Assistant Treasurer shocks with recent announcement: $20bn surplus targeted towards debt, not cost of living relief

- Replies 10

At the Seniors Discount Club, we always have our eyes peeled for anything finance-related—especially those that affect our beloved members.

Well, brace yourselves because we've come across some rather disconcerting news. It might be a good idea to take a seat and maybe even brew a nice cup of tea to soften the blow.

Here's the scoop: the federal government has thrown Aussies a curveball, or should we say, a fiscal boomerang that's not planning on making a return trip anytime soon. It's definitely caught many off guard, and they're not exactly thrilled about it.

In a twist that left many Aussies hoping for some extra cost-of-living relief scratching their heads, Assistant Treasurer Stephen Jones has dropped a bit of a shocker.

Instead of using the budget surplus of around $20 billion to ease the financial strain of everyday Australians in these challenging times, the focus is on debt repayment.

To say that many Australians are feeling 'disappointed' would be an understatement—it's safe to say that the news has left citizens taken aback and feeling a sense of disbelief. We were all crossing our fingers for some breathing room in our wallets, but it looks like the surplus has other plans.

According to the latest monthly report from the Finance Department, the budget for the 2022-23 fiscal year has been doing exceptionally well. Surpassing the predicted $4.2 billion surplus announced in May, the figures for the first 11 months reveal an impressive surplus of $19 billion.

Assistant Treasurer Stephen Jones, in a Monday morning announcement, confirmed that the surplus is expected to grow even further, reaching an approximate total of $20 billion.

However, instead of using this extra revenue to provide relief for the cost of living, the government plans to bank it, thanks to the substantial increase in company and personal taxes.

'It's a good number. But we're focused on the medium term, not just one budget figure, and we know that there are structural problems with the budget,' Mr Jones told ABC News Breakfast.

'Big expenses coming in aged care, the NDIS and defence. We have to be able to meet not only this year's and next year's expenses but well over into the future.'

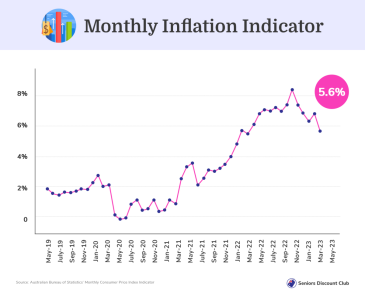

With costs of living—notably fuel prices, energy bills and groceries—rising exponentially, it's becoming tougher for Australians to make ends meet. Meanwhile, inflation hit a peak of 7.8 per cent, only to pull back to 7 per cent.

The cause for the rise in surplus lies in a tight job market boosting tax revenue, exceeding expectations by a noteworthy $8.5 billion.

Mr Jones believes that distributing payments to the Australian public while inflation is high wouldn't solve the overall issue. He emphasised that paying down the nation's debt is the government's primary focus—news that comes as a stinging revelation for many Aussies.

'But I want to make this point: Inflation is a problem,' explained Mr Jones.

'It looks like it is on the turn now, and that's good news, but the worst thing that the federal government could do at the moment was to take that $19, $20bn … and dump it into the economy, which was already facing inflationary pressures.'

He continued: 'That's why restraint and paying down the trillion dollars worth of debt that we have on our books is our number one focus.'

What this means for the average Aussie remains uncertain at the moment. Nevertheless, it's a good idea to get your affairs in order and be ready for any potential changes in the financial landscape.

As we wait for developments at the top levels of politics, let's be cautious with our spending and keep our budgets under control. What do you all think about this news, members? We're eager to hear your thoughts! Drop a comment below and share your opinions on this topic.

Well, brace yourselves because we've come across some rather disconcerting news. It might be a good idea to take a seat and maybe even brew a nice cup of tea to soften the blow.

Here's the scoop: the federal government has thrown Aussies a curveball, or should we say, a fiscal boomerang that's not planning on making a return trip anytime soon. It's definitely caught many off guard, and they're not exactly thrilled about it.

In a twist that left many Aussies hoping for some extra cost-of-living relief scratching their heads, Assistant Treasurer Stephen Jones has dropped a bit of a shocker.

Aussies hoping there could be more cost of living relief in the pipeline could be left disappointed with the government's plans for the additional revenue. Credit: Shutterstock.

Instead of using the budget surplus of around $20 billion to ease the financial strain of everyday Australians in these challenging times, the focus is on debt repayment.

To say that many Australians are feeling 'disappointed' would be an understatement—it's safe to say that the news has left citizens taken aback and feeling a sense of disbelief. We were all crossing our fingers for some breathing room in our wallets, but it looks like the surplus has other plans.

According to the latest monthly report from the Finance Department, the budget for the 2022-23 fiscal year has been doing exceptionally well. Surpassing the predicted $4.2 billion surplus announced in May, the figures for the first 11 months reveal an impressive surplus of $19 billion.

Assistant Treasurer Stephen Jones, in a Monday morning announcement, confirmed that the surplus is expected to grow even further, reaching an approximate total of $20 billion.

However, instead of using this extra revenue to provide relief for the cost of living, the government plans to bank it, thanks to the substantial increase in company and personal taxes.

'It's a good number. But we're focused on the medium term, not just one budget figure, and we know that there are structural problems with the budget,' Mr Jones told ABC News Breakfast.

'Big expenses coming in aged care, the NDIS and defence. We have to be able to meet not only this year's and next year's expenses but well over into the future.'

With costs of living—notably fuel prices, energy bills and groceries—rising exponentially, it's becoming tougher for Australians to make ends meet. Meanwhile, inflation hit a peak of 7.8 per cent, only to pull back to 7 per cent.

The cause for the rise in surplus lies in a tight job market boosting tax revenue, exceeding expectations by a noteworthy $8.5 billion.

Mr Jones believes that distributing payments to the Australian public while inflation is high wouldn't solve the overall issue. He emphasised that paying down the nation's debt is the government's primary focus—news that comes as a stinging revelation for many Aussies.

'But I want to make this point: Inflation is a problem,' explained Mr Jones.

'It looks like it is on the turn now, and that's good news, but the worst thing that the federal government could do at the moment was to take that $19, $20bn … and dump it into the economy, which was already facing inflationary pressures.'

He continued: 'That's why restraint and paying down the trillion dollars worth of debt that we have on our books is our number one focus.'

Key Takeaways

- The Australian federal government revealed that the surplus, which increased to an unexpected $20 billion, will not be used for additional cost-of-living relief.

- Assistant Treasurer Stephen Jones stated the funds would be used to pay down debt, emphasising a priority on long-term structural budget issues in areas like aged care, the NDIS and defence.

- The budget's growth is attributed to an unexpectedly high tax revenue due to a tight job market and reduced forecasted payments.

- Mr Jones argued that further cost-of-living relief payouts wouldn't solve the overall problem in the context of high inflation, instead emphasising recently implemented childcare subsidies and energy bill reliefs.

What this means for the average Aussie remains uncertain at the moment. Nevertheless, it's a good idea to get your affairs in order and be ready for any potential changes in the financial landscape.

As we wait for developments at the top levels of politics, let's be cautious with our spending and keep our budgets under control. What do you all think about this news, members? We're eager to hear your thoughts! Drop a comment below and share your opinions on this topic.