Cash at risk? Seniors groups reveal shocking truth behind new mandate

By

Gian T

- Replies 0

In an era where digital transactions are swiftly becoming the norm, the Australian government's recent proposal to protect cash purchases has sparked a heated debate among senior groups.

The mandate, which aims to make it illegal for businesses to refuse cash for essential purchases, has been criticised for not going far enough to safeguard the rights of those who rely on physical currency.

Set to take effect on 1 January 2026, the mandate specifies that essential items such as groceries, infant clothing, cleaning and personal care products, medicines, and fuel must be purchasable with cash.

However, it leaves a wide array of goods categorised as non-essential—like cakes, biscuits, takeaway, adult clothing, alcohol, furniture, and tools—where businesses could legally refuse cash payments.

The distinction between essential and non-essential items has caused confusion and concern among seniors, who prefer cash for its tangibility and simplicity.

Cash transactions eliminate card surcharges, reduce the risk of online banking fraud, and assist with personal budgeting.

For many seniors, cash is not just a payment method; it's a way to maintain financial autonomy and security.

Tass Maniatis, from the Frog n Toad Cafe, emphasised the importance of cash, especially in areas with an older demographic.

'We have an older demographic in the area but the young ones too,' Maniatis said.

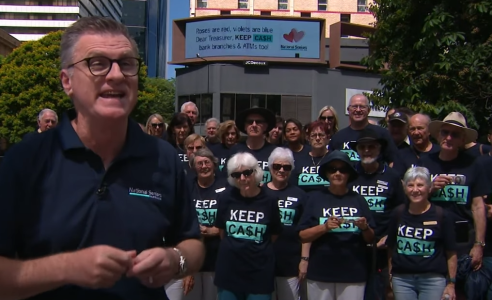

Chris Grice from National Seniors Australia points out the ambiguity of the mandate, questioning its practicality at the point of sale.

'If you go to the till and you pay for bread and you pay for cake, does that mean that you pay cash for one item and then you've got to use a card for the other?' Grice said.

This scenario illustrated the potential complications and inconveniences that could arise for consumers, particularly seniors who may not be as comfortable with digital payment methods.

The deadline for public submissions on the mandate is fast approaching, and Treasurer Jim Chalmers urged the community to voice their opinions.

'What this consultation means is that people from all corners of our community can express a view,' Chalmers said.

It's a critical opportunity for seniors and other cash-reliant Australians to make their concerns heard and advocate for a more inclusive mandate that recognises the value of cash in all transactions.

As we navigate the complexities of this proposed mandate, it's essential to consider the broader implications for our senior community.

The shift towards a cashless society may offer convenience for some, but it also risks leaving behind those who depend on or prefer cash.

It's a reminder that in our pursuit of technological advancement, we must not forget the importance of inclusivity and the diverse needs of all Australians.

In other news, starting 6 January, Commonwealth Bank will introduce a new $3 fee for cash withdrawals made at branches, post offices, or by phone.

Customers with a 'Complete Access Account' will be moved to 'Smart Access Accounts,' including this new fee. You can read more about it here.

Credit: YouTube

Have you faced challenges with businesses refusing cash? Does the proposed mandate address your needs? Join the conversation in the comments below, and let's ensure that the voices of seniors are heard loudly and clearly during this critical discussion.

Have you faced challenges with businesses refusing cash? Does the proposed mandate address your needs? Join the conversation in the comments below, and let's ensure that the voices of seniors are heard loudly and clearly during this critical discussion.

The mandate, which aims to make it illegal for businesses to refuse cash for essential purchases, has been criticised for not going far enough to safeguard the rights of those who rely on physical currency.

Set to take effect on 1 January 2026, the mandate specifies that essential items such as groceries, infant clothing, cleaning and personal care products, medicines, and fuel must be purchasable with cash.

However, it leaves a wide array of goods categorised as non-essential—like cakes, biscuits, takeaway, adult clothing, alcohol, furniture, and tools—where businesses could legally refuse cash payments.

The distinction between essential and non-essential items has caused confusion and concern among seniors, who prefer cash for its tangibility and simplicity.

Cash transactions eliminate card surcharges, reduce the risk of online banking fraud, and assist with personal budgeting.

For many seniors, cash is not just a payment method; it's a way to maintain financial autonomy and security.

Tass Maniatis, from the Frog n Toad Cafe, emphasised the importance of cash, especially in areas with an older demographic.

'We have an older demographic in the area but the young ones too,' Maniatis said.

Chris Grice from National Seniors Australia points out the ambiguity of the mandate, questioning its practicality at the point of sale.

'If you go to the till and you pay for bread and you pay for cake, does that mean that you pay cash for one item and then you've got to use a card for the other?' Grice said.

This scenario illustrated the potential complications and inconveniences that could arise for consumers, particularly seniors who may not be as comfortable with digital payment methods.

The deadline for public submissions on the mandate is fast approaching, and Treasurer Jim Chalmers urged the community to voice their opinions.

'What this consultation means is that people from all corners of our community can express a view,' Chalmers said.

It's a critical opportunity for seniors and other cash-reliant Australians to make their concerns heard and advocate for a more inclusive mandate that recognises the value of cash in all transactions.

As we navigate the complexities of this proposed mandate, it's essential to consider the broader implications for our senior community.

The shift towards a cashless society may offer convenience for some, but it also risks leaving behind those who depend on or prefer cash.

It's a reminder that in our pursuit of technological advancement, we must not forget the importance of inclusivity and the diverse needs of all Australians.

In other news, starting 6 January, Commonwealth Bank will introduce a new $3 fee for cash withdrawals made at branches, post offices, or by phone.

Customers with a 'Complete Access Account' will be moved to 'Smart Access Accounts,' including this new fee. You can read more about it here.

Credit: YouTube

Key Takeaways

- Senior groups are criticising the proposed government mandate that aims to protect cash purchases, saying it doesn't go far enough.

- The mandate, expected to start on 1 January 2026, will require businesses to accept cash for essential items but not for non-essential goods.

- Supporters of cash point out its benefits, such as avoiding card surcharges, reducing online banking risks, and aiding in budgeting.

- There is some confusion over the mandate, exemplified by the complication of paying for some grocery items with cash while having to use a card for others. The deadline for public submissions on the matter is approaching.