Alert: How Job Seekers are Falling Victim to Recruitment Scams and Losing Thousands

- Replies 22

Disclaimer: The name/s with an asterisk (*) in this article were changed to protect the identity of the victim/s.

We here at the SDC want to bring attention to a serious issue that many Australians might be unaware of: recruitment scams.

And while we know this may not affect many of you directly, it can happen to the people you love and care about.

So, let them know that before they take on that online job or respond to any job advertisement on social media, they should be aware of the warning signs related to recruitment scams.

For many Australians, finding a job can be an incredibly difficult prospect – especially in today’s job market. This means that job seekers are more willing to take up any offer that appears to be genuine. And it’s this desperation that criminals are exploiting.

Sadly, 67-year-old Adam* became an unfortunate victim of this scheme. He told reporters that the job he expected to bring him extra income ended up ‘destroying’ him financially.

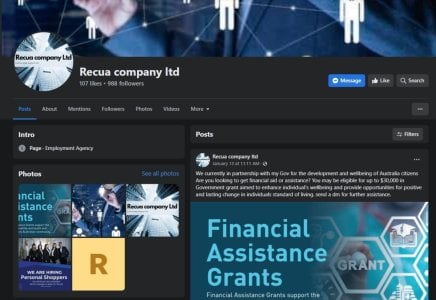

Adam* shared that after he saw a job advertisement on Facebook, he applied for it and was contacted over the social media messaging site, WhatsApp.

The company that posted the ad told him they handled e-commerce for LUISAVIAROMA, an Italian luxury retailer. Adam* was offered the job and was given a demonstration on how to use the company's platform—all of which were part of the scam.

In a span of five days, Adam* was scammed out of $28,000.

‘It was a disaster. It ruined me.’ He told reporters.

According to Adam*, the job required him to act as a ‘buyer’, meaning he needed to deposit different amounts of his own money into the ‘sellers’ account in order to buy products. Then, the scammer promised to deliver said products and offered Adam* a commission on top of the product’s price.

This is a common tactic used by e-commerce scammers.

Adam* shared that the scammer’s website used identical logos and copywriting as the real Italian retailer. They also had similar websites of well-known companies, including Target, Coles, and Bunnings.

These websites alleviated Adam’s* worries because they made the company look ‘totally legitimate’.

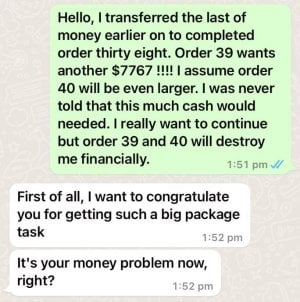

However, three days into the ‘job’, the scammer asked Adam* to increase his deposit for an order that was almost AU $8,000.

A screenshot of the conversations between him and the scammers were posted online, to bring awareness and prevent similar scams from victimising unsuspecting job seekers.

In it, he told the scammers that he was unaware he needed to shell out a huge amount of money for the job and that transferring $8,000 would destroy him financially.

It is unclear what the scammers have told Adam* beyond the conversation, but he reluctantly gave them his hard-earned cash.

By the fifth day, Adam* realised the whole thing was a set-up and he contacted NAB immediately to notify them of the incident. However, he told reporters that ‘greater measures’ could have been taken by the bank to prevent the substantial loss of his money.

‘NAB didn’t try to contact me to flag these large transfers going out of my account.’ He said before adding that he felt ‘let down’ by the bank.

‘Why didn’t they ask me: “Are you doing this transfer under coercion?”’ He stated.

Fortunately, $6,000 was returned to Adam’s* account after he submitted a formal complaint to the bank.

Georgia Brookes, NAB’s Head of Financial Crime Investigations, said the bank had ‘systems and processes in place to monitor suspicious and unusual transactions’.

But she also urged customers to be wary of unsolicited ‘work-from-home’ or other employment opportunities that involve transferring money.

‘Never agree to receive or forward funds through your account as part of the job’, she said.

Adam* stated that the entire ordeal ‘significantly heightened’ his caution while being online.

‘Coping with such a loss of savings is very difficult. I am receiving professional counselling to help me get through,’ he admitted.

So, what are recruitment scams?

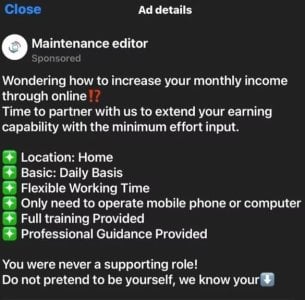

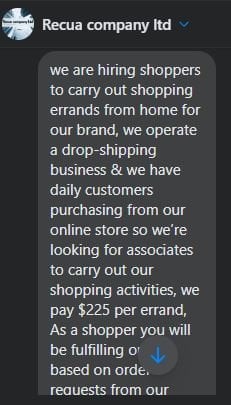

These are the types of online schemes that prey on jobseeker’s feelings of hope. Scammers pretend to be hiring on behalf of high-profile companies or online shopping platforms, or impersonate recruitment agencies.

The scammer typically contacts the jobseeker via letter, email, or phone and offers them a job that requires little effort but with high returns. Essentially, it is a ‘get-rich-quick’ scheme or a modified form of a Ponzi scheme.

False job advertisements on social media lure unsuspecting victims online, just like what happened to Adam*.

Last year, more than $8.7 million was stolen from Australians due to scams, as reported by the ACCC.

Delia Rickard, the Deputy Chair of the ACCC, said: ‘If you are job-hunting and you are offered work that requires little effort for a big financial reward, it is most likely a scam.’ Jobs of this nature might include repeatedly clicking a button on a website or app to purchase products or submit reviews.

While the scammers usually target younger Australians, older adults can still fall victim to this scam as some, like Adam*, may be searching for extra income amid the rising cost of living.

Key Takeaways

- Adam* was scammed by a fake e-commerce job, losing $28,000 in the process.

- Recruitment scams target Australians looking to make the most of a highly competitive job market.

- Scammers impersonate well-known recruitment agencies and offer ‘work from home’ jobs that promise little effort for high returns.

- If a job offer sounds too good to be true, it's probably a scam.

- Avoid giving out personal information over the phone. As much as possible, search the number you were called from on the website of the bank (or other institution) to check the legitimacy of the number.

- Don’t panic and assess the situation. We know this may be easier said than done. But scammers usually create a false sense of urgency to manipulate their victims’ emotions. Pause and calmly assess the details first before agreeing to anything.

- Learn to spot the red flags. Banks will never pressure you to update or verify your details to continue banking.

What tips do you have for staying safe against recruitment scams for job seekers out there? Please let us know in the comments below! And please share this article with your friends and family! Let’s all stay safe together.