ANZ CEO calls homebuying as ‘only for the rich’: ‘Is that a society we want?’

By

Seia Ibanez

- Replies 3

It’s a worrying reality that will likely face the majority in their life—being able to afford to buy the essentials or buying a house of their own.

In response to this worry, the CEO of ANZ Bank has now issued a stark warning that’s sounded a shrill alarm in the hearts of every Aussie.

According to ANZ Bank CEO Shayne Elliot, owning your own home is now the 'preserve of the rich' because of the low housing supply and increasing interest rates.

He said now is the most difficult time to get approved for a home loan in over three decades due to high mortgage repayments, tougher lending regulations, and the shortage of housing.

This comment followed after ex-federal Treasurer and outgoing Future Fund Chairman Peter Costello warned that Australia’s high migration record weighed on the rental market, making it more difficult for the Reserve Bank to lower the inflation rate.

'If you want a loan, you have to be better off and, essentially, rich,' Elliot said.

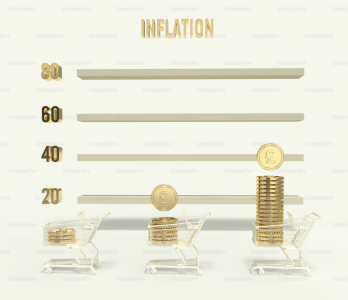

The International Monetary Fund (IMF) has expressed its own concern about the country’s inflation problem. That’s why it advised the Reserve Bank to raise interest rates, and governments are cautioned to scale back infrastructure projects to combat high inflation.

'There's big social and political consequences...Is that a society we want, where people can't get a home loan or get a loan to start a business?' Elliot continued.

According to the Bureau of Statistics, the average Australian mortgage went up from around $350,000 in 2013 to $598,867 this year.

However, first-time homebuyers still bought properties while the interest rates were less than one per cent. But with the Reserve Bank's 13 interest rate hikes in the next 18 months, the average monthly mortgage repayments have increased significantly.

Canstar’s data in April 2022 showed that the average monthly mortgage bill was $2,750, but it rose to $4151 with 4.35 per cent interest.

Costello said that this trend wasn’t limited to just homebuyers—renters were feeling the pinch too.

He highlighted Australia's record-high migration rate—500,000 people in the 12 months to September—as being a predominant contributor to this crisis.

'Australia has always been a migrant country, and I've always supported immigration. But the levels of immigration now are extremely high,' Costello said.

He added that it was ‘no wonder’ there were rental shortages.

A spokesperson for the Reserve Bank of Australia (RBA), Marion Kohler, confirmed the inflation problems.

Kohler said that the sudden increase in oil prices was a ‘timely reminder’ that supply shocks may add to the challenge of lowering inflation.

She also said that the broader economy had evolved ‘more or less’ than what was expected a year ago.

As supply chain issues were resolved, economic growth slowed down, the labour market eased, and inflation was also coming down due to the moderation of prices of goods.

‘Inflation is still too high, and underlying inflation is higher than expected a year ago,’ Kohler said.

'Prices of many services have been rising briskly in Australia,' she added, as she noted that services price inflation became slower due to decline in other economies.

Treasurer Jim Chalmers said that inflation was still his 'primary concern' but was not the ‘only challenge'.

‘Central banks and budgets are focused on demand management, but it's on the supply side where we can lift the speed limits of our economies in the medium term,’ he said during the APEC economic ministers’ meeting in the United States.

He also urged economic reorientation so that it could be better prepared to help face the realities of major trends, such as the low carbon transition and ageing population.

The October payment data from the Commonwealth Bank revealed a sharp slowdown in spending after major events, such as the FIFA Women’s World Cup, maintained spending elevated three months prior.

Three months of monthly improvements followed after the one per cent fall in October, which caused the annual pace of growth to fall back.

Recreation and hospitality recorded the biggest monthly declines, with a 4.7 and 4.5 per cent drop, respectively, according to the CommBank Household Spending Insights Index.

Stephen Halmarick, CBA Chief Economist, said that ‘people may have exhausted their desire to go to these big events and until the next big event happens, things look a bit soft.’

Halmarick added that higher interest rates coupled with essential services, such as utilities, transport, education, health, and insurance, have been adding enormous stress to households.

Discretionary spending lowered by 3.7 per cent, while spending on essentials rose by 0.3 per cent.

‘The spending that's increased is really about higher prices, and people having to spend more money on things that they may not necessarily enjoy spending more money on,' Halmarick said.

Do you think that buying or renting a home is becoming more difficult these days? How has inflation affected you? Share your thoughts with us in the comments!

