Are Gen Z Aussies onto something? How bold cash move led to a $97 fine

By

- Replies 48

In an age where tapping your card or phone is second nature, one young Aussie is making headlines for defending something many of us grew up with—good old-fashioned cash.

His stand ended up costing him more than he expected, but it sparked a nationwide debate about the future of physical money and why it still matters.

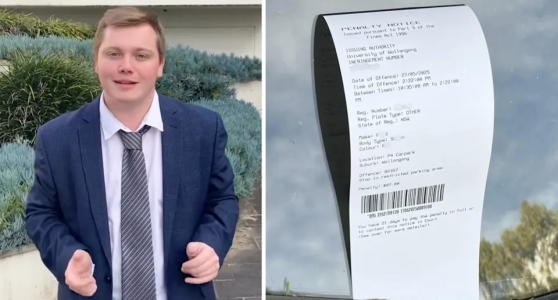

Oliver Griffiths, a 21-year-old university student, found himself in a classic David vs Goliath scenario earlier this year.

After parking his car at the University of Wollongong campus, he was slapped with a $97 fine.

His crime is not paying for parking through the university’s new cashless system. But Oliver wasn’t trying to dodge the fee—far from it.

He actually tried to pay, but in a way that’s becoming increasingly rare: with cash.

Oliver’s frustration began when he discovered that the university had switched to a cashless parking system.

Instead of popping coins into a meter, drivers now had to download an app called CellOPark, register their card details, and let the system bulk bill them at the end of the month.

For many, this might sound convenient. But for Oliver—and, we suspect, for plenty of our readers—it was a step too far.

'I’m sometimes short on digital cash,' Oliver explained, pointing out that bills, textbooks, and other expenses can make it tricky to keep enough in his account for unexpected charges.

When he tried the app, it deducted $40 in one go, which ended up putting a restriction on his debit card.

Frustrated and feeling boxed in by technology, Oliver decided to take a stand. He left a $10 note on his dashboard and a handwritten explanation that he wanted to pay for parking in cash.

Unfortunately, his protest didn’t sway the parking inspectors. He still received a $97 fine. Rather than simply paying up, Oliver took the matter to court, arguing that he should be able to use legal tender—cash—to pay for parking.

The court, however, sided with the university, and Oliver was ordered to pay not only the original fine but also $98 in court costs, bringing his total to $195.

Despite the outcome, Oliver remains unbowed. 'If I knew the outcome was going to be 100 per cent guilty, which I kind of did anyway before I took on the challenge, I’d do it again,' he said.

'It’s such an important principle to stand by. Regardless of the outcome, the trial was given exposure to nearly 1.5 million people.

The issue has gained heaps of support for cash to be protected, and that momentum in itself is a win.'

Oliver’s story isn’t just about a parking fine—it’s about a much larger shift happening across Australia.

More and more businesses, councils, and even government services are moving towards cashless payments.

For some, this is a welcome change: it’s quick, convenient, and reduces the need to carry loose change.

But for others—especially those of us who grew up in a world where cash was king—it can feel like we’re being left behind.

There are plenty of reasons why people still prefer cash. It’s private, it doesn’t require a smartphone or internet connection, and it can help with budgeting.

For many seniors, cash is simply more familiar and trustworthy. And let’s not forget: cash is still legal tender in Australia.

In theory, that means it should be accepted everywhere. But as Oliver’s case shows, the reality is more complicated.

You might be wondering: if cash is legal tender, how can a business or institution refuse it? The answer is a bit murky.

According to the Reserve Bank of Australia, while cash is legal tender, there’s no law that forces a business to accept it.

Businesses are allowed to set their own payment policies, as long as they make them clear before a transaction takes place.

That means a car park, café, or even a government office can legally refuse cash, as long as you know about it before you try to pay.

The move towards cashless payments isn’t just an inconvenience for some—it can be a real barrier.

Not everyone has a smartphone, a credit card, or reliable internet access. Cashless systems can make everyday tasks much harder for older Australians, people on low incomes, or those living in rural areas.

There’s also the risk of technical glitches, hacking, or simply running out of battery at the wrong moment.

Oliver’s story has struck a chord with people of all ages who worry that the rush towards a cashless society could leave some of us behind.

While digital payments are here to stay, businesses and institutions are increasingly urging the use of cash as an option, at least for now.

