Commonwealth Bank urges Aussies to net phishing fraudsters before tax time tangles

- Replies 17

In an era where technology dominates our daily lives, the rise of digital scams has become a pressing issue.

Australians are increasingly falling victim to sophisticated fraud schemes, highlighting the importance of vigilance and awareness.

This growing concern underscores the need for robust measures to protect individuals from the ever-evolving tactics of cybercriminals.

As the financial year draws to a close, Australians are being urged to stay vigilant against the ever-present threat of tax phishing scams.

Despite Australians' general confidence in detecting such deceptions, startling new research indicated that nearly one in three individuals could be ensnared by these fraudulent schemes.

The study initiated by the Commonwealth Bank revealed a concerning gap between confidence and reality.

While nine out of ten adults surveyed expressed assurance in their scam-spotting abilities, a practical test involving three different tax scam scenarios found that only 69 per cent could accurately identify all as fakes.

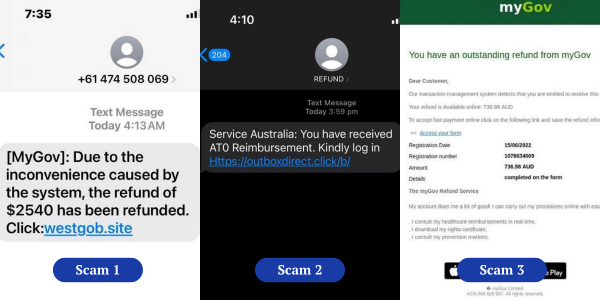

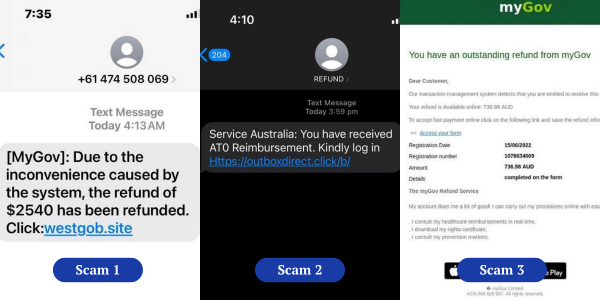

Let's delve into the details of these scams to understand why they can be so convincing:

Scam number 1 was the most obvious, with a mere 4 per cent of respondents being duped by the fake text message.

Scam number 2 proved slightly more challenging, with 7 per cent of participants failing to recognise the deceit.

Scam number 3, however, was the most insidious of all. This scam, masquerading as a legitimate message from MyGov, fooled 28 per cent of those surveyed, showcasing the sophistication of scammers in mimicking official communications.

The research also highlighted that about one in four Australians have encountered a tax-related scam, emphasising the prevalence of this issue.

The Australian Tax Office (ATO) received over 22,000 reports of tax scams in the previous year. Notably, these incidents surged from the end of the financial year, peaking in October—the period when most tax returns are processed.

James Roberts, CBA's General Manager of Group Fraud, expressed a mix of reassurance and concern. While the majority could spot scams, the fact that almost a third could not is alarming.

‘Scammers are the most opportunistic criminals and will actively campaign to capitalise on tax season,’ Mr Roberts pointed out.

‘Everyone should keep an eye out for text messages and emails impersonating myGov and the ATO.’

‘They may appear in a thread of legitimate messages from these organisations. The major red flag for this type of scam is the link, which differs considerably from the official myGov and ATO website addresses,’ he added.

Phishing scams typically involve SMS messages or emails that impersonate reputable entities.

These messages contain links leading to counterfeit websites designed to harvest personal and financial information from unsuspecting victims.

According to the National Anti-Scam Centre, phishing ranks as the third most common scam type, trailing only behind investment and romance scams.

In this year alone, Australians reported losses nearing $4.7 million to phishing scams, with the average victim losing approximately $2000.

To protect yourself from falling prey to these cunning tactics, consider the following tips:

With the prevalence of these scams on the rise, it is crucial for all Australians, especially seniors, to stay informed and vigilant.

Tax season, in particular, sees a surge in fraudulent activities as scammers exploit the financial anxieties and confusion surrounding this period.

These schemes often target older Australians, making it essential to understand how to protect your hard-earned cash from these cunning fraudsters.

