstock/wavebreakmedia.

The country's largest pension fund in Australia, AustralianSuper, reported a negative return of -4.2 per cent as of Thursday.

It was predicted that the rate would stay in the negative for the rest of the financial year for the first time since the Global Financial Crisis.

Ron de Grunchy, president of WA Self Funded Retirees, assured Australians that the stock market was still strong, claiming that this is not a "major catastrophe".

"Woolies shops are still open for business, BHP still has its iron ore reserves in the ground, the quality is still there and ultimately the price will reflect the quality," he said.

More losses could be on the way for the ASX amid rising fears the US is headed towards a recession that could have dire repercussions on the global economy.

The Albanese government is preparing radical change to superannuation that would give every Australian a much bigger nest egg when they retire.

Under the current system, employer's compulsory contributions are 12 per cent, but Labor wants to raise this to 15 per cent. This would mean that a worker on $90,000 a year would have an extra $174,016 when they retire.

We want to hear your thoughts on this. Are you worried about the stock market and/or the economy in general, or do you think this is just a temporary blip?

The downturn is being blamed on a massive fall in stock markets, both here in Australia and globally. The Australian stock market has plunged nearly 15% this year to date, with an estimated $270 billion of value wiped out.

The ASX has fallen 14% since January this year. Source: Google

Despite the difficult news, it's a good reminder to stay calm and not get too caught up in the ups and downs of the stock market. After all, our retirement savings are for the long term, not just for this year.

Independent financial advisor Nick Bruining said that retirees and workers should not overly worry about the state of the stock market as their superannuation will most likely bounce back over time.

He explained: "While the value of the shares may have fallen, the quality hasn't. And, eventually, values will come back up to reflect the quality of the assets."

Australians are advised to stay calm amidst the plummeting stock market and to be mindful that their superannuation will most probably bounce back over time. Credit: Shutterstock/wavebreakmedia.

The country's largest pension fund in Australia, AustralianSuper, reported a negative return of -4.2 per cent as of Thursday.

It was predicted that the rate would stay in the negative for the rest of the financial year for the first time since the Global Financial Crisis.

Ron de Grunchy, president of WA Self Funded Retirees, assured Australians that the stock market was still strong, claiming that this is not a "major catastrophe".

"Woolies shops are still open for business, BHP still has its iron ore reserves in the ground, the quality is still there and ultimately the price will reflect the quality," he said.

More losses could be on the way for the ASX amid rising fears the US is headed towards a recession that could have dire repercussions on the global economy.

The Albanese government is preparing radical change to superannuation that would give every Australian a much bigger nest egg when they retire.

Under the current system, employer's compulsory contributions are 12 per cent, but Labor wants to raise this to 15 per cent. This would mean that a worker on $90,000 a year would have an extra $174,016 when they retire.

We want to hear your thoughts on this. Are you worried about the stock market and/or the economy in general, or do you think this is just a temporary blip?