Are frequent flyer points worth the ALDI surcharge?

- Replies 9

If you fill your weekly grocery shopping basket at ALDI, chances are you've noticed a small 0.5 per cent surcharge when paying by credit card.

ALDI's website states that this is in exchange for their lower prices across the board, sparing their shoppers from inflating costs due to credit card acceptance fees.

But what exactly is a credit card surcharge, and when is it applied?

A credit card surcharge is a fee merchants can apply to your credit card transactions on top of the advertised retail price.

This surcharge helps them cover the cost of accepting credit card payments. Debit cards and other types of payments may also attract a surcharge, but it must never be more than the actual cost to the business for the transaction.

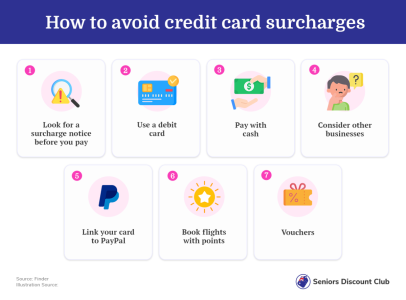

Now, you might be wondering how to avoid the surcharge. While it's not always possible, there are some strategies to sidestep credit card surcharges. Many businesses provide alternative payment methods that don't incur surcharges.

For example, they often exempt debit card transactions, which are generally cheaper to process.

It's also a good idea to check if PayPal is accepted and whether any surcharges apply. If not, you can link your credit card to your PayPal account and make the payment through PayPal. Another hassle-free option is simply using cash.

When it comes to using a frequent flyer credit card, a question often comes to mind: Is it worth using the card—and paying the associated surcharge—just to earn a few extra points?

According to Finder, the answer depends on the type of credit card you have and the number of points you'll accrue from your purchase.

To better understand this, let's walk through an example. Suppose you've just spent $185 on groceries at ALDI while using a credit card that grants you 1 Qantas Point for every dollar spent, such as the Qantas Premier Platinum card. After covering your grocery bill, you'll incur a 0.5 per cent surcharge of 93 cents.

This means that each Qantas Point costs you approximately 0.5 cents. According to Finder's current calculations regarding the value of points, 1 Qantas Point can range from being worth as little as 0.3 cents to as much as 8 cents.

If you redeem these points for a reward flight, each point could be valued at least 1.3 cents, making it a worthwhile choice even after factoring in the surcharge.

However, if you opt for a gift card redemption, you'll pay more for the points than their actual value. If your card earns Qantas Points at a lower rate, the outcome becomes even less favourable.

So, in conclusion, if your card earns 1 Qantas Point per $1 spent, and you plan to use these points for rewards or upgrades, you're likely to come out ahead despite the surcharge. But if this isn't the case, it might be wiser to use other payment methods when shopping at ALDI.

If you believe you've been charged an excessive surcharge, don't hesitate to contact the ACCC through their website. They will conduct an investigation, and penalties may be imposed if the business is found to have violated the law.

The ACCC also advises that if you have concerns regarding surcharges associated with BPAY, PayPal, Diners Club, or American Express, you can report these concerns directly to the respective BPAY, PayPal, Diners Club, or American Express systems.

As for surcharges on taxi fares, please report any issues to the relevant state or territory taxi industry regulator.

Members, we hope you found this article helpful and informative! We know just how much every cent and dollar counts, so it's always a great feeling when we save money wherever we can.

Do you have other money-saving tips and advice to share? Please feel free to leave them in the comments below!

ALDI's website states that this is in exchange for their lower prices across the board, sparing their shoppers from inflating costs due to credit card acceptance fees.

But what exactly is a credit card surcharge, and when is it applied?

A credit card surcharge is a fee merchants can apply to your credit card transactions on top of the advertised retail price.

This surcharge helps them cover the cost of accepting credit card payments. Debit cards and other types of payments may also attract a surcharge, but it must never be more than the actual cost to the business for the transaction.

Using a credit card at ALDI can be convenient and earn points, but will it cost you more in the long run? Credit: Pixabay.

Now, you might be wondering how to avoid the surcharge. While it's not always possible, there are some strategies to sidestep credit card surcharges. Many businesses provide alternative payment methods that don't incur surcharges.

For example, they often exempt debit card transactions, which are generally cheaper to process.

It's also a good idea to check if PayPal is accepted and whether any surcharges apply. If not, you can link your credit card to your PayPal account and make the payment through PayPal. Another hassle-free option is simply using cash.

When it comes to using a frequent flyer credit card, a question often comes to mind: Is it worth using the card—and paying the associated surcharge—just to earn a few extra points?

According to Finder, the answer depends on the type of credit card you have and the number of points you'll accrue from your purchase.

To better understand this, let's walk through an example. Suppose you've just spent $185 on groceries at ALDI while using a credit card that grants you 1 Qantas Point for every dollar spent, such as the Qantas Premier Platinum card. After covering your grocery bill, you'll incur a 0.5 per cent surcharge of 93 cents.

This means that each Qantas Point costs you approximately 0.5 cents. According to Finder's current calculations regarding the value of points, 1 Qantas Point can range from being worth as little as 0.3 cents to as much as 8 cents.

If you redeem these points for a reward flight, each point could be valued at least 1.3 cents, making it a worthwhile choice even after factoring in the surcharge.

However, if you opt for a gift card redemption, you'll pay more for the points than their actual value. If your card earns Qantas Points at a lower rate, the outcome becomes even less favourable.

So, in conclusion, if your card earns 1 Qantas Point per $1 spent, and you plan to use these points for rewards or upgrades, you're likely to come out ahead despite the surcharge. But if this isn't the case, it might be wiser to use other payment methods when shopping at ALDI.

If you believe you've been charged an excessive surcharge, don't hesitate to contact the ACCC through their website. They will conduct an investigation, and penalties may be imposed if the business is found to have violated the law.

The ACCC also advises that if you have concerns regarding surcharges associated with BPAY, PayPal, Diners Club, or American Express, you can report these concerns directly to the respective BPAY, PayPal, Diners Club, or American Express systems.

As for surcharges on taxi fares, please report any issues to the relevant state or territory taxi industry regulator.

Key Takeaways

- ALDI imposes a 0.5 per cent credit card surcharge on transactions, which allows the supermarket to avoid inflating prices to cover the cost of accepting credit cards.

- The surcharge can be avoided by paying with a debit card or cash, but the decision to use a frequent flyer credit card could determine whether the points earned outweigh the surcharge cost.

- Depending on how the points are used, it is possible to come out ahead even after the surcharge. However, if points are redeemed at a lower value or if the credit card earns points at a lower rate, it may be more cost-effective to use another payment method.

Members, we hope you found this article helpful and informative! We know just how much every cent and dollar counts, so it's always a great feeling when we save money wherever we can.

Do you have other money-saving tips and advice to share? Please feel free to leave them in the comments below!