Boost your retirement fund: Six methods to increase your income

- Replies 1

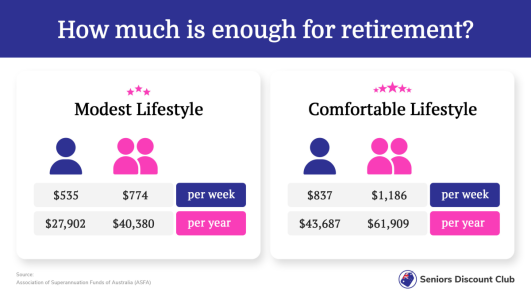

These days, with the rising costs of living, it can be a challenge to ensure that we have enough funds to get by in retirement.

At the Seniors Discount Club, our mission is to help members make the most of their hard-earned money, so we were keen to uncover any best-kept secrets for boosting retirement savings and increasing funds.

Thankfully, there are still a few silver linings out there! Below, we look at six strategies savvy retired folks could use to maximise their income.

Let your savings do the heavy lifting

The superannuation guarantee (SG) refers to a portion of your regular earnings, apart from your wages, that your employer contributes to your retirement fund. This measure has been in effect since 1992 and has led to individuals accumulating greater savings than ever before.

In Australia, the SG rate currently stands at 11% per year and is slated to gradually increase by 0.5% annually until it reaches 12% by July 2025.

This has prompted people to seek professional advice to bolster their retirement savings during the crucial years leading up to their retirement. This often involves selling assets and transferring the proceeds into their superannuation accounts.

According to Jonathan Philpot, a specialist Wealth Management Adviser at HLB Mann Judd in Sydney, selling assets after retirement offers the advantage of reduced capital gains tax. Retirees can also make non-concessional contributions to their super funds.

Furthermore, income generated from pension earnings and withdrawals is tax-free. The option to make non-concessional contributions has also been extended to age 75.

'People should be aiming to put as much of their wealth from outside into super as they can to maximise the tax-free pension limits,' said Philpot.

Best risk-free rate in a decade

During the better part of the last decade, starting from 2012 up until last year, interest rates were exceptionally low. During this period, retirees encountered a situation where they had to take on riskier investments to generate the income and overall returns they needed.

In this financial landscape, the income they relied upon was precarious. There was a chance that their invested capital could decrease if they moved away from the safety of holding cash or similar low-risk investments.

Philpot explained that they had refrained from investing in term deposits for five years but have now reconsidered that strategy. He suggested that readjusting the distribution of their investments should be a gradual process rather than a sudden one.

'It's possible retirees are the only group celebrating higher interest rates– their debt is mostly all gone, and they can now get a reasonable return on the risk-free portion of their retirement savings,' he added.

Use behavioural biases to your advantage

Retirees with a few years of retirement experience tend to choose a fixed income to withdraw from their retirement funds. This decision remains consistent even if their daily expenses increase over time.

Anne Graham, the CEO and Senior Financial Planner at Story Wealth Management in Melbourne, has observed this behaviour among her clients.

According to her, retirees often say they'd rather stick to their predetermined withdrawal amount. They are hesitant to increase their withdrawal even if they can afford it, fearing they might develop a habit of spending more than they need.

Some retirees could comfortably withdraw a higher income, yet they opt to take occasional lump sum withdrawals instead.

'It becomes a conscious effort to call their financial adviser to draw down the lump sum rather than get used to the higher periodic payments,' Graham said.

Put share market volatility into perspective

When faced with a down year in the share markets, Philpot advises his clients not to postpone important family holiday plans. He emphasised that experiencing market declines for a year or two is a natural part of investing.

Instead of getting caught up in short-term fluctuations, it's crucial to maintain focus on your long-term financial plan. This approach ensures you can continue enjoying your desired lifestyle throughout various market cycles.

To help you navigate these fluctuations, Philpot offered a practical guideline. For retirees, he suggests withdrawing approximately 5 per cent of their portfolio's value—a figure slightly above the risk-free rate—in any given year.

He also recommended that around 20 per cent of your portfolio be allocated to a 'safe and secure bucket', which includes assets like cash or fixed-income investments.

This strategic allocation ensures that you have a financial cushion equivalent to at least four years' worth of future income, providing added stability and confidence regardless of short-term market shifts.

Let your asset allocation do the talking

Avoiding unnecessary selling of your investments during unfavourable times is crucial. Having a well-suited asset allocation strategy gives you the confidence to maintain a steady income, access your reserves as needed, and stay invested while markets go through recovery phases.

Graham said, 'I always make sure my clients have a buffer so they can draw down lump sums if they need to. They're drawing on their defensive component, which is cash. It may be you're rebalancing every 6 or 12 months to keep in line with your risk profile.'

Meanwhile, Philpot argued: 'Regardless of what share markets do, you want to be in a position where you don't need to sell investments at the wrong time.'

Live a 100-year life

With the advancement of time, a significant transformation has occurred in how we live. This shift is highlighted in a study titled The 100-Year Life – Living and Working in an Age of Longevity, conducted by Lynda Grattan, a professor at the London Business School.

In the past, people's lifespans were relatively shorter. However, the current trend reveals a remarkable increase in longevity. This prolonged lifespan has led to the emergence of more life stages.

Imagine reaching the age of 100. In this scenario, desiring a retirement income equivalent to 50% of your final earnings necessitates working well into your late 70s or early 80ss.

This extended working life doesn't imply adhering to a single career or job until the traditional retirement age. Grattan's study illustrates a different approach.

People are now adopting a more flexible attitude towards work. They're exploring various avenues, taking breaks from the workforce, contemplating diverse career trajectories, and harnessing technology to continue working later in life, all according to their preferences and circumstances.

We hope you found these tips helpful and informative, members! Do you have more to share? Feel free to let us know in the comments below!

