90-year-old Australian grandmother scammed out of $100,000 in the latest IT-based con - Learn how to stay safe

By

- Replies 39

It's no secret that scams and frauds are rampant these days. With every passing day, fraudsters seem to use a new tactic to prey on everyday Australians.

It can be overwhelming to stay on top of all the tricks as con artists and scammers seem to always be one step ahead.

That's why we here at the SDC are dedicated to keeping an eye out for any shady or illegal activity, especially concerning our beloved seniors.

We want to ensure that our members are well-informed about the latest scams and frauds to stay safe and protected.

As it turns out, our previous warning about scams and fraudsters has become a reality for a 90-year-old grandmother residing in western Sydney.

The elderly resident, who we'll call ‘Brenda’ to protect her privacy, was recently scammed out of $100,000 after she fell victim to a cruel IT-based con.

It all started when Brenda was browsing on her computer at home and noticed a security alert – which she thought was legitimate since it displayed a phone number that she could call to 'fix' the issue.

She made the call, but things soon took an unexpected turn when a woman identified as ‘Jade’ from ‘Apple Security’ picked up the phone on the other end and offered assistance.

Brenda, however, was none the wiser and cooperated as ‘Jade’ started to ‘work’ on the problem.

Jade then told Brenda, who lives in a retirement village, that they owed her a refund of $500 and would need her internet banking details.

Not having used online banking before, ‘Jade’ helped Brenda set up an online account.

Unfortunately, this had a grave consequence - in doing so, the scammers had installed remote access software onto Brenda’s device, meaning they had access to her personal information.

With their newfound access, the scammers told Brenda that they had transferred too many zeros to her account and inadvertently given her a ‘refund’ of $50,000 instead of $500.

In order to ‘rectify’ their mistake, ‘Jade’ told Brenda to go immediately to her bank and transfer the large sum of money into an account labelled ACN Constructions Pty Ltd NSW, citing it as ‘renovations’ if the bank asked why.

Brenda remembered how she felt uneasy with Jade’s insistent tone.

'I was very frightened and scared, and I felt like they were watching me and listening to me,' she shared.

The grandmother followed the scammer's instructions and visited ANZ bank.

Once there, a bank official escorted her to an office and, after performing a few checks, processed the transfer.

Little did she know, she had just unwittingly transferred $50,000 to the scammers.

However, this is just the beginning of the scam. Jade and another male fraudster contacted her again, this time alleging that the same mistake had been made again.

The scammers were relentless and kept pressuring her to keep the situation under wraps, warning her not to disclose anything to anyone.

Flustered and scared, and so as not to draw attention, Brenda sadly lost another $50,000.

Summoning her courage, the 90-year-old finally confided in her sons about the incident. As soon as Brenda shared what had occurred, her sons recognised that their mother had fallen victim to a fraudulent scheme.

One of her sons said: 'We were horrified ... Mum has been a customer with ANZ for 60 years. How could they let this happen?'

The grandmother had believed that being without internet banking made her immune to scams. However, what she and her sons didn't know was that these criminals had found a way to hijack her computer.

Brenda also came to the realisation that there were warning signs that she had overlooked. She remembered feeling pressured to act hastily, leaving her with insufficient time to carefully consider the situation.

She remarked: 'People said "Well, why didn't you just hang up", but I was worried they would have kept ringing me. On the Tuesday, they rang me about 18 times.’

According to an ANZ spokesperson, the bank is actively collaborating with other financial institutions, regulators, and the government to tackle this issue and find a viable solution.

The representative said: 'ANZ has robust processes and systems in place to protect our customers against fraud and scams.’

'ANZ will never email, call or text message you, asking for personal information like your password, PIN, one-time password for payments, RSA token, ANZ Shield or ask you to transfer funds into another account.'

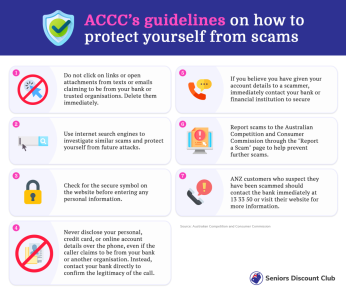

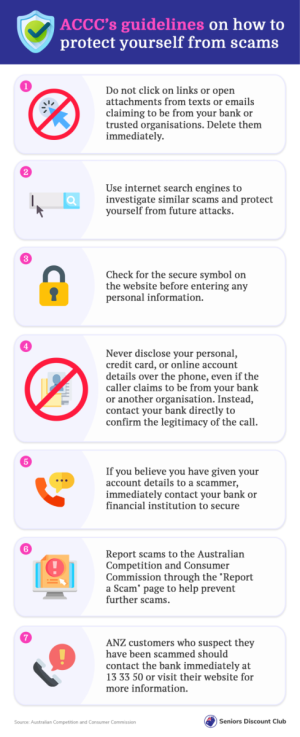

This frightening story serves as an important reminder to be vigilant when it comes to suspicious emails, texts or security alerts.