Have you encountered similar messages? Are you confident that you could identify a scam when shown one? What would you recommend to others to avoid falling victim to these schemes? We invite you to share your experiences and advice in the comments below!

Australians are increasingly falling victim to sophisticated fraud schemes, highlighting the importance of vigilance and awareness.

This growing concern underscores the need for robust measures to protect individuals from the ever-evolving tactics of cybercriminals.

As the financial year draws to a close, Australians are being urged to stay vigilant against the ever-present threat of tax phishing scams.

Despite Australians' general confidence in detecting such deceptions, startling new research indicated that nearly one in three individuals could be ensnared by these fraudulent schemes.

The study initiated by the Commonwealth Bank revealed a concerning gap between confidence and reality.

While nine out of ten adults surveyed expressed assurance in their scam-spotting abilities, a practical test involving three different tax scam scenarios found that only 69 per cent could accurately identify all as fakes.

Nearly one in three Australians couldn't detect a tax scam despite their confidence in spotting fake messages. Credits: Commonwealth Bank Australia

Let's delve into the details of these scams to understand why they can be so convincing:

Scam number 1 was the most obvious, with a mere 4 per cent of respondents being duped by the fake text message.

Scam number 2 proved slightly more challenging, with 7 per cent of participants failing to recognise the deceit.

Scam number 3, however, was the most insidious of all. This scam, masquerading as a legitimate message from MyGov, fooled 28 per cent of those surveyed, showcasing the sophistication of scammers in mimicking official communications.

The research also highlighted that about one in four Australians have encountered a tax-related scam, emphasising the prevalence of this issue.

The Australian Tax Office (ATO) received over 22,000 reports of tax scams in the previous year. Notably, these incidents surged from the end of the financial year, peaking in October—the period when most tax returns are processed.

James Roberts, CBA's General Manager of Group Fraud, expressed a mix of reassurance and concern. While the majority could spot scams, the fact that almost a third could not is alarming.

‘Scammers are the most opportunistic criminals and will actively campaign to capitalise on tax season,’ Mr Roberts pointed out.

‘Everyone should keep an eye out for text messages and emails impersonating myGov and the ATO.’

‘They may appear in a thread of legitimate messages from these organisations. The major red flag for this type of scam is the link, which differs considerably from the official myGov and ATO website addresses,’ he added.

Phishing scams typically involve SMS messages or emails that impersonate reputable entities.

These messages contain links leading to counterfeit websites designed to harvest personal and financial information from unsuspecting victims.

According to the National Anti-Scam Centre, phishing ranks as the third most common scam type, trailing only behind investment and romance scams.

In this year alone, Australians reported losses nearing $4.7 million to phishing scams, with the average victim losing approximately $2000.

To protect yourself from falling prey to these cunning tactics, consider the following tips:

- Stop and think: If a call, email, or text message seems suspicious or pressures you to act immediately, it's a red flag. Legitimate organisations will not rush you into making decisions.

- Check the facts: If in doubt, seek advice from someone you trust or reach out to the organisation directly using a verified number. Do not use contact details provided by the sender, as they may be part of the scam.

- Reject unsolicited contacts: If you're uncertain about the legitimacy of a communication, it's best to hang up the phone, delete the email, or block the number.

With the prevalence of these scams on the rise, it is crucial for all Australians, especially seniors, to stay informed and vigilant.

Tax season, in particular, sees a surge in fraudulent activities as scammers exploit the financial anxieties and confusion surrounding this period.

These schemes often target older Australians, making it essential to understand how to protect your hard-earned cash from these cunning fraudsters.

Key Takeaways

- Almost one in three Australians failed to identify at least one tax scam when tested, despite being confident in their abilities to spot fake messages.

- Research commissioned by the Commonwealth Bank highlighted that 69 per cent of participants correctly identified all three examples of tax phishing scams.

- Tax scams have been prolific, with over 22,000 reported to the Australian Tax Office last year, and scammers are known to target individuals during the tax season.

- Australians were advised to be vigilant of phishing scams by considering the legitimacy of requests, checking with trusted sources, and rejecting any suspicious calls or messages.

Last edited: