Authorities crack down on telcos for allowing scammers to infiltrate SMS networks

- Replies 6

For months, scam texts have been causing significant distress and wreaking havoc on Australians, particularly those who are more vulnerable to such deceitful tactics. Fortunately, recent developments have shed light on these fraudulent activities, and the Australian Communications and Media Authority (ACMA) is taking action.

The ACMA recently completed an investigation that uncovered the questionable practices of three telecommunications companies operating in the country.

Specifically, Sinch Australia Pty Ltd and Infobip Information Technology Pty Ltd were found to have failed to meet code obligations, resulting in scam texts being sent to customers.

These texts were designed to look like they were sent by legitimate road toll companies, making it easier for scammers to deceive unsuspecting victims.

Telco-giant Sinch has recently come under fire for allowing a whopping 14,291 non-compliant SMSes to be sent via their network. And they're not the only ones in hot water. Infobip also reportedly authorised a huge 103,146 non-compliant SMSes, some of which impersonated well-known organisations like Medicare and Australia Post.

It's a disappointing revelation, as these non-compliant SMSes have opened the door for scammers. During a recent press briefing, ACMA Chairwoman Nerida O'Loughlin highlighted the gravity of the situation, stating, 'This wouldn't have happened if the companies had adequate processes in place and complied with the rules.'

The ACMA has taken action against Sinch and Infobip by issuing them with formal directions to ensure compliance with their obligations. Failure to comply may result in severe financial penalties of up to $250,000 for these telcos.

In the case of Phone Card Selector Pty Ltd, although they were found to have inadequate systems in place, there is no evidence to suggest that scammers had exploited this vulnerability. This comes as a relief, as it means that customers of the company can breathe a sigh of relief knowing their information has not been compromised.

Scammers are notorious for employing text-based sender IDs to deceive unsuspecting individuals by masquerading as legitimate organisations, including government agencies, banks, and road toll companies.

To combat this issue, Australian telcos are bound by the Reducing Scam Calls and Scam SMS Code, which mandates that they obtain evidence from customers justifying their use of text-based sender IDs, such as using business names, in SMS communications.

Acknowledging the severity of the situation, the federal government has recently announced a significant measure to tackle this problem head-on. The ACMA will take the lead in developing an SMS sender ID register aimed at preventing offshore scammers from impersonating trusted brands and government agencies.

ACMA Chairwoman Nerida O'Loughlin emphasised the significance of this initiative, stating that it will help 'close a key vulnerability' used by scammers. By implementing such a register, the government aims to enhance consumer protection and thwart scammers' efforts to exploit the trust placed in well-known brands and government entities.

Staying vigilant against scams is crucial, and there are several proactive steps we can take to protect ourselves.

It's important to exercise caution and be sceptical of any text messages that seem suspicious or offer deals that appear too good to be true. When in doubt, it's wise to double-check the authenticity of such messages.

Regularly monitoring our bank and phone accounts for any unusual activity is another effective way to stay on top of potential scams. If any suspicious transactions or issues arise, it is imperative to immediately contact our bank or phone company and inform them about the situation.

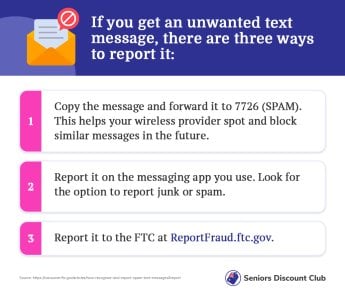

In the unfortunate event that you fall victim to a scam, swift action is essential. Reporting the incident to Scamwatch, contacting your bank and phone company to mitigate further damage, and reaching out to IDCARE for support if personal information has been compromised are all crucial steps to take.

For valuable insights on identifying and preventing phone scams, visiting the acma.gov.au/phone-scams website can provide helpful information. Additionally, staying informed about the latest news and updates on scams and frauds by browsing through the Scam Watch forum on our website is highly recommended.

Have you ever reported a scam text message or communication to the authorities or your telecommunications provider? If so, what was your experience like, and were any actions taken as a result?

Also, what advice would you give to others to help them stay vigilant and protect themselves from falling victim to scam text messages? Feel free to leave a comment below!

The ACMA recently completed an investigation that uncovered the questionable practices of three telecommunications companies operating in the country.

