Cashless banking era approaches: Major bank announces plans to end cash and cheque services

- Replies 34

Macquarie Bank is gearing up to streamline its services by transitioning to digital-only payment systems, which will discontinue cash, cheque, and phone payments for customers starting next year.

Alongside these changes, Macquarie Bank is also severing its partnership with NAB bank branches.

In a recent letter addressed to customers, Macquarie Bank has outlined that by November 2024, customers will lose the ability to write or deposit cheques, including bank cheques, deposit or withdraw cash over the counter at NAB branches or make super contributions or payments using cheques.

Beginning in January, Macquarie Bank customers can no longer order new chequebooks.

The telephone banking system at Macquarie Bank is set to be phased out in March next year, followed by a complete discontinuation of cheques in May.

Furthermore, as of May 2024, customers will no longer have the option to deposit or withdraw cash or cheques over the counter at Macquarie branches.

'As a digital bank, we're committed to transitioning to completely digital payments by November 2024 as a safer, faster and more convenient way to bank,' a Macquarie Bank spokesperson said.

'The majority of our customers already bank digitally, and we're working very closely to support the less than 1 per cent of our customers who currently use cheques or cash to ensure they have access to other digital payment methods.'

The bank has announced that customers can still make fee-free cash withdrawals from their transaction accounts through ATMs, both within Australia and overseas. However, they will no longer be able to make cash deposits or conduct withdrawals at branches.

Although the bank tried to reassure people, concerns remained regarding the implications of the increasing shift toward digital-only transactions, especially for older and regional Australians.

'Some of these regional communities, in particular, have challenges around internet access,' said Chief Operating Officer of National Seniors Australia Chris Grice.

'There's a lot of work that needs to happen in terms of educating and informing senior Australians in terms of being able to operate using their smartphones and these apps.'

Rhiannon Druce, a business owner operating the Junee Licorice and Chocolate Factory in a rural area of NSW Riverina, pointed out that people in regional areas are particularly disadvantaged when banks transition exclusively to digital services.

'People in regional areas constantly have challenges around internet access, so using cash is often an easier option, making the local bank branch and cash services important to those in country towns.'

'There is concern other banks will follow Macquarie Bank's lead, which unfortunately feels inevitable,' they added.

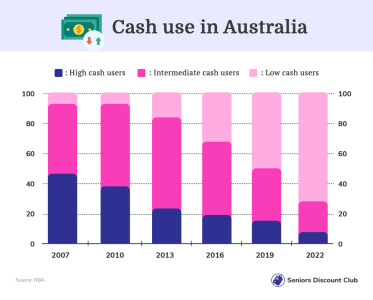

During the pandemic, people displayed a growing preference for digital payments. Surprisingly, though, the use of cash also increased. However, as we fast forward to the present day, it's becoming evident that cash is again losing popularity.

The Reserve Bank of Australia (RBA) reports that the total amount of cash circulating in the country is now just over $101.3 billion, the lowest since November 2019. Notably, the number of $5, $20, and $50 notes in circulation has decreased, with the $50 note experiencing the most significant decline. The $100 note is the only denomination that has seen a slight increase, though even this growth is slowing down.

For more information, read the full article here.

Members, what do you think about the decline in cash usage in Australia? How do you perceive this trend? Is it a positive or negative development, in your opinion? Do you think that banks, retailers, and establishments still give priority to cash transactions? Please share your thoughts by commenting below.

Alongside these changes, Macquarie Bank is also severing its partnership with NAB bank branches.

In a recent letter addressed to customers, Macquarie Bank has outlined that by November 2024, customers will lose the ability to write or deposit cheques, including bank cheques, deposit or withdraw cash over the counter at NAB branches or make super contributions or payments using cheques.

Macquarie Bank is scrapping cash, cheque and phone payment services next year in a major move to modernise its offerings. Credit: Shutterstock.

Beginning in January, Macquarie Bank customers can no longer order new chequebooks.

The telephone banking system at Macquarie Bank is set to be phased out in March next year, followed by a complete discontinuation of cheques in May.

Furthermore, as of May 2024, customers will no longer have the option to deposit or withdraw cash or cheques over the counter at Macquarie branches.

'As a digital bank, we're committed to transitioning to completely digital payments by November 2024 as a safer, faster and more convenient way to bank,' a Macquarie Bank spokesperson said.

'The majority of our customers already bank digitally, and we're working very closely to support the less than 1 per cent of our customers who currently use cheques or cash to ensure they have access to other digital payment methods.'

The bank has announced that customers can still make fee-free cash withdrawals from their transaction accounts through ATMs, both within Australia and overseas. However, they will no longer be able to make cash deposits or conduct withdrawals at branches.

Although the bank tried to reassure people, concerns remained regarding the implications of the increasing shift toward digital-only transactions, especially for older and regional Australians.

'Some of these regional communities, in particular, have challenges around internet access,' said Chief Operating Officer of National Seniors Australia Chris Grice.

'There's a lot of work that needs to happen in terms of educating and informing senior Australians in terms of being able to operate using their smartphones and these apps.'

Rhiannon Druce, a business owner operating the Junee Licorice and Chocolate Factory in a rural area of NSW Riverina, pointed out that people in regional areas are particularly disadvantaged when banks transition exclusively to digital services.

'People in regional areas constantly have challenges around internet access, so using cash is often an easier option, making the local bank branch and cash services important to those in country towns.'

'There is concern other banks will follow Macquarie Bank's lead, which unfortunately feels inevitable,' they added.

During the pandemic, people displayed a growing preference for digital payments. Surprisingly, though, the use of cash also increased. However, as we fast forward to the present day, it's becoming evident that cash is again losing popularity.

The Reserve Bank of Australia (RBA) reports that the total amount of cash circulating in the country is now just over $101.3 billion, the lowest since November 2019. Notably, the number of $5, $20, and $50 notes in circulation has decreased, with the $50 note experiencing the most significant decline. The $100 note is the only denomination that has seen a slight increase, though even this growth is slowing down.

For more information, read the full article here.

Key Takeaways

- Macquarie Bank is planning to phase out cash, cheque and phone payment services starting from January 2024.

- Macquarie Bank customers can only make digital payments, and all cash withdrawals will take place entirely at ATMs from November 2024.

- Depositing or withdrawing cash or cheques over the counter at Macquarie branches will no longer be possible from May 2024.

- From November 2024, the bank will no longer offer cash or cheque services, including writing or depositing cheques, cash deposits and branch withdrawals.

Members, what do you think about the decline in cash usage in Australia? How do you perceive this trend? Is it a positive or negative development, in your opinion? Do you think that banks, retailers, and establishments still give priority to cash transactions? Please share your thoughts by commenting below.