Can banks be held responsible for this $222,000 scam? This man thinks so

At the SDC, despite regularly writing about scams, we still find it difficult to imagine what we would do if we were in the shoes of the scam victims.

Consider this businessman who fell victim to a scam in March of this year, losing an unbelievable $222,000.

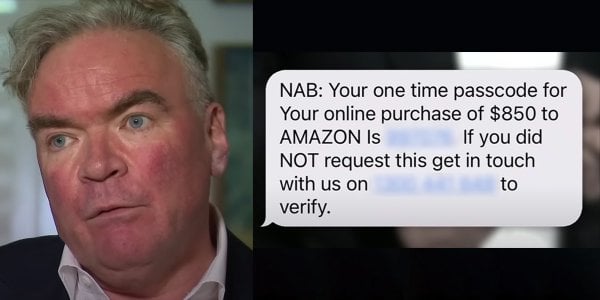

Tim Watkins, originally from the UK and relocated to the country 11 years prior, faced a significant financial setback due to an incident involving a bank impersonation scam.

Mr Watkins said he received an SMS message in a thread of other correspondence from a bank that’s identical to the one he uses, notifying him that $850 had been withdrawn from his account.

Following the instructions provided when he contacted the given number, he took steps to secure his funds.

However, this led to money being stolen in the ten transactions that followed.

‘The feeling when I realised what happened is indescribable,’ said Mr Watkins.

‘It’s this horrible feeling in the pit of your stomach. I had to dig into my mortgage to pay my staff and my suppliers,’ he continued.

If this had occurred in the UK, Mr Watkins believed he could have been reimbursed through the existing voluntary system in place.

Unfortunately, Australian bank customers do not have the same recourse.

Despite expecting a complete refund and feeling naive after the significant loss, he was only granted a reimbursement of $30,000 after losing $222,000.

For this case, Mr Watkins teamed up with nine other Australian scam victims who penned an open letter to the government. The letter, addressed to Prime Minister Anthony Albanese, is set to be released on Wednesday.

In their plea, they urged the government to follow the UK’s model, particularly as they have also suffered losses ranging from several thousand to millions of dollars.

The group argued that Australians should not bear the responsibility of shielding themselves from increasingly sophisticated scams, as the banks, which already have access to the largest amount of resources, are supposed to be doing more.

‘Anyone can be caught by crafty scams,’ wrote the group.

‘That’s why we are really fed up by the narrative—pushed by the banks and others—that we let our guard down and are somehow at fault.’

‘We are the victims here, robbed because Australian banks, telcos, and government—who all have the ability and resources—failed to protect us from the highly sophisticated international scam business,’ the letter further read.

In the previous year, Australians experienced a surge in scam-related losses, reaching a record $3.1 billion, compared to $2 billion in 2021, as reported by the Australian Competition and Consumer Commission (ACCC).

Additionally, the average reported losses on Scamwatch rose by 54 per cent, from $12,742 in 2021 to $19,654.

In April, the Australian Securities and Investments Commission (ASIC) issued a report revealing that during the 2021-22 financial year, 31,100 clients across the big four banks—National Australia Bank (NAB), Westpac, Commonwealth Bank, and Australia and New Zealand Banking Group Limited (ANZ) combined—had lost more than $558 million to various scams.

ASIC also reported having only an average reimbursement rate of 2 per cent to 5 per cent of that money, with a total repayment amount of $21 million.

In their letter, the victims stressed that Australian banks’ anti-scam systems resembled a ‘patchwork’, unlike the soon-to-be mandatory code in the UK, which requires banks to reimburse scam victims for losses not caused by their own fault.

In response, scam victims strongly recommended introducing mandatory reimbursement schemes for the benefit of all parties. The letter can be accessed here.

Assistant Treasurer and Minister for Financial Services Stephen Jones said discussions are underway to mitigate scams.

‘What is critical is that we have a significant uplift from banks, telecommunications and social media platforms because this is the ecosystem that the scammers operate in,’ he noted.

Video source: YouTube/A Current Affair

Chief Executive of the Consumer Action Law Centre, Stephanie Tonkin, who brought together the scam victims to advocate for government changes, pointed out that mandatory reimbursement should be a central component of the anti-scam measures introduced by the government.

‘Only a mandatory reimbursement model will incentivise the banks to do what only they can do to make their platforms safer for customers,’ explained Mr Tonkin.

A representative from the Australian Banking Association mentioned that a recent authorisation from the consumer watchdog would lead to collaborative initiatives among banks to actively disrupt scams.

‘All sectors have a key role to play in the continued fight against scams,’ they emphasised. ‘This includes government, banks, law enforcement, telcos, social media platforms, crypto platforms and individuals.’