Never give out your financial credentials to someone you don’t know, and be cautious about any unsolicited calls or emails.

Always take your time so you can consider any decision carefully.

Finally, if you encounter a scam targeting our members, please let us know so we can alert everyone to be extra careful!

Stay safe out there, folks! Feel free to share this article with your friends and loved ones so they can stay on top of this scheme as well.

For those of you who would like to read more about Brenda’s story, we recommend checking out this article.

It can be overwhelming to stay on top of all the tricks as con artists and scammers seem to always be one step ahead.

That's why we here at the SDC are dedicated to keeping an eye out for any shady or illegal activity, especially concerning our beloved seniors.

We want to ensure that our members are well-informed about the latest scams and frauds to stay safe and protected.

As it turns out, our previous warning about scams and fraudsters has become a reality for a 90-year-old grandmother residing in western Sydney.

A 90-year-old grandmother from western Sydney has fallen victim to a heartless computer scam, resulting in the loss of $100,000 to the criminals involved. Credit: Shutterstock.

The elderly resident, who we'll call ‘Brenda’ to protect her privacy, was recently scammed out of $100,000 after she fell victim to a cruel IT-based con.

It all started when Brenda was browsing on her computer at home and noticed a security alert – which she thought was legitimate since it displayed a phone number that she could call to 'fix' the issue.

She made the call, but things soon took an unexpected turn when a woman identified as ‘Jade’ from ‘Apple Security’ picked up the phone on the other end and offered assistance.

Brenda, however, was none the wiser and cooperated as ‘Jade’ started to ‘work’ on the problem.

Jade then told Brenda, who lives in a retirement village, that they owed her a refund of $500 and would need her internet banking details.

Not having used online banking before, ‘Jade’ helped Brenda set up an online account.

Unfortunately, this had a grave consequence - in doing so, the scammers had installed remote access software onto Brenda’s device, meaning they had access to her personal information.

With their newfound access, the scammers told Brenda that they had transferred too many zeros to her account and inadvertently given her a ‘refund’ of $50,000 instead of $500.

In order to ‘rectify’ their mistake, ‘Jade’ told Brenda to go immediately to her bank and transfer the large sum of money into an account labelled ACN Constructions Pty Ltd NSW, citing it as ‘renovations’ if the bank asked why.

Brenda remembered how she felt uneasy with Jade’s insistent tone.

'I was very frightened and scared, and I felt like they were watching me and listening to me,' she shared.

The grandmother followed the scammer's instructions and visited ANZ bank.

Once there, a bank official escorted her to an office and, after performing a few checks, processed the transfer.

Little did she know, she had just unwittingly transferred $50,000 to the scammers.

However, this is just the beginning of the scam. Jade and another male fraudster contacted her again, this time alleging that the same mistake had been made again.

The scammers were relentless and kept pressuring her to keep the situation under wraps, warning her not to disclose anything to anyone.

Flustered and scared, and so as not to draw attention, Brenda sadly lost another $50,000.

Summoning her courage, the 90-year-old finally confided in her sons about the incident. As soon as Brenda shared what had occurred, her sons recognised that their mother had fallen victim to a fraudulent scheme.

One of her sons said: 'We were horrified ... Mum has been a customer with ANZ for 60 years. How could they let this happen?'

The grandmother had believed that being without internet banking made her immune to scams. However, what she and her sons didn't know was that these criminals had found a way to hijack her computer.

Brenda also came to the realisation that there were warning signs that she had overlooked. She remembered feeling pressured to act hastily, leaving her with insufficient time to carefully consider the situation.

She remarked: 'People said "Well, why didn't you just hang up", but I was worried they would have kept ringing me. On the Tuesday, they rang me about 18 times.’

According to an ANZ spokesperson, the bank is actively collaborating with other financial institutions, regulators, and the government to tackle this issue and find a viable solution.

The representative said: 'ANZ has robust processes and systems in place to protect our customers against fraud and scams.’

'ANZ will never email, call or text message you, asking for personal information like your password, PIN, one-time password for payments, RSA token, ANZ Shield or ask you to transfer funds into another account.'

Key Takeaways

- A 90-year-old grandmother in Western Sydney lost $100,000 in a cruel computer scam.

- Scammers posed as Apple security and convinced her to set up internet banking, which she had never done before.

- After setting up her account, the scammers had access to her information and convinced her to transfer large sums of money.

- Brenda's family was horrified and warned others to be aware of potential scams.

This frightening story serves as an important reminder to be vigilant when it comes to suspicious emails, texts or security alerts.

Never give out your financial credentials to someone you don’t know, and be cautious about any unsolicited calls or emails.

Always take your time so you can consider any decision carefully.

Finally, if you encounter a scam targeting our members, please let us know so we can alert everyone to be extra careful!

Stay safe out there, folks! Feel free to share this article with your friends and loved ones so they can stay on top of this scheme as well.

For those of you who would like to read more about Brenda’s story, we recommend checking out this article.

Attachments

Last edited by a moderator: