Can winning the lottery make your life worse? This pensioner's story will shock you

By

- Replies 23

We all love the idea of winning the lottery. Just imagine – all your money troubles could be over in an instant! No more worrying about bills or whether you can afford your weekly shop.

For most of us, it's nothing more than a pipe dream. But every now and then, someone's lucky enough to hit the jackpot and have their life changed forever.

However, recent incidents show that a huge sum of cash could make someone’s life significantly worse… such as what happened to this lottery winner.

61-year-old Craig Hill, who has been diagnosed with schizophrenia and post-traumatic stress disorder after being held hostage by eight inmates at Townsville Prison during his shift as a prison guard 18 years ago, claimed that a lottery win meant a steep drop in his pension benefits.

In an interview, Craig said he entered The Lott’s ‘Set For Life’ game back in October, and scored a prize of around $60,000 – a lower division win.

Under the terms of the lottery, he was supposed to receive $5,000 a month for a year.

However, Mr Hill’s joy quickly turned into dread and panic because as it turned out, his $60,000 win was considered as 'income'.

And because he suffers from psychological problems, Centrelink ruled him as 'a professional gambler' and slashed his disability pension by $250 a week.

Due to the cut, Craig now only receives about $328.20 a fortnight which is nearly half of his disability pension.

Following his request for a review, Mr Hill alleged that Centrelink officials also reduced his wife's carer's allowance by roughly the same amount as his pension.

'It’s ridiculous,' he said.

'I did the right thing and contacted Centrelink and they told me because it was paid monthly it counted as income from gambling.'

'So I asked if I could deduct all my gambling losses over the past 20 years and they said no, you only become a professional gambler on the day you win.'

'If I'd won $600,000 on the Powerball it wouldn't affect my pension but because it's paid monthly I'm a professional gambler?'

Craig vowed to take the dispute to the Administrative Appeals Tribunal but then was told that an audit of his entire pension for the past seven years is a possibility.

'There's a culture in some of these departments where they see clients as the enemy but if they didn't have clients they wouldn't have jobs,' he added.

Understandably, the pensioner was outraged. Not only was he not expecting this turn of events, but he’s claiming that he’s not even close to being a 'professional gambler'.

He mentioned that he only plays Powerball whenever the jackpot gets high, and he also bought ‘Set For Life’ regularly since 2015.

Mr Hill clarified: 'I'm not betting on the horses or going to the casino, I maybe have a bit of a lash on the poker machines once in a while.'

Mr Hill also reached out to The Lott, the company in charge of distributing tickets for the game, in an attempt to have the money paid out all at once, but he claims that the organisation refused to do so and didn’t give a reason.

Given that his winnings weren’t considered taxable income by the Australian Taxation Office, and that ‘Set For Life’ was purchased with money that wasn’t immediately considered income by Centrelink, it doesn’t make sense to classify it as such.

However, even if the lottery winnings were tax-free, that wouldn’t influence their capacity to be assessed as income. According to the Social Services Department, 'unless specifically exempted in legislation, few income amounts are excluded from welfare calculations’.

'Lottery winnings that are received periodically, for example on a monthly basis for an indefinite length of time, are assessed as income for the period to which they relate,' the statement read.

'This is consistent with the principle of targeting assistance to those who need it most. A periodic lottery winning is an ongoing source of income which can be used for a person’s own self-support.'

In retrospect, it’s understandable that they made that decision given that there are rules set for such situations. However, Mr Hill's unique case is surely something to be reconsidered by the system.

In your opinion, do you think authorities should change the rules for pensioners claiming cash prizes?

For most of us, it's nothing more than a pipe dream. But every now and then, someone's lucky enough to hit the jackpot and have their life changed forever.

However, recent incidents show that a huge sum of cash could make someone’s life significantly worse… such as what happened to this lottery winner.

61-year-old Craig Hill, who has been diagnosed with schizophrenia and post-traumatic stress disorder after being held hostage by eight inmates at Townsville Prison during his shift as a prison guard 18 years ago, claimed that a lottery win meant a steep drop in his pension benefits.

