Are Buy Now, Pay Later Services Pushing Australians to Choose Between Essential Medications and Debt?

By

- Replies 12

In today's economy, it's no secret that many Australians face significant financial challenges. With the cost of petrol on the rise and inflated grocery prices, it can feel like making ends meet is a never-ending battle.

Whether you're living off a pension or trying to save for the future, financial stress can take a toll on your well-being.

But what if those costs extend to essential medications for your loved ones?

Tammy Taylor, a mum of two from Mildura, Victoria, is all too familiar with this situation.

She relies on buy now, pay later services to provide essential medication for her son with a disability.

Tammy explained: ‘With the cost of those medications, sometimes you just don't make enough money to pay for them all at once.’

'His medication costs me $250 a month. I have had to use Afterpay to pay for my son's meds.'

To make ends meet, she is forced to spend money she doesn't have yet, adding to her financial stress.

'If I needed medication or one of my other children needed medication, I have to use Afterpay because they wouldn't be able to afford it since the cost of living has gone up so much,' she added.

Her story is sadly far too common. The Australian Bureau of Statistics (ABS) recently released a report which found that the proportion of people who delayed or did not get prescription medication when needed due to cost increased to 5.6 % in 2021-22 from 4.4% in 2020-21.

Buy now, pay later services have become increasingly popular, but experts are sounding the alarm, particularly for those with fixed incomes.

According to Andrew Grant, an associate finance professor at the University of Sydney Business School, accumulating significant debt through such services can be overwhelming for those already struggling to meet their financial obligations.

He explained: ‘By allowing people to access further credit in the form of buy now, pay later might make them more in debt than they would be otherwise.’

‘It might also encourage them to default on other financial products, such as credit cards or personal loans.’

Maddy Spencer, a resident of Mildura, relies on Afterpay and Zip at the chemist, but describes using buy now, pay later services as being ‘stuck in a loop’.

For Maddy, most paydays involve paying off $200-300 of Afterpay, as well as other bills and fuel for her car, while relying on her husband's income for essential expenses like food, mortgage, and insurance.

While she initially started using Afterpay to budget for more costly items like birthday presents and quality shoes, Maddy has been using it to get by until her next paycheck.

Meanwhile, fellow Mildura resident Sue Watson, who has a monthly medication bill of $120, feels uneasy using buy now, pay later services to pay for her medication.

She said: ‘I know my health is suffering from not taking some of my medications, but that's life at the moment.’

Despite the rising cost of living, Sue remained firmly against using such services.

While Afterpay and Zip do not charge compounding interest, customers may face late fees if they fail to pay the monthly minimum payment or remaining balance on time, as noted.

According to a Zip spokesperson, more customers are turning to their services, including for everyday expenses within the health sector, to avoid credit card interest. Additionally, Afterpay reported that in the first quarter of 2023, 98% of purchases did not incur late fees.

However, Associate Finance Professor Andrew Grant cautioned that those who use these services irresponsibly could face hardships, particularly if they have multiple accounts or maxed-out credit cards, leading them to rely on buy now, pay later services to cover the gap.

Such cases could be concerning for people who may feel forced to use buy now, pay later to cover the cost of medication.

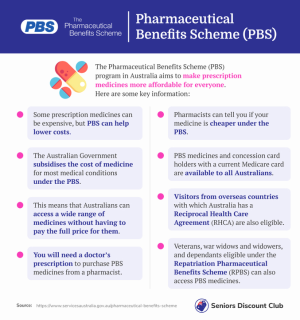

On the other hand, while the recent changes to the Pharmaceutical Benefits Scheme (PBS) reduced the cost of subsidised medicine for patients like Sue Watson from $42.50 to $30, she still finds it challenging to make payments on time.

While the safety net helps to bring down the cost of medication, Ms Watson noted that she and her family can now only afford the basics.

To support the implementation of changes to the PBS, Services Australia has been allocated $1.2 million in 2022-23 and $1.6 million over four years.

The Australian Bureau of Statistics reports that two in three people were supplied with at least one PBS medication in the six months before or after the National Health Survey interview.

Among those with chronic conditions, 80.4% were supplied with PBS medication, while nearly all (97%) people aged 75 years and over received PBS medication.

It is important to carefully evaluate your financial situation and capabilities before signing up for buy now, pay later services.

While they can be useful if used responsibly, it is crucial to exercise caution to avoid accumulating overwhelming debt.

What do you think about this? Feel free to share your thoughts in the comments section below.

