Are Scammers Getting Savvier? How to Avoid Falling Prey to Bank Impersonation Scams

- Replies 19

The world of scams has never been more dangerous or cunning, with scammers constantly upgrading their tactics to trick unsuspecting victims.

Modern technology has provided them with an arsenal of sophisticated tools to achieve their nefarious goals, making it increasingly difficult for even the most cautious individuals to stay safe.

One particular scheme that has seen a meteoric rise in recent years is bank impersonation scams. These clever cons have become so prevalent that the Australian Competition and Consumer Commission (ACCC) received over 14,000 reports of them in the last year alone.

Shockingly, victims of this type of scam have suffered a devastating $20 million in losses.

So how do bank impersonation scams work?

One of the most common approaches scammers use is to pretend to be one of the big four banks or other financial institutions.

They will then create a sense of urgency and panic in their victims by informing them of suspicious or fraudulent activity on their accounts. Sometimes they even pose as the bank's security department, making it seem like the victim's account has been compromised.

Text messages are often the tool of choice, and they can be highly convincing. Victims may receive messages stating that their bank account has been accessed or locked, or that a payment has been made from their account without their authorisation. The message will then provide a phone number to call for 'assistance' or an ‘internet banking portal’ link.

It's easy to see how anyone could fall for these types of scams, especially in the heat of the moment. But by staying informed and taking extra precautions, you can protect yourself from falling prey to these malicious scams.

As experts have wisely warned, one crucial fact to remember is that a legitimate bank will NEVER ask you to transfer funds. If you receive a request like this, you must be on your guard and proceed with caution.

Another red flag to watch out for is receiving a text message with a phone number to call.

To avoid becoming a scam victim, it's always best to call your bank directly using a number you've found independently. This ensures that you're speaking to a legitimate representative from the bank and not an imposter.

To keep yourself and your money safe, there are several other tips that are worth bearing in mind.

For instance, it's never a good idea to provide your online banking passwords, one-time security codes, pins, or tokens over the phone, as these can be used to access your account.

In addition, it's important never to click on links in text messages, as these could lead to malicious websites or apps that can steal your personal information.

Finally, whenever you speak with your bank, make sure to ask for a reference number, which can help you track the conversation and provide a record of the interaction in case of any disputes or issues that arise.

If you want to keep yourself up-to-date with the latest scams and fraud news, head over to the Scam Watch forum on the SDC website. You'll be able to read about the latest tactics and techniques that scammers are using, as well as tips and advice on how to protect yourself and your finances.

The alarming rise of bank impersonation scams has left authorities deeply concerned, as the potential consequences can be devastating.

According to the ACCC Deputy Chair, Catriona Lowe, the concern is that these scams are incredibly convincing, making them difficult to detect. The impact on victims can be both financial and emotional, as the losses can be significant, with some victims losing their entire life savings.

The average loss is around $22,000, with some reports of losses between $40,000 and $800,000.

One example is a man who lost $38,000 after receiving a text message about a suspicious transaction in his bank account.

According to Lowe, the man received the scam text in the same conversation thread as legitimate messages from his bank, which made it appear more convincing. He called the number provided in the text and was put through to someone who claimed to be a member of his bank's fraud team.

Unfortunately, the fraudster was able to convince him to provide his personal banking information, leading to the loss of all his life savings.

In addition to the rise of bank impersonation scams, there have been recent reports of scammers posing as undercover police officers to convince victims to withdraw cash from their accounts.

The Bank of Queensland has issued an urgent alert after receiving an influx of reports from customers who have fallen victim to this scam.

According to the bank, the scammers have been targeting the elderly and vulnerable, claiming to be working on an operation to stop a hacker from stealing the victim's money. They introduce themselves with an alias, badge/staff number, and a fake reference number to make their scam appear more legitimate.

It's important to note that police officers will never ask a member of the public to withdraw money from their bank account as part of an investigation. If you receive a call from someone claiming to be a police officer and asking you to withdraw cash, it's likely to be a scam.

To read the full report, click here.

As always, here at the SDC, we strive to keep our readers informed and aware of the latest scams and frauds to help protect them from falling victim.

Members, have you recently received a suspicious text or call from someone claiming to be your bank or the police? Don't hesitate to share your story and advice on how to deal with these scams. By working together, we can stay one step ahead of these scammers and protect ourselves and our loved ones from financial devastation.

Modern technology has provided them with an arsenal of sophisticated tools to achieve their nefarious goals, making it increasingly difficult for even the most cautious individuals to stay safe.

One particular scheme that has seen a meteoric rise in recent years is bank impersonation scams. These clever cons have become so prevalent that the Australian Competition and Consumer Commission (ACCC) received over 14,000 reports of them in the last year alone.

Shockingly, victims of this type of scam have suffered a devastating $20 million in losses.

Bank impersonation scams are on the rise, with more than 14,000 reports made last year and over $20 million lost to these types of scams. Credit: Unsplash/Marcus Reubenstein.

So how do bank impersonation scams work?

One of the most common approaches scammers use is to pretend to be one of the big four banks or other financial institutions.

They will then create a sense of urgency and panic in their victims by informing them of suspicious or fraudulent activity on their accounts. Sometimes they even pose as the bank's security department, making it seem like the victim's account has been compromised.

