A Few Minutes Is All You Need to Start Saving Money with These Unbelievably Simple Finance Tips

By

- Replies 4

Many of us have grand money plans and saving goals that we hope to reach. But when it comes to hammering out the details and actually getting around to budgeting, it’s easy to become overwhelmed!

Here at Seniors Discount Club, we understand just how daunting budgeting can be, no matter your age.

But fret not – budgeting does not have to be a complex process! If you feel like you don’t have the time or patience to create an extensive budget from scratch, but want to become money-savvy quickly, we’ve got you covered.

Here are five easy steps that you can follow, to become a more conscious spender and start saving money more effectively:

1. Have a goal in mind

It’s all too common to hear people mention 'I’m not good with money.' And yet, when something of interest grabs their attention, they seem to be a total financial whiz, scouring the internet for the best bargains and deals.

The truth is, when it comes to money, it helps to be motivated. A great way to stay motivated and get interested in your money is to save for something that really excites you.

We’ve all heard stories about people who seem clueless when it comes to money and finance, but as soon as they decide they want to travel to see their family, suddenly they’re a financial guru. That’s because there’s a real incentive - they have something to save towards that they’re genuinely passionate about.

Taking a notepad (or using notes app on your phone) is a great way to help get organised with your saving goals. Write down what it is you’re saving for, followed by an estimated cost and the date you want to achieve it.

Getting interested in your money is the first step. Once that spark of motivation is there, you’re more likely to keep up the routine of saving. Whether it’s a house deposit, a holiday, or a new laptop, saving money with a goal in mind can make money matters a lot more enjoyable.

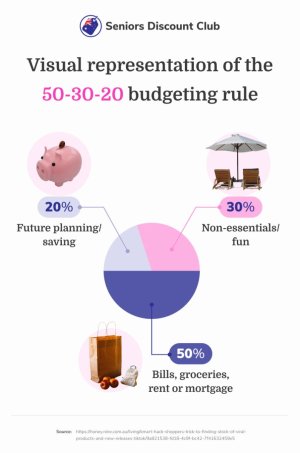

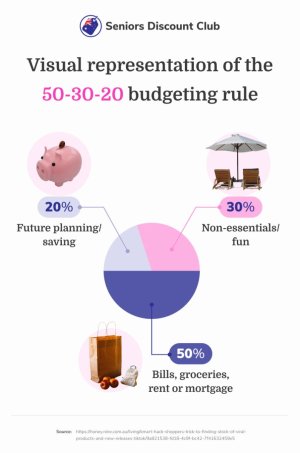

2. Consider the ‘50/30/20 rule’

When it comes to budgeting, most people think they have to be super organised with things like spreadsheets and complicated tracking methods. But, don’t worry, it doesn’t have to be so overwhelming- there’s a much easier way to keep on top of your money!

Girls Just Wanna Have Funds author, Molly Benjamin, has a few easy tricks up her sleeve which can help you keep track of your money and budget without the boring tech.

The 50/30/20 rule is perhaps the most popular of the methods suggested - and it’s incredibly easy to use. All you need to do is put your money in three (or more!) accounts, each with their own label or nickname, and move that percentage of money into them each pay cycle.

This rule clearly specifies what your money can be used for (e.g. 50 per cent for essentials and 30 per cent for discretionary expenses, etc). But that doesn’t mean it’s set in stone - the percentages can be adjusted to suit your own personal budget.

3. Take advantage of budget-tracking apps

Having a sense of how and where you spend your hard-earned money will help you stay out of debt, save for the future, and live a happier and more fulfilling life.

But let's be honest here: not everybody is born with an innate knowledge or understanding of how to manage their personal finances, which is why it's important that we're always exploring new and effective methods.

One of the easiest and most useful ways for us to do this is to take advantage of budgeting apps, which allow us to get a good idea of our spending in different categories like groceries, bills, and health expenses.

Luckily, there are a few extremely helpful free apps readily available – like WeMoney and Frollo – that let you do this. They will categorise your expenditure, alert you when you have an upcoming bill, and let you set goals.