Members, do you agree that Australian banks should follow the UK's model, urging banks to reimburse scam victims for losses not their fault? Share your thoughts in the comments below!

Consider this businessman who fell victim to a scam in March of this year, losing an unbelievable $222,000.

Tim Watkins, originally from the UK and relocated to the country 11 years prior, faced a significant financial setback due to an incident involving a bank impersonation scam.

Mr Watkins said he received an SMS message in a thread of other correspondence from a bank that’s identical to the one he uses, notifying him that $850 had been withdrawn from his account.

Following the instructions provided when he contacted the given number, he took steps to secure his funds.

However, this led to money being stolen in the ten transactions that followed.

‘The feeling when I realised what happened is indescribable,’ said Mr Watkins.

‘It’s this horrible feeling in the pit of your stomach. I had to dig into my mortgage to pay my staff and my suppliers,’ he continued.

If this had occurred in the UK, Mr Watkins believed he could have been reimbursed through the existing voluntary system in place.

Unfortunately, Australian bank customers do not have the same recourse.

Despite expecting a complete refund and feeling naive after the significant loss, he was only granted a reimbursement of $30,000 after losing $222,000.

For this case, Mr Watkins teamed up with nine other Australian scam victims who penned an open letter to the government. The letter, addressed to Prime Minister Anthony Albanese, is set to be released on Wednesday.

In their plea, they urged the government to follow the UK’s model, particularly as they have also suffered losses ranging from several thousand to millions of dollars.

The group argued that Australians should not bear the responsibility of shielding themselves from increasingly sophisticated scams, as the banks, which already have access to the largest amount of resources, are supposed to be doing more.

‘Anyone can be caught by crafty scams,’ wrote the group.

‘That’s why we are really fed up by the narrative—pushed by the banks and others—that we let our guard down and are somehow at fault.’

‘We are the victims here, robbed because Australian banks, telcos, and government—who all have the ability and resources—failed to protect us from the highly sophisticated international scam business,’ the letter further read.

In the previous year, Australians experienced a surge in scam-related losses, reaching a record $3.1 billion, compared to $2 billion in 2021, as reported by the Australian Competition and Consumer Commission (ACCC).

Additionally, the average reported losses on Scamwatch rose by 54 per cent, from $12,742 in 2021 to $19,654.

In April, the Australian Securities and Investments Commission (ASIC) issued a report revealing that during the 2021-22 financial year, 31,100 clients across the big four banks—National Australia Bank (NAB), Westpac, Commonwealth Bank, and Australia and New Zealand Banking Group Limited (ANZ) combined—had lost more than $558 million to various scams.

ASIC also reported having only an average reimbursement rate of 2 per cent to 5 per cent of that money, with a total repayment amount of $21 million.

In their letter, the victims stressed that Australian banks’ anti-scam systems resembled a ‘patchwork’, unlike the soon-to-be mandatory code in the UK, which requires banks to reimburse scam victims for losses not caused by their own fault.

In response, scam victims strongly recommended introducing mandatory reimbursement schemes for the benefit of all parties. The letter can be accessed here.

Assistant Treasurer and Minister for Financial Services Stephen Jones said discussions are underway to mitigate scams.

‘What is critical is that we have a significant uplift from banks, telecommunications and social media platforms because this is the ecosystem that the scammers operate in,’ he noted.

Video source: YouTube/A Current Affair

Chief Executive of the Consumer Action Law Centre, Stephanie Tonkin, who brought together the scam victims to advocate for government changes, pointed out that mandatory reimbursement should be a central component of the anti-scam measures introduced by the government.

‘Only a mandatory reimbursement model will incentivise the banks to do what only they can do to make their platforms safer for customers,’ explained Mr Tonkin.

A representative from the Australian Banking Association mentioned that a recent authorisation from the consumer watchdog would lead to collaborative initiatives among banks to actively disrupt scams.

‘All sectors have a key role to play in the continued fight against scams,’ they emphasised. ‘This includes government, banks, law enforcement, telcos, social media platforms, crypto platforms and individuals.’

Key Takeaways

- Tim Watkins, who moved to Australia from the UK, was scammed out of $222,000 but was only reimbursed $30,000.

- Watkins, along with nine other Australian scam victims, have written an open letter to the government urging it to adopt the UK's model of reimbursing scam victims.

- There is currently no requirement in Australia for banks to reimburse scam victims; British banks, on the other hand, will soon be legally bound to do so.

- Estimates from the Australian Securities and Investments Commission suggest that only two to five per cent of money lost to scams was reimbursed in the 2021-22 financial year, while average reported losses on Scamwatch have increased by 54 per cent.