In an interview, Craig said he entered The Lott’s ‘Set For Life’ game back in October, and scored a prize of around $60,000 – a lower division win.

Craig saw his pension payment reduced after his Lotto win. Credit: Twitter/Craig Hill.

Under the terms of the lottery, he was supposed to receive $5,000 a month for a year.

However, Mr Hill’s joy quickly turned into dread and panic because as it turned out, his $60,000 win was considered as 'income'.

And because he suffers from psychological problems, Centrelink ruled him as 'a professional gambler' and slashed his disability pension by $250 a week.

Due to the cut, Craig now only receives about $328.20 a fortnight which is nearly half of his disability pension.

Following his request for a review, Mr Hill alleged that Centrelink officials also reduced his wife's carer's allowance by roughly the same amount as his pension.

'It’s ridiculous,' he said.

'I did the right thing and contacted Centrelink and they told me because it was paid monthly it counted as income from gambling.'

'So I asked if I could deduct all my gambling losses over the past 20 years and they said no, you only become a professional gambler on the day you win.'

'If I'd won $600,000 on the Powerball it wouldn't affect my pension but because it's paid monthly I'm a professional gambler?'

Craig vowed to take the dispute to the Administrative Appeals Tribunal but then was told that an audit of his entire pension for the past seven years is a possibility.

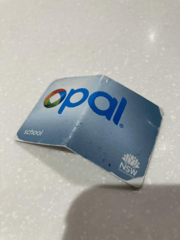

While the top prize for the Lott's Set for Life lottery is a monthly payment of $20,000 per month for 20 years, Mr Hill won a lower division with a one-year payment of $5,000 per month. Credit: The Lott.

'There's a culture in some of these departments where they see clients as the enemy but if they didn't have clients they wouldn't have jobs,' he added.

Understandably, the pensioner was outraged. Not only was he not expecting this turn of events, but he’s claiming that he’s not even close to being a 'professional gambler'.

He mentioned that he only plays Powerball whenever the jackpot gets high, and he also bought ‘Set For Life’ regularly since 2015.

Mr Hill clarified: 'I'm not betting on the horses or going to the casino, I maybe have a bit of a lash on the poker machines once in a while.'

Mr Hill also reached out to The Lott, the company in charge of distributing tickets for the game, in an attempt to have the money paid out all at once, but he claims that the organisation refused to do so and didn’t give a reason.

Given that his winnings weren’t considered taxable income by the Australian Taxation Office, and that ‘Set For Life’ was purchased with money that wasn’t immediately considered income by Centrelink, it doesn’t make sense to classify it as such.

However, even if the lottery winnings were tax-free, that wouldn’t influence their capacity to be assessed as income. According to the Social Services Department, 'unless specifically exempted in legislation, few income amounts are excluded from welfare calculations’.

'Lottery winnings that are received periodically, for example on a monthly basis for an indefinite length of time, are assessed as income for the period to which they relate,' the statement read.

'This is consistent with the principle of targeting assistance to those who need it most. A periodic lottery winning is an ongoing source of income which can be used for a person’s own self-support.'

Key Takeaways

- A disabled 61-year-old Australian had his pension slashed by $500 a fortnight after a $60,000 lottery win.

- Centrelink considered him a 'professional gambler' and cut his wife's carer's allowance by a similar amount.

- Mr Hill claimed he was very far from being a professional gambler and only played the lottery occasionally.

- Services Australia said that unless specifically exempted in legislation, few income amounts were excluded from welfare calculations.

- The department admitted that if Mr Hill had received the payout as a lump sum it wouldn't have been assessed as income.

In retrospect, it’s understandable that they made that decision given that there are rules set for such situations. However, Mr Hill's unique case is surely something to be reconsidered by the system.

In your opinion, do you think authorities should change the rules for pensioners claiming cash prizes?