If you don’t want to do things on your phone, you can also access the Australian Government’s MoneySmart website. Here, you can find a very simple online budgeting tool to help keep track of your outgoings.

4. Automate your transactions

Are you sick of forgetting to pay your bills each month or being short when it comes time to pay, and then being hit with charges for late payments?

If so, then it’s time to start automating your bills! Direct debiting is the perfect way to ensure your bills, memberships and other payments are taken care of – with minimal effort on your part.

Direct debiting involves setting up your bank account to transfer money automatically to a designated person, institution or store on specific dates. This eliminates the need to constantly remember, log in and enter your passwords to payments on time, ensuring you're never slugged with expensive late fees.

It also provides the convenience of being able to review your debits every few months, giving you an overview of your finances at a glance. When you're ready to stop a regular direct debit, it's simply a matter of cancelling it via your bank you have it set up with.

Another option for those who still want to have control over their finances is to set up a regular payment schedule using BPAY. This way, you get to choose exactly when to send money to the providers, while knowing you also have the power to stop it at any time.

From phone plans, gym memberships and electricity to internet and insurance payments, there's plenty of room to get creative with automation when it comes to your finances.

5. Negotiate your contracts

Are your bills weighing on your shoulders? From energy bills to insurance contracts - there are plenty of opportunities to save money if you have the right negotiation skills.

As Joel Gibson - author of Kill Bills and Easy Money - states; 'if you’re not negotiating with your bill suppliers at least once a year, you’re leaving money on the table’.

To ensure you’re getting the best price, start by making a phone call to your bill supplier. But be sure to do your research first - know what the competitors are offering and be prepared to present the case for your desired savings.

If the thought of picking up the phone has your heart racing, fear not - Molly Benjamin has put together a helpful script for you to use when you negotiate:

'Hi, my name is __________ and I have been a customer for about __________. I’m looking to get a better deal on my __________ bill, please. I’m currently paying _____________. What can you do for me? I’ve had a look around and found __________ company is offering a better deal. Can you beat it? Otherwise, I will have to consider leaving.'

To sum things up, getting on top of your money doesn’t have to take hours or need complicated calculations. A simple 10-minute task could help you save and give you a greater sense of control and well-being.

Members, if you want to make your finances simpler and more productive in 2023, give these tricks a try and see how you fare.

Do you have any money-saving or budgeting tips of your own? Let us know in the comments below.

Here at Seniors Discount Club, we understand just how daunting budgeting can be, no matter your age.

But fret not – budgeting does not have to be a complex process! If you feel like you don’t have the time or patience to create an extensive budget from scratch, but want to become money-savvy quickly, we’ve got you covered.

Here are five easy steps that you can follow, to become a more conscious spender and start saving money more effectively:

Monitoring expenses can be a tiresome task for many people. Credit: Pexels/Joslyn Pickens.

1. Have a goal in mind

It’s all too common to hear people mention 'I’m not good with money.' And yet, when something of interest grabs their attention, they seem to be a total financial whiz, scouring the internet for the best bargains and deals.

The truth is, when it comes to money, it helps to be motivated. A great way to stay motivated and get interested in your money is to save for something that really excites you.

We’ve all heard stories about people who seem clueless when it comes to money and finance, but as soon as they decide they want to travel to see their family, suddenly they’re a financial guru. That’s because there’s a real incentive - they have something to save towards that they’re genuinely passionate about.

Taking a notepad (or using notes app on your phone) is a great way to help get organised with your saving goals. Write down what it is you’re saving for, followed by an estimated cost and the date you want to achieve it.

Getting interested in your money is the first step. Once that spark of motivation is there, you’re more likely to keep up the routine of saving. Whether it’s a house deposit, a holiday, or a new laptop, saving money with a goal in mind can make money matters a lot more enjoyable.

2. Consider the ‘50/30/20 rule’

When it comes to budgeting, most people think they have to be super organised with things like spreadsheets and complicated tracking methods. But, don’t worry, it doesn’t have to be so overwhelming- there’s a much easier way to keep on top of your money!

