Actuaries Institute suggests new age pension asset test for family homes over $2.1 million

By

Seia Ibanez

- Replies 150

The concept of the Australian dream has long been synonymous with owning a family home. It's a symbol of security, a place to raise a family, and, for many, a significant part of their retirement plan.

However, recent discussions have revealed a contentious issue that could impact retirees with high-value homes.

The Actuaries Institute suggested that the government consider including the value of family homes above $2.1 million in the age pension asset test.

This move would encourage retirees to downsize and release some of the estimated $1.3 trillion in housing equity held by Australian retirees, according to the Institute.

This proposal, detailed in a discussion paper, suggested that the value of the family home above the threshold should be included to assess the eligibility for a full or part age pension.

The Actuaries Institute's recommendation is an inflation-adjusted echo of the 2010 Henry tax review, which suggested that homes above $1.2 million owned by retirees should be included in asset testing.

With a 4 per cent annual indexation, today's threshold would be around $2.1 million, potentially varying by region or postcode to reflect the diverse property market across the country.

Currently, the family home is exempt from the asset test for the age pension, a policy that the Actuaries Institute believed should be reconsidered.

The inclusion of high-value homes in the asset test could lead to a reassessment of entitlements for a number of age pension recipients, similar to the estimated 10,000 affected if the policy had been implemented in 2010.

National Seniors Australia and the Combined Pensioners and Superannuants Association (CPSA) have both rejected the idea.

National Seniors Australia Chief Executive Chris Grice advocated for ‘a universal pension with appropriate tax reform’.

On the other hand, CPSA believes the current asset limits for the age pension were ‘sufficient’, stating, ‘the Australian government has plenty of other options to make homeownership more affordable for younger generations.’

Counting the family home in the age pension asset test has long been a taboo subject, and the government has previously dismissed the notion.

However, Andrew Boal, the report's author and Chairman of the Actuaries Institute’s Retirement Strategy Group, argued that Australia should not shy away from this debate, especially considering the recent tax changes for superannuation accounts exceeding $3 million.

‘One of the things we’ve seen recently is the introduction of the additional earnings tax for superannuation accounts of more than $3 million, so difficult changes can be made,’ Boal said.

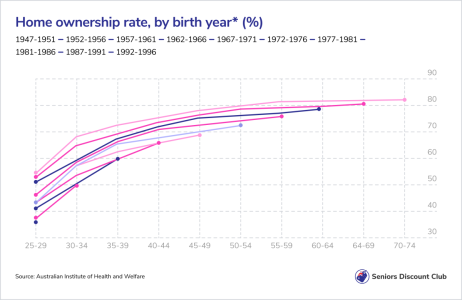

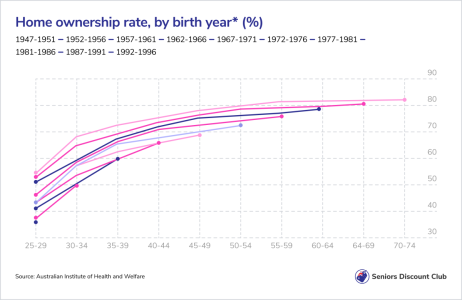

The 2020 Retirement Income Review highlighted that retirees often avoid tapping into their housing wealth to fund retirement, even with limited income.

This is despite various incentives and home equity release schemes available to them. With data showing that over 60 per cent of retirees have less than $250,000 in superannuation, the report suggested additional measures to support asset-rich, cash-poor retirees.

These measures include abolishing stamp duty for downsizers over 55 and allowing those who access equity in their home through schemes like reverse mortgages to make a 'downsizer contribution' to their superannuation.

Furthermore, the report recommended that the age pension asset test exempt amounts up to $300,000 for singles and $600,000 for couples when the family home is sold or equity is accessed.

Boal mentioned that every measure would enable asset-rich, cash-poor retirees to live more comfortably and reduce the risk of depleting their retirement savings.

Additionally, these measures would address the family housing shortage.

What are your thoughts on the proposed changes to the age pension asset test? Share your experiences and opinions in the comments below.

However, recent discussions have revealed a contentious issue that could impact retirees with high-value homes.

The Actuaries Institute suggested that the government consider including the value of family homes above $2.1 million in the age pension asset test.

This move would encourage retirees to downsize and release some of the estimated $1.3 trillion in housing equity held by Australian retirees, according to the Institute.

Actuaries Institute suggested including the value of family homes over $2.1 million in the age pension asset test.

This proposal, detailed in a discussion paper, suggested that the value of the family home above the threshold should be included to assess the eligibility for a full or part age pension.

The Actuaries Institute's recommendation is an inflation-adjusted echo of the 2010 Henry tax review, which suggested that homes above $1.2 million owned by retirees should be included in asset testing.

With a 4 per cent annual indexation, today's threshold would be around $2.1 million, potentially varying by region or postcode to reflect the diverse property market across the country.

Currently, the family home is exempt from the asset test for the age pension, a policy that the Actuaries Institute believed should be reconsidered.

The inclusion of high-value homes in the asset test could lead to a reassessment of entitlements for a number of age pension recipients, similar to the estimated 10,000 affected if the policy had been implemented in 2010.

National Seniors Australia and the Combined Pensioners and Superannuants Association (CPSA) have both rejected the idea.

National Seniors Australia Chief Executive Chris Grice advocated for ‘a universal pension with appropriate tax reform’.

On the other hand, CPSA believes the current asset limits for the age pension were ‘sufficient’, stating, ‘the Australian government has plenty of other options to make homeownership more affordable for younger generations.’

Counting the family home in the age pension asset test has long been a taboo subject, and the government has previously dismissed the notion.

However, Andrew Boal, the report's author and Chairman of the Actuaries Institute’s Retirement Strategy Group, argued that Australia should not shy away from this debate, especially considering the recent tax changes for superannuation accounts exceeding $3 million.

‘One of the things we’ve seen recently is the introduction of the additional earnings tax for superannuation accounts of more than $3 million, so difficult changes can be made,’ Boal said.

The 2020 Retirement Income Review highlighted that retirees often avoid tapping into their housing wealth to fund retirement, even with limited income.

This is despite various incentives and home equity release schemes available to them. With data showing that over 60 per cent of retirees have less than $250,000 in superannuation, the report suggested additional measures to support asset-rich, cash-poor retirees.

These measures include abolishing stamp duty for downsizers over 55 and allowing those who access equity in their home through schemes like reverse mortgages to make a 'downsizer contribution' to their superannuation.

Furthermore, the report recommended that the age pension asset test exempt amounts up to $300,000 for singles and $600,000 for couples when the family home is sold or equity is accessed.

Boal mentioned that every measure would enable asset-rich, cash-poor retirees to live more comfortably and reduce the risk of depleting their retirement savings.

Additionally, these measures would address the family housing shortage.

Key Takeaways

- The Actuaries Institute has suggested that the Australian government include the value of family homes exceeding $2.1 million in the age pension asset test.

- The institute believed that this change would contribute to releasing part of the estimated $1.3 trillion in housing equity held by retirees, encouraging them to downsize.

- Senior groups, including National Seniors Australia and the Combined Pensioners and Superannuants Association, have rejected the proposal, arguing for other solutions.

- The report also recommends abolishing stamp duty for downsizers over 55 and allowing contributions into superannuation from those utilising equity release schemes, in addition to exempting certain amounts from the age pension asset test when the family home is sold or its equity is accessed.

Last edited: