Aussies throw cash at Black Friday deals despite rising costs: ‘It was a big hit’

By

Seia Ibanez

- Replies 21

In the face of escalating living costs, Australians have shown a surprising shift in their spending habits.

The traditional December shopping craze has been replaced by a November spending spree, thanks to the allure of Black Friday sales.

This trend has seen Aussies strategically holding back on their discretionary spending in October to splurge on discounted items in November.

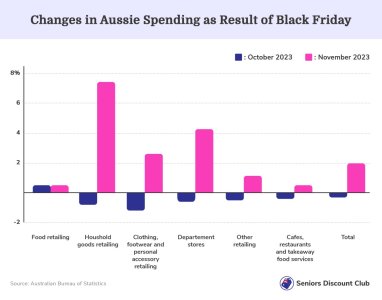

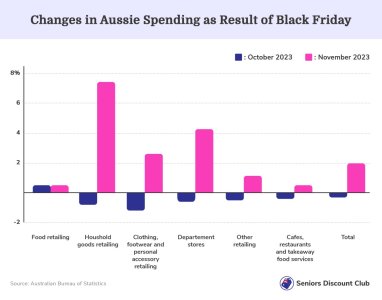

According to the Australian Bureau of Statistics (ABS), retail turnover rose by 2 per cent in November 2023, a stark contrast to the 0.4 per cent fall witnessed in October.

Robert Ewing, the ABS head of business statistics, attributes this shift to the extended promotional periods retailers offer during the Black Friday sales.

'Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years,' Ewing said.

'The strong rise suggests that consumers held back on discretionary spending in October to take advantage of discounts in November.'

‘Shoppers may have also brought forward some Christmas spending that would usually happen in December.’

In Australia, Black Friday has become a much-anticipated event, with consumers eagerly awaiting the opportunity to snag a bargain.

The trend of holding back on spending in October to splurge in November suggests that Aussies are becoming more strategic in their shopping habits, planning their purchases around sales events to maximise savings.

This comes after businesses resorted to offering attractive discounts early on leading up to the Black Friday sales, hoping to lure in shoppers seeking Christmas deals.

Paul Zahra, the former boss of David Jones, who now leads the Australian Retailers Association (ARA), noted the shift in shopping behaviours due to the ongoing financial crunch.

'What we're finding is that consumers [have become] a very much budget-conscious consumer, driven by value,' he said.

The ABS data reveals that household goods were the top purchases during the Black Friday sales, with a rise of 7.5 per cent compared to October.

Department stores saw a 4.2 per cent rise the previous month, while clothing, footwear, and personal accessories came in a close third with a 2.7 per cent rise.

'Retailers told us that the success of Black Friday sales was boosted by consumers seeking out discounts in response to cost-of-living pressures,' Ewing said.

South Australians led the charge in the Black Friday sales, with a 2.8 per cent rise in spending compared to October, closely followed by Victoria.

Both states saw a fall in discretionary buying in October, indicating consumers were saving their spending for the November sales.

What are your thoughts, dear readers? Did you also shift your spending habits to maximise Black Friday sales? Share your experiences in the comments below.

What are your thoughts, dear readers? Did you also shift your spending habits to maximise Black Friday sales? Share your experiences in the comments below.

The traditional December shopping craze has been replaced by a November spending spree, thanks to the allure of Black Friday sales.

This trend has seen Aussies strategically holding back on their discretionary spending in October to splurge on discounted items in November.

According to the Australian Bureau of Statistics (ABS), retail turnover rose by 2 per cent in November 2023, a stark contrast to the 0.4 per cent fall witnessed in October.

Robert Ewing, the ABS head of business statistics, attributes this shift to the extended promotional periods retailers offer during the Black Friday sales.

'Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years,' Ewing said.

'The strong rise suggests that consumers held back on discretionary spending in October to take advantage of discounts in November.'

‘Shoppers may have also brought forward some Christmas spending that would usually happen in December.’

In Australia, Black Friday has become a much-anticipated event, with consumers eagerly awaiting the opportunity to snag a bargain.

The trend of holding back on spending in October to splurge in November suggests that Aussies are becoming more strategic in their shopping habits, planning their purchases around sales events to maximise savings.

This comes after businesses resorted to offering attractive discounts early on leading up to the Black Friday sales, hoping to lure in shoppers seeking Christmas deals.

Paul Zahra, the former boss of David Jones, who now leads the Australian Retailers Association (ARA), noted the shift in shopping behaviours due to the ongoing financial crunch.

'What we're finding is that consumers [have become] a very much budget-conscious consumer, driven by value,' he said.

The ABS data reveals that household goods were the top purchases during the Black Friday sales, with a rise of 7.5 per cent compared to October.

Department stores saw a 4.2 per cent rise the previous month, while clothing, footwear, and personal accessories came in a close third with a 2.7 per cent rise.

'Retailers told us that the success of Black Friday sales was boosted by consumers seeking out discounts in response to cost-of-living pressures,' Ewing said.

South Australians led the charge in the Black Friday sales, with a 2.8 per cent rise in spending compared to October, closely followed by Victoria.

Both states saw a fall in discretionary buying in October, indicating consumers were saving their spending for the November sales.

Key Takeaways

- Australians altered their spending patterns in 2023, engaging more in Black Friday sales in November rather than the traditional pre-Christmas spending surge in December.

- Retail turnover in November 2023 increased by 2 per cent, in contrast to a 0.4 per cent decline in October, as the Australian Bureau of Statistics reported.

- Black Friday sales were particularly successful due to retailers extending promotional periods and consumers looking for discounts amid growing cost-of-living pressures.

- Household goods led the spending during Black Friday, with South Australians and Victorians notably taking advantage of the sales, as indicated by increased spending in November.