At the Seniors Discount Club, our mission is to help members make the most of their hard-earned money, so we were keen to uncover any best-kept secrets for boosting retirement savings and increasing funds.

Thankfully, there are still a few silver linings out there! Below, we look at six strategies savvy retired folks could use to maximise their income.

The tailwinds for retirees to boost their money in their twilight years could be better right now than people think. Credit: Shutterstock.

Let your savings do the heavy lifting

The superannuation guarantee (SG) refers to a portion of your regular earnings, apart from your wages, that your employer contributes to your retirement fund. This measure has been in effect since 1992 and has led to individuals accumulating greater savings than ever before.

In Australia, the SG rate currently stands at 11% per year and is slated to gradually increase by 0.5% annually until it reaches 12% by July 2025.

This has prompted people to seek professional advice to bolster their retirement savings during the crucial years leading up to their retirement. This often involves selling assets and transferring the proceeds into their superannuation accounts.

According to Jonathan Philpot, a specialist Wealth Management Adviser at HLB Mann Judd in Sydney, selling assets after retirement offers the advantage of reduced capital gains tax. Retirees can also make non-concessional contributions to their super funds.

Furthermore, income generated from pension earnings and withdrawals is tax-free. The option to make non-concessional contributions has also been extended to age 75.

'People should be aiming to put as much of their wealth from outside into super as they can to maximise the tax-free pension limits,' said Philpot.

Best risk-free rate in a decade

During the better part of the last decade, starting from 2012 up until last year, interest rates were exceptionally low. During this period, retirees encountered a situation where they had to take on riskier investments to generate the income and overall returns they needed.

In this financial landscape, the income they relied upon was precarious. There was a chance that their invested capital could decrease if they moved away from the safety of holding cash or similar low-risk investments.

Philpot explained that they had refrained from investing in term deposits for five years but have now reconsidered that strategy. He suggested that readjusting the distribution of their investments should be a gradual process rather than a sudden one.

'It's possible retirees are the only group celebrating higher interest rates– their debt is mostly all gone, and they can now get a reasonable return on the risk-free portion of their retirement savings,' he added.

Use behavioural biases to your advantage

Retirees with a few years of retirement experience tend to choose a fixed income to withdraw from their retirement funds. This decision remains consistent even if their daily expenses increase over time.

Anne Graham, the CEO and Senior Financial Planner at Story Wealth Management in Melbourne, has observed this behaviour among her clients.

According to her, retirees often say they'd rather stick to their predetermined withdrawal amount. They are hesitant to increase their withdrawal even if they can afford it, fearing they might develop a habit of spending more than they need.

Some retirees could comfortably withdraw a higher income, yet they opt to take occasional lump sum withdrawals instead.

'It becomes a conscious effort to call their financial adviser to draw down the lump sum rather than get used to the higher periodic payments,' Graham said.

Put share market volatility into perspective

When faced with a down year in the share markets, Philpot advises his clients not to postpone important family holiday plans. He emphasised that experiencing market declines for a year or two is a natural part of investing.

Instead of getting caught up in short-term fluctuations, it's crucial to maintain focus on your long-term financial plan. This approach ensures you can continue enjoying your desired lifestyle throughout various market cycles.

To help you navigate these fluctuations, Philpot offered a practical guideline. For retirees, he suggests withdrawing approximately 5 per cent of their portfolio's value—a figure slightly above the risk-free rate—in any given year.

He also recommended that around 20 per cent of your portfolio be allocated to a 'safe and secure bucket', which includes assets like cash or fixed-income investments.

This strategic allocation ensures that you have a financial cushion equivalent to at least four years' worth of future income, providing added stability and confidence regardless of short-term market shifts.

Let your asset allocation do the talking

Avoiding unnecessary selling of your investments during unfavourable times is crucial. Having a well-suited asset allocation strategy gives you the confidence to maintain a steady income, access your reserves as needed, and stay invested while markets go through recovery phases.

Graham said, 'I always make sure my clients have a buffer so they can draw down lump sums if they need to. They're drawing on their defensive component, which is cash. It may be you're rebalancing every 6 or 12 months to keep in line with your risk profile.'

Meanwhile, Philpot argued: 'Regardless of what share markets do, you want to be in a position where you don't need to sell investments at the wrong time.'

Live a 100-year life

With the advancement of time, a significant transformation has occurred in how we live. This shift is highlighted in a study titled The 100-Year Life – Living and Working in an Age of Longevity, conducted by Lynda Grattan, a professor at the London Business School.

In the past, people's lifespans were relatively shorter. However, the current trend reveals a remarkable increase in longevity. This prolonged lifespan has led to the emergence of more life stages.

Imagine reaching the age of 100. In this scenario, desiring a retirement income equivalent to 50% of your final earnings necessitates working well into your late 70s or early 80ss.

This extended working life doesn't imply adhering to a single career or job until the traditional retirement age. Grattan's study illustrates a different approach.

People are now adopting a more flexible attitude towards work. They're exploring various avenues, taking breaks from the workforce, contemplating diverse career trajectories, and harnessing technology to continue working later in life, all according to their preferences and circumstances.

Key Takeaways

- Maximising income in retirement can be managed by letting your savings do the heavy lifting, with expert advice recommending building up superannuation as much as possible before retirement.

- Even though interest rates have been historically low, a rise in these rates will benefit retirees owing to their minimal debt and the opportunity for a higher return on their savings with little to no risk.

- Utilising behavioural bias to stick to nominated income amounts can help maintain spending habits, even if day-to-day costs increase.

- Asset allocation is crucial in retirement planning, ensuring that income can be maintained even while markets recover or face fluctuation.

We hope you found these tips helpful and informative, members! Do you have more to share? Feel free to let us know in the comments below!