Girls Just Wanna Have Funds author, Molly Benjamin, has a few easy tricks up her sleeve which can help you keep track of your money and budget without the boring tech.

The 50/30/20 rule is perhaps the most popular of the methods suggested - and it’s incredibly easy to use. All you need to do is put your money in three (or more!) accounts, each with their own label or nickname, and move that percentage of money into them each pay cycle.

Anyone can adjust the percentages, depending on their individual needs. Credit: Seniors Discount Club.

This rule clearly specifies what your money can be used for (e.g. 50 per cent for essentials and 30 per cent for discretionary expenses, etc). But that doesn’t mean it’s set in stone - the percentages can be adjusted to suit your own personal budget.

3. Take advantage of budget-tracking apps

Having a sense of how and where you spend your hard-earned money will help you stay out of debt, save for the future, and live a happier and more fulfilling life.

But let's be honest here: not everybody is born with an innate knowledge or understanding of how to manage their personal finances, which is why it's important that we're always exploring new and effective methods.

One of the easiest and most useful ways for us to do this is to take advantage of budgeting apps, which allow us to get a good idea of our spending in different categories like groceries, bills, and health expenses.

Luckily, there are a few extremely helpful free apps readily available – like WeMoney and Frollo – that let you do this. They will categorise your expenditure, alert you when you have an upcoming bill, and let you set goals.

If you don’t want to do things on your phone, you can also access the Australian Government’s MoneySmart website. Here, you can find a very simple online budgeting tool to help keep track of your outgoings.

4. Automate your transactions

Are you sick of forgetting to pay your bills each month or being short when it comes time to pay, and then being hit with charges for late payments?

If so, then it’s time to start automating your bills! Direct debiting is the perfect way to ensure your bills, memberships and other payments are taken care of – with minimal effort on your part.

Direct debiting involves setting up your bank account to transfer money automatically to a designated person, institution or store on specific dates. This eliminates the need to constantly remember, log in and enter your passwords to payments on time, ensuring you're never slugged with expensive late fees.

It also provides the convenience of being able to review your debits every few months, giving you an overview of your finances at a glance. When you're ready to stop a regular direct debit, it's simply a matter of cancelling it via your bank you have it set up with.

Another option for those who still want to have control over their finances is to set up a regular payment schedule using BPAY. This way, you get to choose exactly when to send money to the providers, while knowing you also have the power to stop it at any time.

From phone plans, gym memberships and electricity to internet and insurance payments, there's plenty of room to get creative with automation when it comes to your finances.

5. Negotiate your contracts

Are your bills weighing on your shoulders? From energy bills to insurance contracts - there are plenty of opportunities to save money if you have the right negotiation skills.

As Joel Gibson - author of Kill Bills and Easy Money - states; 'if you’re not negotiating with your bill suppliers at least once a year, you’re leaving money on the table’.

To ensure you’re getting the best price, start by making a phone call to your bill supplier. But be sure to do your research first - know what the competitors are offering and be prepared to present the case for your desired savings.

If the thought of picking up the phone has your heart racing, fear not - Molly Benjamin has put together a helpful script for you to use when you negotiate:

'Hi, my name is __________ and I have been a customer for about __________. I’m looking to get a better deal on my __________ bill, please. I’m currently paying _____________. What can you do for me? I’ve had a look around and found __________ company is offering a better deal. Can you beat it? Otherwise, I will have to consider leaving.'

Key Takeaways

- Budgeting can be daunting for those who are not familiar with the process.

- There are five simple and fast methods that any time-poor person can do to help them get money-savvy.

- Setting up automated payments and direct debits is a great way to stay on top of your bills, but also be sure to review them every few months.

- Taking just 10 minutes to do research, note down what you want to achieve with your money, and downloading a budgeting app can help you make the most of your money.

To sum things up, getting on top of your money doesn’t have to take hours or need complicated calculations. A simple 10-minute task could help you save and give you a greater sense of control and well-being.

Members, if you want to make your finances simpler and more productive in 2023, give these tricks a try and see how you fare.

Do you have any money-saving or budgeting tips of your own? Let us know in the comments below.