Can I receive the Age Pension while living overseas?

- Replies 16

While you may baulk at the idea of leaving our wonderful country, for some seniors, it’s their best option. Whether they are reuniting with family abroad, are dual citizens, are looking to experience another culture or searching for a budget-friendly place to live, it raises the question: Are they still eligible for the Australian Age Pension?

One such senior asked this question to the Sydney Morning Herald. Their full question is as follows:

‘I intend to retire at the end of 2023 at the age of 64. As a dual-national, I will be moving to Italy as a self-funded retiree, drawing initially on my Australian superannuation. Should my super balance drop below the Centrelink age pension threshold for singles in the future and current pension rules remain unchanged, could I access any Centrelink assistance as an Australian citizen living abroad? What government pension entitlements would I be eligible for when I reach 67?’

What a fantastic question! George Cochrane, a superannuation and retirement expert, was kind enough to answer.

Services Australia states that ‘to get Age Pension you generally need to have been an Australian resident for at least 10 years in total. For at least 5 of these years, there must be no break in your residence.’

There are, however, social security agreements that may help you claim if you’re living or have lived and worked in certain countries. You’ll need to confirm whether the country you are moving to/living in holds a social security agreement with Australia.

In this particular case, they are moving to Italy. Australia and Italy have a current agreement in place requiring that ‘your total Australian residence combined with your period(s) of

coverage in Italy must add up to at least 10 years’.

If you live outside Australia when you claim, you generally need at least 12 months of Australian ‘Working Life Residence’, of which 6 months must be in one period. This simply means you must have worked for at least 12 months between the ages of 16 and 67.

Need help? International Services can:

Ready to claim?

Claim forms can be found on Services Australia’s website:

Claim for Age Pension and Pension Bonus

Income and Assets form

You can then print these out and submit them according to the postal address on the form. You can also take the forms with you to your nearest service centre.

Alternatively, you can use your myGov account to fill out the forms electronically. Please note that your myGov and Centrelink accounts must be linked.

Not sure how to link your accounts? Services Australia has provided step-by-step instructions for your convenience. You can read more here.

You can submit your claim in the 13 weeks before you reach Age Pension age.

Eligibility

The age eligibility, according to Services Australia, is:

On 1 July 2021, the Age Pension age increased to 66 years and 6 months for people born from 1 July 1955 to 31 December 1956, inclusive.

If your birthdate is on or after 1 January 1957, you’ll have to wait until you turn 67. This will be the Age Pension age from 1 July 2023.

How much will I be paid?

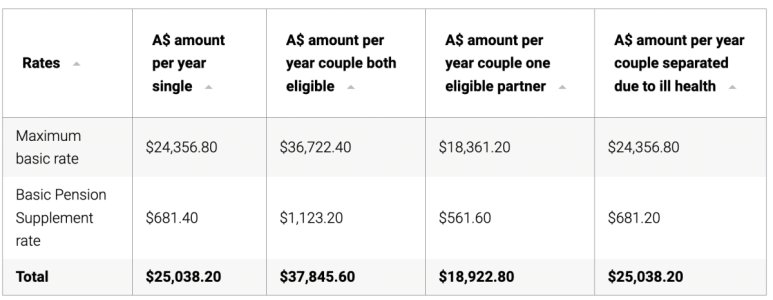

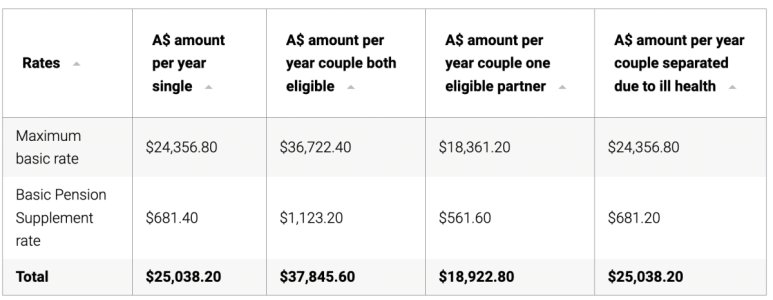

The maximum single age pension paid overseas is $25,038.