Whether you're living off a pension or trying to save for the future, financial stress can take a toll on your well-being.

But what if those costs extend to essential medications for your loved ones?

Tammy Taylor, a mum of two from Mildura, Victoria, is all too familiar with this situation.

She relies on buy now, pay later services to provide essential medication for her son with a disability.

Some Aussies who are struggling to afford medicine were forced to use ‘buy now, pay later’ schemes. Credit: Shutterstock.

Tammy explained: ‘With the cost of those medications, sometimes you just don't make enough money to pay for them all at once.’

'His medication costs me $250 a month. I have had to use Afterpay to pay for my son's meds.'

To make ends meet, she is forced to spend money she doesn't have yet, adding to her financial stress.

'If I needed medication or one of my other children needed medication, I have to use Afterpay because they wouldn't be able to afford it since the cost of living has gone up so much,' she added.

Her story is sadly far too common. The Australian Bureau of Statistics (ABS) recently released a report which found that the proportion of people who delayed or did not get prescription medication when needed due to cost increased to 5.6 % in 2021-22 from 4.4% in 2020-21.

Buy now, pay later services have become increasingly popular, but experts are sounding the alarm, particularly for those with fixed incomes.

According to Andrew Grant, an associate finance professor at the University of Sydney Business School, accumulating significant debt through such services can be overwhelming for those already struggling to meet their financial obligations.

He explained: ‘By allowing people to access further credit in the form of buy now, pay later might make them more in debt than they would be otherwise.’

‘It might also encourage them to default on other financial products, such as credit cards or personal loans.’

Maddy Spencer, a resident of Mildura, relies on Afterpay and Zip at the chemist, but describes using buy now, pay later services as being ‘stuck in a loop’.

For Maddy, most paydays involve paying off $200-300 of Afterpay, as well as other bills and fuel for her car, while relying on her husband's income for essential expenses like food, mortgage, and insurance.

While she initially started using Afterpay to budget for more costly items like birthday presents and quality shoes, Maddy has been using it to get by until her next paycheck.

Meanwhile, fellow Mildura resident Sue Watson, who has a monthly medication bill of $120, feels uneasy using buy now, pay later services to pay for her medication.

She said: ‘I know my health is suffering from not taking some of my medications, but that's life at the moment.’

Despite the rising cost of living, Sue remained firmly against using such services.

While Afterpay and Zip do not charge compounding interest, customers may face late fees if they fail to pay the monthly minimum payment or remaining balance on time, as noted.

According to a Zip spokesperson, more customers are turning to their services, including for everyday expenses within the health sector, to avoid credit card interest. Additionally, Afterpay reported that in the first quarter of 2023, 98% of purchases did not incur late fees.

However, Associate Finance Professor Andrew Grant cautioned that those who use these services irresponsibly could face hardships, particularly if they have multiple accounts or maxed-out credit cards, leading them to rely on buy now, pay later services to cover the gap.

Such cases could be concerning for people who may feel forced to use buy now, pay later to cover the cost of medication.

On the other hand, while the recent changes to the Pharmaceutical Benefits Scheme (PBS) reduced the cost of subsidised medicine for patients like Sue Watson from $42.50 to $30, she still finds it challenging to make payments on time.

While the safety net helps to bring down the cost of medication, Ms Watson noted that she and her family can now only afford the basics.

To support the implementation of changes to the PBS, Services Australia has been allocated $1.2 million in 2022-23 and $1.6 million over four years.

The Australian Bureau of Statistics reports that two in three people were supplied with at least one PBS medication in the six months before or after the National Health Survey interview.

Among those with chronic conditions, 80.4% were supplied with PBS medication, while nearly all (97%) people aged 75 years and over received PBS medication.

Key Takeaways

- Many Australians are facing financial challenges, including the rising cost of essential medications.

- Buy now, pay later services have become increasingly popular, but experts warn of the potential for accumulating debt, especially for those on fixed incomes.

- The Australian Bureau of Statistics (ABS) reported that the proportion of people who delayed or did not get prescription medication due to cost increased in 2021-22.

- Recent changes to the Pharmaceutical Benefits Scheme (PBS) aim to reduce the cost of subsidised medicine, but many people are still struggling to afford essential medications.

It is important to carefully evaluate your financial situation and capabilities before signing up for buy now, pay later services.

While they can be useful if used responsibly, it is crucial to exercise caution to avoid accumulating overwhelming debt.

What do you think about this? Feel free to share your thoughts in the comments section below.