Beware: This sophisticated scam sweeps millions using clever tactics

By

Seia Ibanez

- Replies 12

In the digital age, scams have become increasingly sophisticated, and Australians are being urged to stay vigilant as a new type of fraud sweeps across the nation.

The latest scam to hit our shores is not only clever but also devastatingly effective, as evidenced by the unfortunate experience of one couple who lost a staggering $275,000.

This incident is a stark reminder that anyone can fall victim to these deceitful tactics.

The scam in question is known as a payment redirection scam or, more commonly, an invoice scam.

It's a particularly insidious form of fraud that preys on the trust between a customer and a business.

The Australian Competition and Consumer Commission's (ACCC) Scamwatch has reported an increase in these scams, with Australians losing $16.2 million in 2023 alone.

The average amount lost per scam is rising, indicating that scammers are becoming more successful at their game.

How do these invoice scams operate?

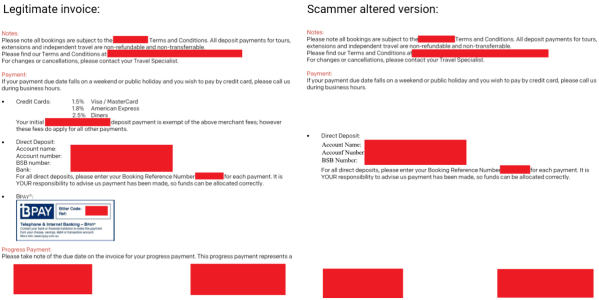

They begin with criminals impersonating a legitimate business the victim has previously engaged with.

The scammers craft an invoice that appears genuine but contains modified payment details, directing the funds into their pockets.

These fraudulent invoices can be sent from a compromised business email account or from an address that closely mimics the legitimate one.

The deception is often so well-executed that victims don't realise they've been scammed until the real business inquires about the outstanding payment.

By then, the money has usually vanished into the ether, with little chance of recovery.

Who is at risk?

The ACCC warned that these scams often target customers of businesses that issue large invoices, such as those in the real estate, legal, and construction sectors.

Scamwatch has noted that customers of travel companies and car dealerships have also been targeted recently.

One particularly heartbreaking story is a couple who lost over $275,000 while finalising a property settlement.

They believed they followed their solicitor's instructions, only to discover that the bank details they had been given were for a scammer's account.

Another man lost more than $35,000 after scammers compromised the email account of a car dealership from which he was purchasing a vehicle.

‘After paying the deposit securely through the dealership’s official website, he received an email with an invoice for the remaining amount owed, which he paid thinking it was genuine,’ the ACCC said.

‘When he went to pick up his new car, he found out that the invoice was a scam and the dealership had only received his deposit.’

So, how can you protect yourself from falling prey to an invoice scam?

The ACCC advised taking a moment to verify who you are dealing with before making any large payments online.

Always confirm payment details by calling the business directly using independently sourced contact details.

Do not rely on phone numbers provided in the email, as these could lead you straight back to the scammer.

Contact your bank immediately if you suspect you've transferred money to a scammer, inform the business or platform you were scammed through, and report the incident to Scamwatch here.

Members, have you received emails similar to these? If so, how did you handle them? Let us know in the comments below!

The latest scam to hit our shores is not only clever but also devastatingly effective, as evidenced by the unfortunate experience of one couple who lost a staggering $275,000.

This incident is a stark reminder that anyone can fall victim to these deceitful tactics.

The scam in question is known as a payment redirection scam or, more commonly, an invoice scam.

It's a particularly insidious form of fraud that preys on the trust between a customer and a business.

The Australian Competition and Consumer Commission's (ACCC) Scamwatch has reported an increase in these scams, with Australians losing $16.2 million in 2023 alone.

The average amount lost per scam is rising, indicating that scammers are becoming more successful at their game.

How do these invoice scams operate?

They begin with criminals impersonating a legitimate business the victim has previously engaged with.

The scammers craft an invoice that appears genuine but contains modified payment details, directing the funds into their pockets.

These fraudulent invoices can be sent from a compromised business email account or from an address that closely mimics the legitimate one.

The deception is often so well-executed that victims don't realise they've been scammed until the real business inquires about the outstanding payment.

By then, the money has usually vanished into the ether, with little chance of recovery.

Who is at risk?

The ACCC warned that these scams often target customers of businesses that issue large invoices, such as those in the real estate, legal, and construction sectors.

Scamwatch has noted that customers of travel companies and car dealerships have also been targeted recently.

One particularly heartbreaking story is a couple who lost over $275,000 while finalising a property settlement.

They believed they followed their solicitor's instructions, only to discover that the bank details they had been given were for a scammer's account.

Another man lost more than $35,000 after scammers compromised the email account of a car dealership from which he was purchasing a vehicle.

‘After paying the deposit securely through the dealership’s official website, he received an email with an invoice for the remaining amount owed, which he paid thinking it was genuine,’ the ACCC said.

‘When he went to pick up his new car, he found out that the invoice was a scam and the dealership had only received his deposit.’

So, how can you protect yourself from falling prey to an invoice scam?

The ACCC advised taking a moment to verify who you are dealing with before making any large payments online.

Always confirm payment details by calling the business directly using independently sourced contact details.

Do not rely on phone numbers provided in the email, as these could lead you straight back to the scammer.

Contact your bank immediately if you suspect you've transferred money to a scammer, inform the business or platform you were scammed through, and report the incident to Scamwatch here.

Key Takeaways

- A couple lost $275,000 due to fake invoice scams, with overall losses reported at $16.2 million in 2023 due to payment redirection scams.

- The scam involved criminals impersonating businesses and sending invoices with modified payment details to redirect payments to the scammer's account.

- The ACCC has issued a warning and advises people to check invoice details thoroughly, confirming payment details are correct by calling businesses using independently sourced contact details.

- If someone falls victim to an invoice scam, they should act quickly to contact their bank, Scamwatch, and inform the affected business or platform.

Last edited: