Brace yourself: New data reveals a shocking decline in Australian home values

- Replies 2

Homeowners, it’s time to brace yourselves.

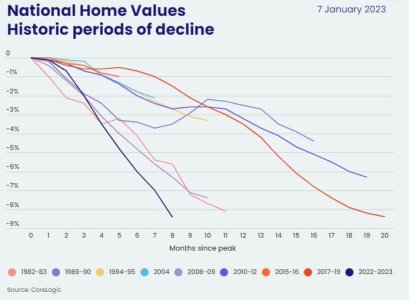

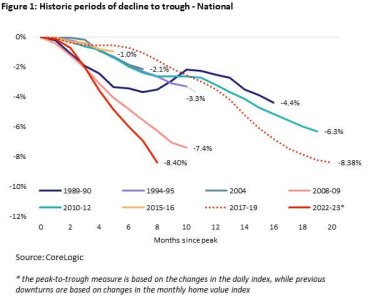

New data from experts reveals the value of homes around Australia has lost thousands in value since May last year – the largest decline in Aussie history so far.

The data from CoreLogic's Daily Home Value Index has revealed that the average value of homes around Australia has lost an estimated average of $64,820 in value after peaking on May 7, 2022. To put it into perspective, that’s an 8.4 per cent decline. It also broke the previous record fall of 8.38 per cent between October 2017 and June 2019.

‘While the housing downturn between 2017 and 2019 lasted 20 months, the new record-breaking price falls have played out in less than nine months,’ said Eliza Owen, Head of Research for CoreLogic Australia. She added that further falls should be expected in the months ahead.

CoreLogic, a company that provides property insights and data, based its Home Value Index on three broad housing types:

According to Ms Owen, the main force behind this fall is the recent cycle of rate hikes that have ‘risen at the fastest pace on record’.

‘A 300-basis point increase in the underlying cash rate over just eight months has resulted in a rapid reduction in borrowing capacity, lowering the amount buyers can offer for homes,’ the data analyst said.

Another factor that they looked into was household debt. Ms Owen shared that homeowners are more indebted today as compared to the ‘historic periods of rate rises’. The latest estimate of the housing debt-to-income ratio from the Reserve Bank of Australia was 188.5 per cent.

However extreme the current decline may seem, Ms Owen said that this downturn is coming off a ‘very high base’.

‘The sharp decline in dwelling values follows an upswing of 28.9% between September 2020 and May 2022, which was the fastest rise in home values nationally on record,’ she explained.

She added further that by the end of 2022, home values were still 16 per cent higher than they were five years ago, and 59.8 per cent higher than 10 years ago.

Australia’s three largest cities, Sydney, Brisbane, and Melbourne lead the bulk of this decline. They also have the largest weight in the Home Value Index.

Sydney home values saw a peak-to-trough fall of 13%.

Brisbane values fell 10%.

Melbourne values fell 8.6% from the peak.

Ms Owen warned that over the coming months, homeowners should expect market conditions to remain ‘soft’.

‘The underlying cash rate is likely to see further increases in 2023, with market expectations pricing a peak of around 4%, while the median forecast from Australian economists is lower at 3.6%,’ she stated.

The data analyst stated that ongoing increases in interest rates will ‘further erode the borrowing capacity’, which will prolong the country’s housing downturn.

On the political front, government policies also play a major role in influencing housing trends and have short-term and long-term effects. When it comes to the current decline in house prices, government policies such as interest rate hike cycles, lending regulations, and restrictions on foreign buyers can all have an impact on fluctuating housing markets.

Whatever the cause of the decline, all these factors and more combine to shape housing trends over time, and a comprehensive understanding of their influence is key to gauging how housing markets will move in the future.

Where do you see the housing market heading in the next few months? Share your thoughts in the comments below.

New data from experts reveals the value of homes around Australia has lost thousands in value since May last year – the largest decline in Aussie history so far.

The data from CoreLogic's Daily Home Value Index has revealed that the average value of homes around Australia has lost an estimated average of $64,820 in value after peaking on May 7, 2022. To put it into perspective, that’s an 8.4 per cent decline. It also broke the previous record fall of 8.38 per cent between October 2017 and June 2019.

‘While the housing downturn between 2017 and 2019 lasted 20 months, the new record-breaking price falls have played out in less than nine months,’ said Eliza Owen, Head of Research for CoreLogic Australia. She added that further falls should be expected in the months ahead.

CoreLogic, a company that provides property insights and data, based its Home Value Index on three broad housing types:

- Detached houses

- Units

- Combined dwellings index that includes both houses and units

According to Ms Owen, the main force behind this fall is the recent cycle of rate hikes that have ‘risen at the fastest pace on record’.

‘A 300-basis point increase in the underlying cash rate over just eight months has resulted in a rapid reduction in borrowing capacity, lowering the amount buyers can offer for homes,’ the data analyst said.

Another factor that they looked into was household debt. Ms Owen shared that homeowners are more indebted today as compared to the ‘historic periods of rate rises’. The latest estimate of the housing debt-to-income ratio from the Reserve Bank of Australia was 188.5 per cent.

However extreme the current decline may seem, Ms Owen said that this downturn is coming off a ‘very high base’.

‘The sharp decline in dwelling values follows an upswing of 28.9% between September 2020 and May 2022, which was the fastest rise in home values nationally on record,’ she explained.

She added further that by the end of 2022, home values were still 16 per cent higher than they were five years ago, and 59.8 per cent higher than 10 years ago.

Australia’s three largest cities, Sydney, Brisbane, and Melbourne lead the bulk of this decline. They also have the largest weight in the Home Value Index.

Sydney home values saw a peak-to-trough fall of 13%.

Brisbane values fell 10%.

Melbourne values fell 8.6% from the peak.

Ms Owen warned that over the coming months, homeowners should expect market conditions to remain ‘soft’.

‘The underlying cash rate is likely to see further increases in 2023, with market expectations pricing a peak of around 4%, while the median forecast from Australian economists is lower at 3.6%,’ she stated.

The data analyst stated that ongoing increases in interest rates will ‘further erode the borrowing capacity’, which will prolong the country’s housing downturn.

On the political front, government policies also play a major role in influencing housing trends and have short-term and long-term effects. When it comes to the current decline in house prices, government policies such as interest rate hike cycles, lending regulations, and restrictions on foreign buyers can all have an impact on fluctuating housing markets.

Whatever the cause of the decline, all these factors and more combine to shape housing trends over time, and a comprehensive understanding of their influence is key to gauging how housing markets will move in the future.

Key Takeaways

- Homes around Australia lost an estimated average of $64,820 in value since May last year according to CoreLogic's Daily Home Value Index.

- The main force behind the decline is the dramatic cycle of rate hikes in the back half of 2022.

- Sydney, Melbourne and Brisbane have seen the largest drops in home values with decreases of 13%, 8.6%, and 10% respectively.

- Home values are expected to continue declining over the coming months, as ongoing interest rate increases erode the borrowing capacity and prolong the housing downturn.