Have you ever been caught out by a cashless system? Do you still prefer to pay with cash, or have you embraced the digital revolution? We’d love to hear your thoughts and stories in the comments below. Let’s keep the conversation going—because whether you’re Team Cash or Team Card, your voice matters!

Have you ever been caught out by a cashless system? Do you still prefer to pay with cash, or have you embraced the digital revolution? We’d love to hear your thoughts and stories in the comments below. Let’s keep the conversation going—because whether you’re Team Cash or Team Card, your voice matters!

Read more: 'That's a lot of breathing space taken': Driver laments over inaccurate parking fine

His stand ended up costing him more than he expected, but it sparked a nationwide debate about the future of physical money and why it still matters.

Oliver Griffiths, a 21-year-old university student, found himself in a classic David vs Goliath scenario earlier this year.

After parking his car at the University of Wollongong campus, he was slapped with a $97 fine.

His crime is not paying for parking through the university’s new cashless system. But Oliver wasn’t trying to dodge the fee—far from it.

He actually tried to pay, but in a way that’s becoming increasingly rare: with cash.

Oliver’s frustration began when he discovered that the university had switched to a cashless parking system.

Instead of popping coins into a meter, drivers now had to download an app called CellOPark, register their card details, and let the system bulk bill them at the end of the month.

For many, this might sound convenient. But for Oliver—and, we suspect, for plenty of our readers—it was a step too far.

'I’m sometimes short on digital cash,' Oliver explained, pointing out that bills, textbooks, and other expenses can make it tricky to keep enough in his account for unexpected charges.

When he tried the app, it deducted $40 in one go, which ended up putting a restriction on his debit card.

Frustrated and feeling boxed in by technology, Oliver decided to take a stand. He left a $10 note on his dashboard and a handwritten explanation that he wanted to pay for parking in cash.

Unfortunately, his protest didn’t sway the parking inspectors. He still received a $97 fine. Rather than simply paying up, Oliver took the matter to court, arguing that he should be able to use legal tender—cash—to pay for parking.

The court, however, sided with the university, and Oliver was ordered to pay not only the original fine but also $98 in court costs, bringing his total to $195.

'It’s such an important principle to stand by. Regardless of the outcome, the trial was given exposure to nearly 1.5 million people.

The issue has gained heaps of support for cash to be protected, and that momentum in itself is a win.'

Oliver’s story isn’t just about a parking fine—it’s about a much larger shift happening across Australia.

More and more businesses, councils, and even government services are moving towards cashless payments.

For some, this is a welcome change: it’s quick, convenient, and reduces the need to carry loose change.

There are plenty of reasons why people still prefer cash. It’s private, it doesn’t require a smartphone or internet connection, and it can help with budgeting.

For many seniors, cash is simply more familiar and trustworthy. And let’s not forget: cash is still legal tender in Australia.

In theory, that means it should be accepted everywhere. But as Oliver’s case shows, the reality is more complicated.

You might be wondering: if cash is legal tender, how can a business or institution refuse it? The answer is a bit murky.

According to the Reserve Bank of Australia, while cash is legal tender, there’s no law that forces a business to accept it.

That means a car park, café, or even a government office can legally refuse cash, as long as you know about it before you try to pay.

The move towards cashless payments isn’t just an inconvenience for some—it can be a real barrier.

Not everyone has a smartphone, a credit card, or reliable internet access. Cashless systems can make everyday tasks much harder for older Australians, people on low incomes, or those living in rural areas.

There’s also the risk of technical glitches, hacking, or simply running out of battery at the wrong moment.

While digital payments are here to stay, businesses and institutions are increasingly urging the use of cash as an option, at least for now.

Key Takeaways

- A 21-year-old student, Oliver Griffiths, was fined $97 for parking at the University of Wollongong and attempted to pay in cash after finding no meters accepting physical money.

- Griffiths placed a $10 note and a written explanation on his dashboard, but still received the fine, prompting him to challenge the penalty in court.

- Despite losing the case and being ordered to pay a total of $195, including court costs, Griffiths stands by his defence of cash payments, highlighting public support for protecting cash as legal tender.

- The university maintains that some cash-accepting meters remain on campus, while Griffiths and supporters argue for the continued right to pay with physical money.

Read more: 'That's a lot of breathing space taken': Driver laments over inaccurate parking fine