Aussie's $6000 ceiling disaster rejected - is your insurer's policy this brutal?

By

- Replies 14

When we pay our insurance premiums, we do so with the belief that when disaster strikes, our insurer will have our backs. It's a safety net that gives us peace of mind, especially as we grow older and seek stability and protection for our homes and possessions. However, the recent experience of a West Australian man has left many questioning the reliability of this safety net.

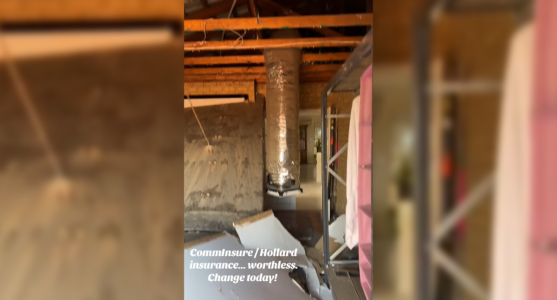

Luke Britton, a resident of the Fremantle area, returned from a nearly month-long holiday in Bali to a shocking sight: his living room ceiling had completely collapsed, leaving a mess of debris and destruction. After 12 years of diligently paying his insurance premiums, totaling almost $20,000, and never having made a claim, Britton believed that his insurer, CommInsure – now owned by the South African-based Hollard Group – would step in to cover the damages. The cost to repair the ceiling was estimated at around $6000, a significant sum that insurance was meant to mitigate.

However, Britton's initial relief turned to frustration when CommInsure denied his claim. The insurer's reason? They alleged that the adhesive glue binding the ceiling's beams to the roof had not been properly maintained. This was despite no prior indication that the beams were faulty or loose. It was a response that many would consider harsh, especially given the lack of evidence that Britton had neglected his ceiling maintenance.

The situation took a turn when Britton, driven by his frustration, took to social media to share his plight. His TikTok video detailing the incident went viral, amassing tens of thousands of views. It was only then that Hollard reconsidered their stance, issuing an apology and agreeing to honor the claim, even waiving the excess fee. They admitted that the initial assessment was perhaps 'a bit unfair.'

Britton's story raises a critical question for all of us, particularly those in the over-60s community who often rely on insurance to safeguard against unforeseen home repairs and other emergencies. Are we truly protected by our insurance policies, or are we at the mercy of assessors who may too quickly dismiss legitimate claims?

It's essential to understand the fine print of our insurance policies. What are the maintenance requirements? How often are assessments required to ensure coverage remains valid? And what recourse do we have if a claim is denied?

Moreover, Britton's experience underscores the power of social media as a tool for consumers to seek justice and accountability from large corporations. Yet, it also highlights a worrying possibility: would Hollard have revised their decision if Britton's video hadn't gone viral? What about those who don't have the means or knowledge to leverage social media in their favor?

Hollard has since apologized to Britton, stating that they have measures in place for customers to request a review of claim outcomes. While this is a positive step, it's a reminder that sometimes, it takes more than just following the process to achieve a fair result.

As members of the Seniors Discount Club, it's crucial to share our experiences and knowledge with one another. Have you ever had to fight for an insurance claim? What advice would you give to others in a similar situation? Your insights could be invaluable to someone facing their battle with an insurer.

Remember, insurance is meant to serve as our financial shield in times of trouble. It's important that we hold these companies accountable and ensure they uphold their end of the bargain. After all, isn't that what we've been paying them for all these years?

Luke Britton, a resident of the Fremantle area, returned from a nearly month-long holiday in Bali to a shocking sight: his living room ceiling had completely collapsed, leaving a mess of debris and destruction. After 12 years of diligently paying his insurance premiums, totaling almost $20,000, and never having made a claim, Britton believed that his insurer, CommInsure – now owned by the South African-based Hollard Group – would step in to cover the damages. The cost to repair the ceiling was estimated at around $6000, a significant sum that insurance was meant to mitigate.

However, Britton's initial relief turned to frustration when CommInsure denied his claim. The insurer's reason? They alleged that the adhesive glue binding the ceiling's beams to the roof had not been properly maintained. This was despite no prior indication that the beams were faulty or loose. It was a response that many would consider harsh, especially given the lack of evidence that Britton had neglected his ceiling maintenance.

The situation took a turn when Britton, driven by his frustration, took to social media to share his plight. His TikTok video detailing the incident went viral, amassing tens of thousands of views. It was only then that Hollard reconsidered their stance, issuing an apology and agreeing to honor the claim, even waiving the excess fee. They admitted that the initial assessment was perhaps 'a bit unfair.'

Britton's story raises a critical question for all of us, particularly those in the over-60s community who often rely on insurance to safeguard against unforeseen home repairs and other emergencies. Are we truly protected by our insurance policies, or are we at the mercy of assessors who may too quickly dismiss legitimate claims?

It's essential to understand the fine print of our insurance policies. What are the maintenance requirements? How often are assessments required to ensure coverage remains valid? And what recourse do we have if a claim is denied?

Moreover, Britton's experience underscores the power of social media as a tool for consumers to seek justice and accountability from large corporations. Yet, it also highlights a worrying possibility: would Hollard have revised their decision if Britton's video hadn't gone viral? What about those who don't have the means or knowledge to leverage social media in their favor?

Hollard has since apologized to Britton, stating that they have measures in place for customers to request a review of claim outcomes. While this is a positive step, it's a reminder that sometimes, it takes more than just following the process to achieve a fair result.

As members of the Seniors Discount Club, it's crucial to share our experiences and knowledge with one another. Have you ever had to fight for an insurance claim? What advice would you give to others in a similar situation? Your insights could be invaluable to someone facing their battle with an insurer.

Key Takeaways

- Luke Britton from Fremantle discovered his ceiling had collapsed after returning from holiday, but his insurer initially refused to cover the $6000 repair cost.

- CommInsure, now owned by Hollard, claimed the ceiling issue was due to improper maintenance and thus not liable for the damage.

- After Britton's social media video went viral, Hollard issued an apology and agreed to cover the repair costs, acknowledging their initial assessment was 'a bit harsh'.

- Hollard has apologised for the inconvenience and encourages customers to request a review if they're dissatisfied with a claim outcome.

Remember, insurance is meant to serve as our financial shield in times of trouble. It's important that we hold these companies accountable and ensure they uphold their end of the bargain. After all, isn't that what we've been paying them for all these years?