Specifically, Sinch Australia Pty Ltd and Infobip Information Technology Pty Ltd were found to have failed to meet code obligations, resulting in scam texts being sent to customers.

These texts were designed to look like they were sent by legitimate road toll companies, making it easier for scammers to deceive unsuspecting victims.

ACMA has put three telcos on notice after their customers were sent scam texts. Credit: Pexels/Tim Samuel.

Telco-giant Sinch has recently come under fire for allowing a whopping 14,291 non-compliant SMSes to be sent via their network. And they're not the only ones in hot water. Infobip also reportedly authorised a huge 103,146 non-compliant SMSes, some of which impersonated well-known organisations like Medicare and Australia Post.

It's a disappointing revelation, as these non-compliant SMSes have opened the door for scammers. During a recent press briefing, ACMA Chairwoman Nerida O'Loughlin highlighted the gravity of the situation, stating, 'This wouldn't have happened if the companies had adequate processes in place and complied with the rules.'

The ACMA has taken action against Sinch and Infobip by issuing them with formal directions to ensure compliance with their obligations. Failure to comply may result in severe financial penalties of up to $250,000 for these telcos.

In the case of Phone Card Selector Pty Ltd, although they were found to have inadequate systems in place, there is no evidence to suggest that scammers had exploited this vulnerability. This comes as a relief, as it means that customers of the company can breathe a sigh of relief knowing their information has not been compromised.

Scammers are notorious for employing text-based sender IDs to deceive unsuspecting individuals by masquerading as legitimate organisations, including government agencies, banks, and road toll companies.

To combat this issue, Australian telcos are bound by the Reducing Scam Calls and Scam SMS Code, which mandates that they obtain evidence from customers justifying their use of text-based sender IDs, such as using business names, in SMS communications.

Australians are being warned about scammers targeting vulnerable people amid the rising cost of living. Credit: Reddit.

Acknowledging the severity of the situation, the federal government has recently announced a significant measure to tackle this problem head-on. The ACMA will take the lead in developing an SMS sender ID register aimed at preventing offshore scammers from impersonating trusted brands and government agencies.

ACMA Chairwoman Nerida O'Loughlin emphasised the significance of this initiative, stating that it will help 'close a key vulnerability' used by scammers. By implementing such a register, the government aims to enhance consumer protection and thwart scammers' efforts to exploit the trust placed in well-known brands and government entities.

Key Takeaways

- Australian telcos Sinch and Infobip were found to have allowed non-compliant SMSes, which led to scammers sending fraudulent messages impersonating well-known organisations.

- ACMA issued formal directions to Sinch and Infobip to comply with their obligations, with potential penalties of up to $250,000.

- Another telco, Phone Card Selector Pty Ltd, was found to have inadequate systems in place, but there was no evidence that scammers had taken advantage of the opportunity.

- The federal government announced the development of an SMS sender ID register aimed at preventing offshore scammers from impersonating trusted brands and government agencies as a measure to enhance consumer protection and prevent fraudulent activities.

Staying vigilant against scams is crucial, and there are several proactive steps we can take to protect ourselves.

It's important to exercise caution and be sceptical of any text messages that seem suspicious or offer deals that appear too good to be true. When in doubt, it's wise to double-check the authenticity of such messages.

Regularly monitoring our bank and phone accounts for any unusual activity is another effective way to stay on top of potential scams. If any suspicious transactions or issues arise, it is imperative to immediately contact our bank or phone company and inform them about the situation.

In the unfortunate event that you fall victim to a scam, swift action is essential. Reporting the incident to Scamwatch, contacting your bank and phone company to mitigate further damage, and reaching out to IDCARE for support if personal information has been compromised are all crucial steps to take.

For valuable insights on identifying and preventing phone scams, visiting the acma.gov.au/phone-scams website can provide helpful information. Additionally, staying informed about the latest news and updates on scams and frauds by browsing through the Scam Watch forum on our website is highly recommended.

Have you ever reported a scam text message or communication to the authorities or your telecommunications provider? If so, what was your experience like, and were any actions taken as a result?

Also, what advice would you give to others to help them stay vigilant and protect themselves from falling victim to scam text messages? Feel free to leave a comment below!