As Cochrane explains, this is ‘lower than that paid to residents, as you only get the basic pension supplement of $681.40 a year and lose the energy supplement of $366.60’.

To be eligible for the full pension, your assets must be below the $280,000 threshold or $419,000 for couples ($504,500 for non-homeowners or $643,500 for couples), and your fortnightly income must be below $190.

To receive a part pension paid overseas, your assets need to be below $601,000 for single homeowners ($904,500 for couples) or $825,500 for single non-homeowners ($1,129,000 for couples), along with fortnightly income below $2116.

You can read more on pension rates payable outside Australia here.

So there you go! Depending on the country, you may still be eligible for a pension paid overseas. Be sure to check your eligibility, members, so you don’t miss out!

One such senior asked this question to the Sydney Morning Herald. Their full question is as follows:

‘I intend to retire at the end of 2023 at the age of 64. As a dual-national, I will be moving to Italy as a self-funded retiree, drawing initially on my Australian superannuation. Should my super balance drop below the Centrelink age pension threshold for singles in the future and current pension rules remain unchanged, could I access any Centrelink assistance as an Australian citizen living abroad? What government pension entitlements would I be eligible for when I reach 67?’

Looking to move overseas? Here’s everything you need to know about the impact on your pension. Image Credit: Shutterstock

What a fantastic question! George Cochrane, a superannuation and retirement expert, was kind enough to answer.

Services Australia states that ‘to get Age Pension you generally need to have been an Australian resident for at least 10 years in total. For at least 5 of these years, there must be no break in your residence.’

There are, however, social security agreements that may help you claim if you’re living or have lived and worked in certain countries. You’ll need to confirm whether the country you are moving to/living in holds a social security agreement with Australia.

In this particular case, they are moving to Italy. Australia and Italy have a current agreement in place requiring that ‘your total Australian residence combined with your period(s) of

coverage in Italy must add up to at least 10 years’.

If you live outside Australia when you claim, you generally need at least 12 months of Australian ‘Working Life Residence’, of which 6 months must be in one period. This simply means you must have worked for at least 12 months between the ages of 16 and 67.

Need help? International Services can:

- help you claim a pension from any country with a social security agreement with Australia

- advise on how to claim a pension from a country without an agreement.

Ready to claim?

Claim forms can be found on Services Australia’s website:

Claim for Age Pension and Pension Bonus

Income and Assets form

You can then print these out and submit them according to the postal address on the form. You can also take the forms with you to your nearest service centre.

Alternatively, you can use your myGov account to fill out the forms electronically. Please note that your myGov and Centrelink accounts must be linked.

Not sure how to link your accounts? Services Australia has provided step-by-step instructions for your convenience. You can read more here.

You can submit your claim in the 13 weeks before you reach Age Pension age.

Eligibility

The age eligibility, according to Services Australia, is:

On 1 July 2021, the Age Pension age increased to 66 years and 6 months for people born from 1 July 1955 to 31 December 1956, inclusive.

If your birthdate is on or after 1 January 1957, you’ll have to wait until you turn 67. This will be the Age Pension age from 1 July 2023.

How much will I be paid?

The maximum basic rate and Basic Pension Supplement rate when you’re living outside Australia. Image Credit: Services Australia.

The maximum single age pension paid overseas is $25,038.

As Cochrane explains, this is ‘lower than that paid to residents, as you only get the basic pension supplement of $681.40 a year and lose the energy supplement of $366.60’.

To be eligible for the full pension, your assets must be below the $280,000 threshold or $419,000 for couples ($504,500 for non-homeowners or $643,500 for couples), and your fortnightly income must be below $190.

To receive a part pension paid overseas, your assets need to be below $601,000 for single homeowners ($904,500 for couples) or $825,500 for single non-homeowners ($1,129,000 for couples), along with fortnightly income below $2116.

You can read more on pension rates payable outside Australia here.

So there you go! Depending on the country, you may still be eligible for a pension paid overseas. Be sure to check your eligibility, members, so you don’t miss out!