Beware! Thousands tricked by alarming UBank scam

By

VanessaC

- Replies 15

Watch out, folks! We've got an urgent warning for you, particularly for those who are Ubank customers.

In an alarming new development, scammers have once again taken to the internet to try and trick unknowing Aussies out of their hard-earned cash.

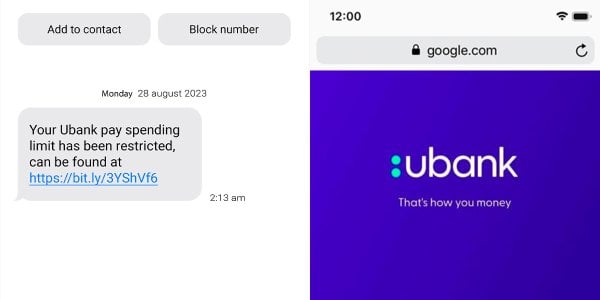

An insidious text message has been circulating, claiming to be from online banking giant UBank.

The text message reads: 'Your UBank pay spending limit has been restricted.'

The accompanying URL link directs victims to a sinister third-party website, where unsuspecting victims are prompted to enter their credit card or banking details.

It is understandable why some may fall for this, because when you see a message like that from your bank, panic can set in, worrying if you can afford your next big purchase.

However, the banks always encourage members to stay cautious. This is especially important when dealing with banking matters in the digital age, where scam artists are very common.

As it stands, UBank, which is home to 700,000 customers, has urged its customers to stand firm, remain vigilant, and contact the bank if any texts raise alarm.

'UBank will never ask you to confirm or disclose banking information via a link in an email or text message,' warned NAB, UBank's parent company.

‘If you have received this type of text message, please forward it to 0476 220 003 (047 NAB 0003) or take a screenshot, email it to [email protected] and then delete the text message,’ NAB advised.

Another type of scam is on the rise leaving authorities alarmed and concerned and these are bank impersonation scams where the average loss is around $22,000, with some reports of losses between $40,000 and $800,000.

An example of this scam is the man who lost $38,000 after receiving a text message about a suspicious transaction in his bank account.

He reportedly received the scam text in the same conversation thread as legitimate messages from his bank, making the scam even more convincing.

He called the number provided in the text and talked to someone who claimed to be a member of his bank's fraud team.

Unfortunately, the fraudster was able to convince him to provide his personal banking information, leading to the loss of all his life savings.

You can read more about what happens next in this article we wrote on bank impersonation scams.

Protection is simple when you know what to look for. The Australian Competition and Consumer Commission (ACCC) even issued a guide to better protect yourself from these pesky phishing scams:

1. Never click on links or open attachments from texts claiming to be from your bank or another trusted organisation asking you to update or verify your details - instead, delete them straight away.

2. Search for any references to a similar scam online. You may refer to our very own Scam Watch for news on the latest scams.

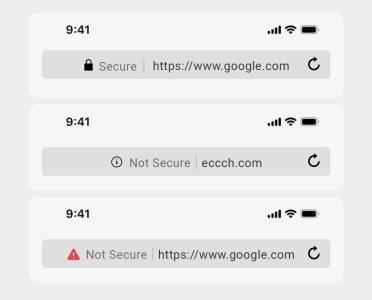

3. Look out for the secure symbol on the website to verify its security.

4. Never provide your personal information–such as, but not limited to, your credit card and online account details– if you receive an unsolicited call or message.

5. If you think you may have fallen for a scam, contact your bank immediately.

6. Report scams to the ACCC via the report a scam page to help forewarn others.

You may also read UBank’s complete security guidelines on their website.

Did you receive a similar text? Let us know in the comments below!

In an alarming new development, scammers have once again taken to the internet to try and trick unknowing Aussies out of their hard-earned cash.

An insidious text message has been circulating, claiming to be from online banking giant UBank.

The text message reads: 'Your UBank pay spending limit has been restricted.'

The accompanying URL link directs victims to a sinister third-party website, where unsuspecting victims are prompted to enter their credit card or banking details.

It is understandable why some may fall for this, because when you see a message like that from your bank, panic can set in, worrying if you can afford your next big purchase.

However, the banks always encourage members to stay cautious. This is especially important when dealing with banking matters in the digital age, where scam artists are very common.

As it stands, UBank, which is home to 700,000 customers, has urged its customers to stand firm, remain vigilant, and contact the bank if any texts raise alarm.

'UBank will never ask you to confirm or disclose banking information via a link in an email or text message,' warned NAB, UBank's parent company.

‘If you have received this type of text message, please forward it to 0476 220 003 (047 NAB 0003) or take a screenshot, email it to [email protected] and then delete the text message,’ NAB advised.

Another type of scam is on the rise leaving authorities alarmed and concerned and these are bank impersonation scams where the average loss is around $22,000, with some reports of losses between $40,000 and $800,000.

An example of this scam is the man who lost $38,000 after receiving a text message about a suspicious transaction in his bank account.

He reportedly received the scam text in the same conversation thread as legitimate messages from his bank, making the scam even more convincing.

He called the number provided in the text and talked to someone who claimed to be a member of his bank's fraud team.

Unfortunately, the fraudster was able to convince him to provide his personal banking information, leading to the loss of all his life savings.

You can read more about what happens next in this article we wrote on bank impersonation scams.

Protection is simple when you know what to look for. The Australian Competition and Consumer Commission (ACCC) even issued a guide to better protect yourself from these pesky phishing scams:

1. Never click on links or open attachments from texts claiming to be from your bank or another trusted organisation asking you to update or verify your details - instead, delete them straight away.

2. Search for any references to a similar scam online. You may refer to our very own Scam Watch for news on the latest scams.

3. Look out for the secure symbol on the website to verify its security.

4. Never provide your personal information–such as, but not limited to, your credit card and online account details– if you receive an unsolicited call or message.

5. If you think you may have fallen for a scam, contact your bank immediately.

6. Report scams to the ACCC via the report a scam page to help forewarn others.

You may also read UBank’s complete security guidelines on their website.

Key Takeaways

- Thousands of UBank customers have been targeted by scammers through a new phishing scam via text message.

- The text message claims that the recipient's UBank spending limit has been restricted and encourages them to visit a third-party website to provide their credit card or banking details.

- UBank, owned by NAB, has warned its customers that such requests would never be made through an email or text message link.

- The ACCC recommends consumers to protect themselves from phishing scams by staying vigilant and reporting any suspicious communications.

Last edited: