SDC Rewards Member

Upgrade yours now

Australians lost more than $3bn to scammers in 2022. Here are 5 emerging scams to look out for

The Australian Competition and Consumer Commission’s latest Targeting Scams report indicates Australians reported more than A$3 billion lost to fraud in 2022. This is about a $1 billion increase on reported losses from 2021.

Year upon year, we’re witnessing a rise in monetary losses to fraud. Behind these figures sit millions of Australians who experience a range of financial and non-financial harms.

Here’s what we’ve learned from the latest report – and some advice on what to look out for in the year ahead.

2022 at a glance

Of the reported $3 billion lost, about half was stolen as part of investment schemes – more than double the $701 million figure from 2021. A desire to invest in cryptocurrency has driven up these losses, with potential investors inadvertently transferring money to offenders advertising a range of falsehoods.Remote access schemes – in which a scammer convinces the victim to grant them access to their computer – jumped into second place, with $229 million in reported losses. This was followed by payment redirection scams (also known as business email compromise fraud).

Those who reported directly to Scamwatch lost an average of $19,654 – an increase of 54% from the $12,742 reported in 2021.

The report also shows not all victims are targeted equally; people aged 65 years and older reported the highest losses across all demographics. Indigenous Australians, people with a disability, and those from culturally and linguistically diverse backgrounds were also overrepresented.

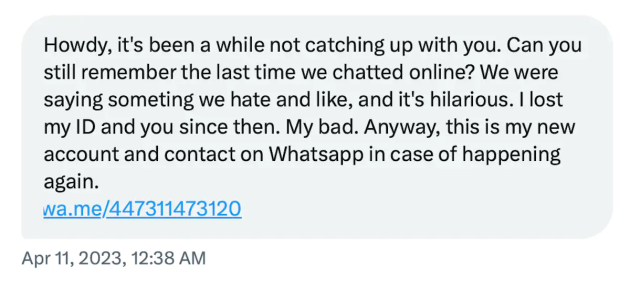

For the first time in many years, text message was the most popular method for offenders to target victims. And while bank transfers were the most popular way to send funds to offenders, cryptocurrency transfers continue to increase in popularity – rising 162.4% in one year.

Scammers are always looking for new ways to deceive people, and this often involves trying to build rapport. Michael Lucy

There was, however, a reduction in fraudulent phone calls. This is likely attributable to the introduction of regulatory action to block known scam calls. It’s a bright spot in an otherwise dark report.

Trends to look out for

The Targeting Scams report demonstrates the many ways offenders seek to defraud victims. On one hand, people are becoming more aware of common scam tactics. On the other, criminals are adjusting their methods to gain the upper hand.Here are five types of relatively lesser-known frauds everyone should be aware of.

1. Romance baiting

Also known as “cryptorom” or “pig butchering”, this scam is a convergence of investment fraud and traditional romance fraud approaches.

The offender first initiates a relationship with the victim – through dating apps, websites or social media platforms. Once they’ve established trust, they encourage the victim to put their money into an “investment” opportunity, often cryptocurrency. The victim will then unknowingly transfer their money to the offender, who is under a different guise.

This kind of romance baiting raises fewer red flags than directly asking for money, and is targeting a younger demographic compared to more traditional romance fraud.

Such deceptions are coded under investment schemes. This is likely driving the surge in investment scheme losses reported in recent years, while also accounting for a lack of substantial increases in romance fraud.

2. Online shopping fraud

Offenders are skilled at creating fake websites and product advertisements that look genuine.

Often these fake sites will have only subtle differences from their real counterparts. Consumers may not be able to tell the difference. Criminals can directly access funds through victims’ credit card details obtained on these sites.

Online shopping fraud targets a range of demographics. It’s happening on stand-alone websites, social media platforms and online marketplaces.

3. Jobs and employment fraud

Research has indicated that working from home and flexible working conditions are strong indicators of a fraudulent job listing.

But in a post-COVID world, flexibility at work is often a key criterion for job seekers, if not a deal-breaker. Offenders have noticed this, and are responding by posting attractive job advertisements that offer flexibility and high incomes.

Victims submit their CVs and personal credentials (setting themselves up for identity crime), or may be required to pay upfront for training or materials costs for a job that doesn’t exist.

Employment scams are targeting younger people in particular, as they’re more likely to have experienced job loss and insecurity in the wake of the pandemic.

4. Recovery schemes

Many fraud victims will want to take whatever action possible to recover lost funds.

To exploit this, offenders will trade the details of victims with each other. They will then pose as authorities (often law enforcement, banks or private agencies) who are aware of the victim’s circumstances and promote their ability to regain the missing funds for a fee.

In this way, victims who are desperate to recover losses are manipulated into paying even more money to offenders.

5. Remote access schemes

Receiving a phone call from a computer technician advising of a problem with your computer and offering to fix it is a common experience for many. While this approach isn’t new, it made a strong resurgence in 2022 – particularly targeting older people.

These scam calls often come through landlines and prey on people’s fear for the security of their bank details and other personal data. The fraudsters often invoke a sense of urgency about needing to rectify the “problem”, and victims are persuaded to give the offender remote access to their computer.

The criminal can then access a wealth of personal information. They can gain direct entry to bank accounts to transfer funds, and can access identity credentials and other sensitive details to commit identity crime in the future.

Change is needed to protect the public

The threat of fraud will only increase alongside technological evolution. Experts are concerned about artificial intelligence tools such as ChatGPT and image and video generators giving cybercriminals yet another tool to add to their arsenal.The latest Scamwatch report is further evidence banks and financial institutions need to implement measures to help reduce fraud losses; among these, the checking of account names against BSB numbers for all transactions. The UK has a confirmation-of-payee policy that does this.

The government is attempting to address the continued surge in fraud losses through the revision of its cybersecurity strategy and the potential establishment of a National Anti-Scams Centre.

These are both positive steps but it’s clear there’s a need for more work to be done.

This article was first published on The Conversation, and was written by Cassandra Cross, Associate Dean (Learning & Teaching) Faculty of Creative Industries, Education and Social Justice, Queensland University of Technology