Beware: Australians are being targeted by this new 'Dad' scam in text messages

- Replies 4

Scam artists know how to take advantage of the good nature of people, and it’s extremely unfortunate when vulnerable people get targeted and taken advantage of by these cyber criminals.

And it’s not just big banks and companies that scammers are impersonating anymore. Now, criminals are also targeting Australians through text messages pretending to be their dads.

Unlike other scams, these messages don’t appear from an unknown phone number but rather appear on your phone under the name ‘Dad’. Yes, that’s right, the scammers have figured out how to make a text message look like it’s actually coming from your dad, making the request to transfer funds to a bank account in order to pay for an item or a service even more believable.

One such instance of a scam text message may begin with a seemingly innocent request for assistance, and it’s not unless you read the text message closely, that you will see it is not from your dad (or any relative, or friend for that matter) but rather a criminal who is after your money.

The text message provides a BSB and account number for ‘dad’, and asks people to send money to the bank account.

An example of the fraudulent text might read: ‘Hey, I brought the wrong card to the petrol station. Can I please borrow 175? I will send it back tonight.’

Late last year, a woman shared a screenshot of an unusual text she received in a popular Facebook group. She said that at first glance, it looked like a call for help from her dad.

‘I’m at Woolworths right now, but I brought the wrong card with me.’ the text message read. ‘Can you please send me $150? I will pay you back today,’ it continued before sending a set of Westpac bank details. You can read more on that story here.

The anti-scam advocacy group Scamwatch urges Aussies to confirm the message's legitimacy with their relatives before transferring any funds. This can be done by quickly calling them to check if they actually sent the message.

This comes after a number of major banks warned their customers about similar scams in November 2022.

One major bank, NAB, disclosed in a statement that several of its customers reported being victims of the scheme. The statement added that the text messages appeared to come from NAB's phone numbers, noting that the fraudsters used a 'spoofing' technique that copied the bank’s information.

The same technique, which has been described as a ‘family impersonation scam’, is now being used by criminals to target Aussies who are simply trying to assist a family member.

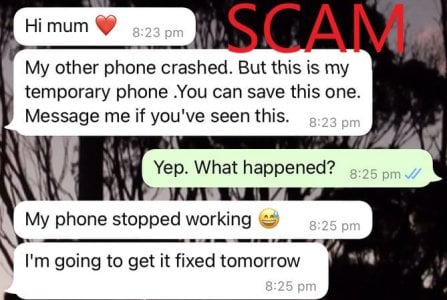

These scams were brought to greater public attention last year with the ‘Hi mum’ scam, which resulted in more than 11,100 Australians losing money in 2022. The total combined reported loss from the ‘Hi mum’ scam alone amounted to $7.2 million.

A twist in the 'Hi mum' scam was also reported. It showed the perpetrator claimed to have lost or broken their phone and then contacted their target from a new number. This establishes a bond with their victims.

Once that happens, the perpetrator would then ask for personal information like photos for their social media profile or money to help pay an urgent bill, contractor, or replace their phone.

Some of these messages can include terrifying sentences like ‘it was a drug debt. If I don’t pay them back, they’ll stab me’, or ‘I am so scared, I don’t know what to do…They have me in the back of a car’ to elicit a sense of urgency from the victim.

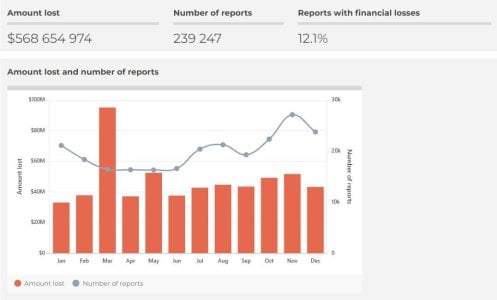

Scamwatch data showed that there were around 240,000 reports last year, with Aussies losing over $568 million to cyber criminals.

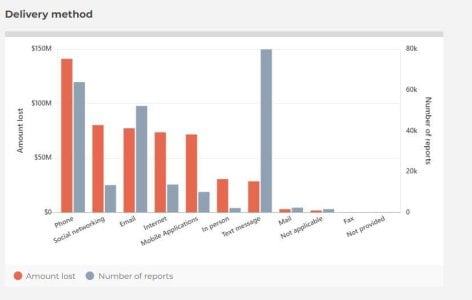

Among those numbers, text message scams were one of the most common types of scams reported in 2022 – at least 80,000 people were reported to have fallen victim to this method of scamming.