In response to this worry, the CEO of ANZ Bank has now issued a stark warning that’s sounded a shrill alarm in the hearts of every Aussie.

According to ANZ Bank CEO Shayne Elliot, owning your own home is now the 'preserve of the rich' because of the low housing supply and increasing interest rates.

He said now is the most difficult time to get approved for a home loan in over three decades due to high mortgage repayments, tougher lending regulations, and the shortage of housing.

This comment followed after ex-federal Treasurer and outgoing Future Fund Chairman Peter Costello warned that Australia’s high migration record weighed on the rental market, making it more difficult for the Reserve Bank to lower the inflation rate.

'If you want a loan, you have to be better off and, essentially, rich,' Elliot said.

The International Monetary Fund (IMF) has expressed its own concern about the country’s inflation problem. That’s why it advised the Reserve Bank to raise interest rates, and governments are cautioned to scale back infrastructure projects to combat high inflation.

'There's big social and political consequences...Is that a society we want, where people can't get a home loan or get a loan to start a business?' Elliot continued.

According to the Bureau of Statistics, the average Australian mortgage went up from around $350,000 in 2013 to $598,867 this year.

However, first-time homebuyers still bought properties while the interest rates were less than one per cent. But with the Reserve Bank's 13 interest rate hikes in the next 18 months, the average monthly mortgage repayments have increased significantly.

Canstar’s data in April 2022 showed that the average monthly mortgage bill was $2,750, but it rose to $4151 with 4.35 per cent interest.

Costello said that this trend wasn’t limited to just homebuyers—renters were feeling the pinch too.

He highlighted Australia's record-high migration rate—500,000 people in the 12 months to September—as being a predominant contributor to this crisis.

'Australia has always been a migrant country, and I've always supported immigration. But the levels of immigration now are extremely high,' Costello said.

He added that it was ‘no wonder’ there were rental shortages.

A spokesperson for the Reserve Bank of Australia (RBA), Marion Kohler, confirmed the inflation problems.

Kohler said that the sudden increase in oil prices was a ‘timely reminder’ that supply shocks may add to the challenge of lowering inflation.

She also said that the broader economy had evolved ‘more or less’ than what was expected a year ago.

As supply chain issues were resolved, economic growth slowed down, the labour market eased, and inflation was also coming down due to the moderation of prices of goods.

‘Inflation is still too high, and underlying inflation is higher than expected a year ago,’ Kohler said.

'Prices of many services have been rising briskly in Australia,' she added, as she noted that services price inflation became slower due to decline in other economies.

Treasurer Jim Chalmers said that inflation was still his 'primary concern' but was not the ‘only challenge'.

‘Central banks and budgets are focused on demand management, but it's on the supply side where we can lift the speed limits of our economies in the medium term,’ he said during the APEC economic ministers’ meeting in the United States.

He also urged economic reorientation so that it could be better prepared to help face the realities of major trends, such as the low carbon transition and ageing population.

The October payment data from the Commonwealth Bank revealed a sharp slowdown in spending after major events, such as the FIFA Women’s World Cup, maintained spending elevated three months prior.

Three months of monthly improvements followed after the one per cent fall in October, which caused the annual pace of growth to fall back.

Recreation and hospitality recorded the biggest monthly declines, with a 4.7 and 4.5 per cent drop, respectively, according to the CommBank Household Spending Insights Index.

Stephen Halmarick, CBA Chief Economist, said that ‘people may have exhausted their desire to go to these big events and until the next big event happens, things look a bit soft.’

Halmarick added that higher interest rates coupled with essential services, such as utilities, transport, education, health, and insurance, have been adding enormous stress to households.

Discretionary spending lowered by 3.7 per cent, while spending on essentials rose by 0.3 per cent.

‘The spending that's increased is really about higher prices, and people having to spend more money on things that they may not necessarily enjoy spending more money on,' Halmarick said.

Key Takeaways

- ANZ CEO Shayne Elliot claimed that home ownership has become a privilege of the rich due to a low housing supply and rising interest rates.

- Elliot also noted it has become increasingly difficult for individuals, particularly first-time homebuyers, to secure a home loan due to high mortgage repayments and stricter lending regulations.

- Ex-federal Treasurer Peter Costello has highlighted how high levels of immigration are adding to pressures on the Australian rental market and making the task of curbing inflation more challenging for the Reserve Bank.

- Costello and ANZ's Elliot have flagged potential social and political repercussions of this housing market situation, questioning whether this is the type of society Australians want.

Do you think that buying or renting a home is becoming more difficult these days? How has inflation affected you? Share your thoughts with us in the comments!