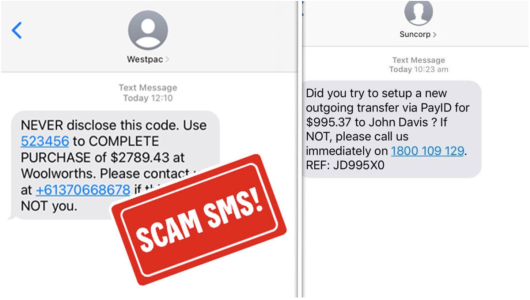

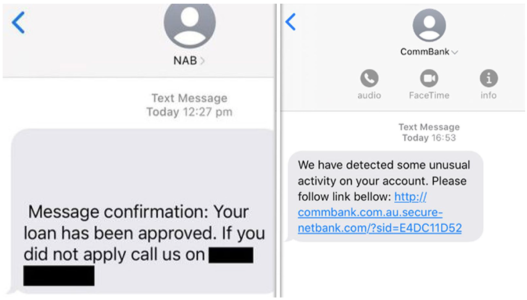

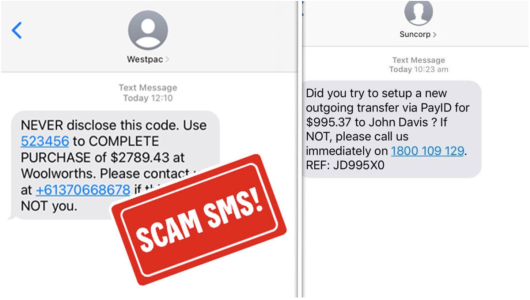

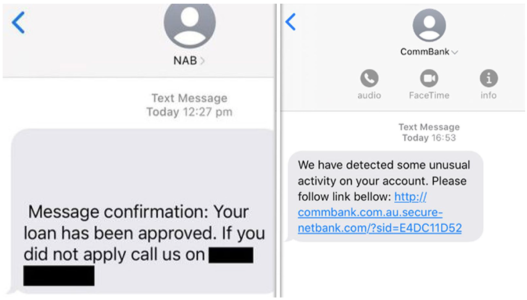

Text messages are often the tool of choice, and they can be highly convincing. Victims may receive messages stating that their bank account has been accessed or locked, or that a payment has been made from their account without their authorisation. The message will then provide a phone number to call for 'assistance' or an ‘internet banking portal’ link.

It's easy to see how anyone could fall for these types of scams, especially in the heat of the moment. But by staying informed and taking extra precautions, you can protect yourself from falling prey to these malicious scams.

Scammers use new technology to make a call appear to come from a bank's legitimate phone number or send a text to appear in the same thread as bank messages. Credit: Westpac/Suncorp.

As experts have wisely warned, one crucial fact to remember is that a legitimate bank will NEVER ask you to transfer funds. If you receive a request like this, you must be on your guard and proceed with caution.

Another red flag to watch out for is receiving a text message with a phone number to call.

To avoid becoming a scam victim, it's always best to call your bank directly using a number you've found independently. This ensures that you're speaking to a legitimate representative from the bank and not an imposter.

To keep yourself and your money safe, there are several other tips that are worth bearing in mind.

For instance, it's never a good idea to provide your online banking passwords, one-time security codes, pins, or tokens over the phone, as these can be used to access your account.

In addition, it's important never to click on links in text messages, as these could lead to malicious websites or apps that can steal your personal information.

Finally, whenever you speak with your bank, make sure to ask for a reference number, which can help you track the conversation and provide a record of the interaction in case of any disputes or issues that arise.

If you want to keep yourself up-to-date with the latest scams and fraud news, head over to the Scam Watch forum on the SDC website. You'll be able to read about the latest tactics and techniques that scammers are using, as well as tips and advice on how to protect yourself and your finances.

To avoid falling prey to these scams, consumers are advised not to use the SMS or phone number provided but to call their bank directly. Credit: NAB/CommBank.

The alarming rise of bank impersonation scams has left authorities deeply concerned, as the potential consequences can be devastating.

According to the ACCC Deputy Chair, Catriona Lowe, the concern is that these scams are incredibly convincing, making them difficult to detect. The impact on victims can be both financial and emotional, as the losses can be significant, with some victims losing their entire life savings.

The average loss is around $22,000, with some reports of losses between $40,000 and $800,000.

One example is a man who lost $38,000 after receiving a text message about a suspicious transaction in his bank account.

According to Lowe, the man received the scam text in the same conversation thread as legitimate messages from his bank, which made it appear more convincing. He called the number provided in the text and was put through to someone who claimed to be a member of his bank's fraud team.

Unfortunately, the fraudster was able to convince him to provide his personal banking information, leading to the loss of all his life savings.

Key Takeaways

- Bank impersonation scams are becoming increasingly sophisticated, with scammers pretending to be representatives of financial institutions and inducing panic in victims by claiming suspicious or fraudulent activity on their accounts.

- Victims are often prompted to call a fake number, leading to the loss of their entire savings account.

- To protect against these scams, it's important to be vigilant, never provide personal information or transfer funds over the phone, and contact your bank directly using a number found independently.

In addition to the rise of bank impersonation scams, there have been recent reports of scammers posing as undercover police officers to convince victims to withdraw cash from their accounts.

The Bank of Queensland has issued an urgent alert after receiving an influx of reports from customers who have fallen victim to this scam.

According to the bank, the scammers have been targeting the elderly and vulnerable, claiming to be working on an operation to stop a hacker from stealing the victim's money. They introduce themselves with an alias, badge/staff number, and a fake reference number to make their scam appear more legitimate.

It's important to note that police officers will never ask a member of the public to withdraw money from their bank account as part of an investigation. If you receive a call from someone claiming to be a police officer and asking you to withdraw cash, it's likely to be a scam.

To read the full report, click here.

As always, here at the SDC, we strive to keep our readers informed and aware of the latest scams and frauds to help protect them from falling victim.

Members, have you recently received a suspicious text or call from someone claiming to be your bank or the police? Don't hesitate to share your story and advice on how to deal with these scams. By working together, we can stay one step ahead of these scammers and protect ourselves and our loved ones from financial devastation.