We encourage you all to be aware of and watch carefully for these scams, as they are constantly changing to take advantage of unsuspecting people.

To that end, here are some tips to stay ahead of the scammers:

Stay vigilant, everyone! If you ever receive a text message that you believe could be a scam, then please report it to Scamwatch using their form here.

And it’s not just big banks and companies that scammers are impersonating anymore. Now, criminals are also targeting Australians through text messages pretending to be their dads.

Unlike other scams, these messages don’t appear from an unknown phone number but rather appear on your phone under the name ‘Dad’. Yes, that’s right, the scammers have figured out how to make a text message look like it’s actually coming from your dad, making the request to transfer funds to a bank account in order to pay for an item or a service even more believable.

One such instance of a scam text message may begin with a seemingly innocent request for assistance, and it’s not unless you read the text message closely, that you will see it is not from your dad (or any relative, or friend for that matter) but rather a criminal who is after your money.

The text message provides a BSB and account number for ‘dad’, and asks people to send money to the bank account.

An example of the fraudulent text might read: ‘Hey, I brought the wrong card to the petrol station. Can I please borrow 175? I will send it back tonight.’

Late last year, a woman shared a screenshot of an unusual text she received in a popular Facebook group. She said that at first glance, it looked like a call for help from her dad.

‘I’m at Woolworths right now, but I brought the wrong card with me.’ the text message read. ‘Can you please send me $150? I will pay you back today,’ it continued before sending a set of Westpac bank details. You can read more on that story here.

The anti-scam advocacy group Scamwatch urges Aussies to confirm the message's legitimacy with their relatives before transferring any funds. This can be done by quickly calling them to check if they actually sent the message.

This comes after a number of major banks warned their customers about similar scams in November 2022.

One major bank, NAB, disclosed in a statement that several of its customers reported being victims of the scheme. The statement added that the text messages appeared to come from NAB's phone numbers, noting that the fraudsters used a 'spoofing' technique that copied the bank’s information.

The same technique, which has been described as a ‘family impersonation scam’, is now being used by criminals to target Aussies who are simply trying to assist a family member.

These scams were brought to greater public attention last year with the ‘Hi mum’ scam, which resulted in more than 11,100 Australians losing money in 2022. The total combined reported loss from the ‘Hi mum’ scam alone amounted to $7.2 million.

A twist in the 'Hi mum' scam was also reported. It showed the perpetrator claimed to have lost or broken their phone and then contacted their target from a new number. This establishes a bond with their victims.

Once that happens, the perpetrator would then ask for personal information like photos for their social media profile or money to help pay an urgent bill, contractor, or replace their phone.

Some of these messages can include terrifying sentences like ‘it was a drug debt. If I don’t pay them back, they’ll stab me’, or ‘I am so scared, I don’t know what to do…They have me in the back of a car’ to elicit a sense of urgency from the victim.

Scamwatch data showed that there were around 240,000 reports last year, with Aussies losing over $568 million to cyber criminals.

Among those numbers, text message scams were one of the most common types of scams reported in 2022 – at least 80,000 people were reported to have fallen victim to this method of scamming.

We encourage you all to be aware of and watch carefully for these scams, as they are constantly changing to take advantage of unsuspecting people.

To that end, here are some tips to stay ahead of the scammers:

- If you receive a text message that you were not expecting related to financial matters, do not act immediately.

- Keep your personal details secured. Use two-factor authentications and/or password protection when possible.

- Always keep your antivirus and security system updated.

- Be extra wary of messages asking you to send money ‘immediately’. Always check if the message is legitimate by finding an alternative way of contacting the person i.e. calling them.

- Be careful when shopping online, especially on offers that seem too good to be true. Use an online shopping service you know and trust.

Key Takeaways

- A new scam text is doing the rounds, this time impersonating Aussie dads, in which a criminal asks the recipient to transfer funds to a bank account.

- Banks have warned customers about this scam which appears to come from legitimate numbers.

- Last year, 80,000 text message scams were reported.