Aged care funding shakeup: New proposal may compel older Aussies to tap into their supers

- Replies 98

For decades, the term 'retirement' has always been linked with 'superannuation'. Superannuation funds, commonly known as 'super', have been a reliable source of financial support for older Australians during their golden years.

But now, a major change on the horizon could completely reshape the world of superannuation as we know it. This change has the potential to significantly alter how retirees use their savings, marking a monumental shift in the retirement landscape.

The aged care sector in Australia is facing a funding crisis, and the peak advocacy group for the sector, the Aged and Community Care Providers Association (ACCPA), has put forth some potential solutions.

They recently released an issues paper at a national summit, suggesting two main alternatives to address the funding shortfall.

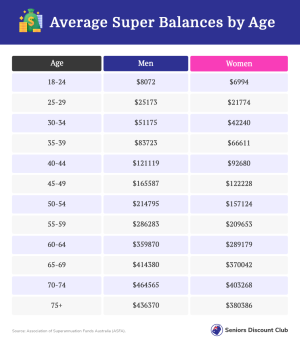

Firstly, they proposed that Australians could consider setting aside some of their superannuation savings to improve the standards in aged care. The superannuation system, with a value of $3.5 trillion, could play a part in addressing the funding gap.

By allocating a portion of people's superannuation funds specifically for aged care costs, there could be a way to bolster the funding available for this critical sector.

Secondly, the ACCPA discussed possibly implementing a new social insurance scheme or a Medicare-style levy. These alternatives could help bridge the financial gap and ensure adequate funding for aged care services.

These suggestions come in the wake of distressing revelations about the neglect of elderly Australians that came to light during the 2021 aged care royal commission.

The aged care sector's challenges are complex and multi-faceted, including insufficient funding and an aging population. The recent federal budget revealed that aged care costs for the coming financial year had increased significantly due to recommendations made by the royal commission.

Despite the increase in funding, the sector's allocation remains relatively low, with federal aged care funding accounting for only 1.2 per cent of the country's GDP, well below the OECD average of 2.5 per cent. However, there are plans to further increase funding for the sector, with projections indicating it will reach nearly $40 billion by the fiscal year 2026-27, including funds for a 15 per cent pay rise for aged care workers over the next four years.

While the federal government will continue to be the primary source of funding, the ACCPA's proposal to utilise a portion of superannuation savings could be one way to address the ongoing funding crisis and improve the quality of care for elderly Australians.

According to ACCPA's CEO Tom Symondson, the superannuation system aims to ensure financial independence for people during retirement by providing a source of income.

However, the system faces an issue where superannuation savings are sometimes passed on as inheritance instead of being used for aged care services, contrary to its intended purpose.

'We want to see a system that encourages the use of superannuation as it was intended,' he explained.

In 2021, the Productivity Commission released a research paper predicting that approximately $3.5 trillion in assets would change hands in Australia by the middle of the century, with the superannuation system playing a crucial role in this wealth transfer.

The issues paper proposes the implementation of an inheritance tax on a deceased estate if the funds from 'superannuation' are not used as intended for retirement—even though Australia abolished inheritance taxes in July 1979, following Queensland's National Party premier Joh Bjelke-Petersen's efforts to eliminate death duties.

Under this proposal, wealthier retirees may also be required to contribute additional funds to their superannuation to cover their aged care expenses, despite the recent increase in compulsory employer contributions to 11 per cent on July 1.

Members, what are your thoughts on these proposals? Share your opinions with us in the comments below.

But now, a major change on the horizon could completely reshape the world of superannuation as we know it. This change has the potential to significantly alter how retirees use their savings, marking a monumental shift in the retirement landscape.

The aged care sector in Australia is facing a funding crisis, and the peak advocacy group for the sector, the Aged and Community Care Providers Association (ACCPA), has put forth some potential solutions.

They recently released an issues paper at a national summit, suggesting two main alternatives to address the funding shortfall.

Older Aussies could soon be forced to use their superannuation for aged care or pay an inheritance tax on their estate under a radical proposal put to the federal government. Credit: Shutterstock.

Firstly, they proposed that Australians could consider setting aside some of their superannuation savings to improve the standards in aged care. The superannuation system, with a value of $3.5 trillion, could play a part in addressing the funding gap.

By allocating a portion of people's superannuation funds specifically for aged care costs, there could be a way to bolster the funding available for this critical sector.

Secondly, the ACCPA discussed possibly implementing a new social insurance scheme or a Medicare-style levy. These alternatives could help bridge the financial gap and ensure adequate funding for aged care services.

These suggestions come in the wake of distressing revelations about the neglect of elderly Australians that came to light during the 2021 aged care royal commission.

The aged care sector's challenges are complex and multi-faceted, including insufficient funding and an aging population. The recent federal budget revealed that aged care costs for the coming financial year had increased significantly due to recommendations made by the royal commission.

Despite the increase in funding, the sector's allocation remains relatively low, with federal aged care funding accounting for only 1.2 per cent of the country's GDP, well below the OECD average of 2.5 per cent. However, there are plans to further increase funding for the sector, with projections indicating it will reach nearly $40 billion by the fiscal year 2026-27, including funds for a 15 per cent pay rise for aged care workers over the next four years.

While the federal government will continue to be the primary source of funding, the ACCPA's proposal to utilise a portion of superannuation savings could be one way to address the ongoing funding crisis and improve the quality of care for elderly Australians.

According to ACCPA's CEO Tom Symondson, the superannuation system aims to ensure financial independence for people during retirement by providing a source of income.

However, the system faces an issue where superannuation savings are sometimes passed on as inheritance instead of being used for aged care services, contrary to its intended purpose.

'We want to see a system that encourages the use of superannuation as it was intended,' he explained.

In 2021, the Productivity Commission released a research paper predicting that approximately $3.5 trillion in assets would change hands in Australia by the middle of the century, with the superannuation system playing a crucial role in this wealth transfer.

The issues paper proposes the implementation of an inheritance tax on a deceased estate if the funds from 'superannuation' are not used as intended for retirement—even though Australia abolished inheritance taxes in July 1979, following Queensland's National Party premier Joh Bjelke-Petersen's efforts to eliminate death duties.

Under this proposal, wealthier retirees may also be required to contribute additional funds to their superannuation to cover their aged care expenses, despite the recent increase in compulsory employer contributions to 11 per cent on July 1.

Key Takeaways

- The Aged and Community Care Providers Association (ACCPA) has proposed that some of Australians' superannuation savings should be set aside to help improve standards in aged care and address the sector's funding shortages.

- The ACCPA has revealed harrowing details of neglect towards elderly Australians in the 2021 Aged Care Royal Commission and claims the funding problems will be further exacerbated as Australia's population ages.

- ACCPA CEO Tom Symondson noted that superannuation savings are frequently passed on as inheritance rather than paying for aged care services. The executive called for a system where superannuation is used as it was intended.

Members, what are your thoughts on these proposals? Share your opinions with us in the comments below.