2024-25 federal budget set to ‘alleviate pocket pressures’ amid cost-of-living crisis

By

Seia Ibanez

- Replies 66

As the leaves turn golden and the air cools, Australians are not just preparing for the change of seasons but also the federal budget announcement.

It's a time when the government lays out its financial plans for the year ahead, and it's crucial to understand how these decisions will affect everyone’s pockets.

With the cost of living continuing to be a hot topic nationwide, many are eager to see what measures will be introduced to ease the financial burden.

Treasurer Jim Chalmers has been managing expectations, clarifying that Australians shouldn't expect 'big cash splashes' this time.

However, with the cost of living eating into budgets, the 2024-25 budget is anticipated to include policies to alleviate pocket pressures many are feeling.

Here's what we can look forward to on 14 May—and how it might make life a little easier for you.

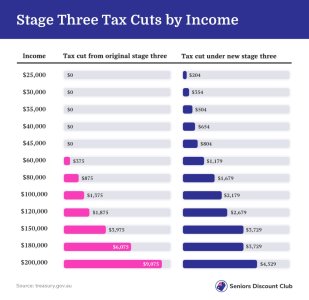

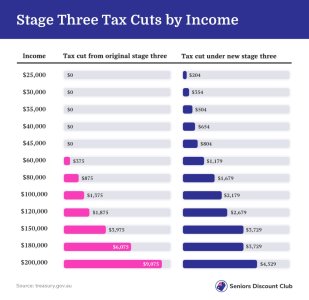

Stage 3 Tax Cuts

The government's revised tax policy is set to be a cornerstone of this year's budget.

Initially announced in January and passed by parliament shortly after, the policy aims to provide more tax relief to low- and middle-income earners while still offering benefits to those on higher salaries.

The tax cuts are designed to address cost-of-living pressures and bracket creep.

The changes will lower the tax rate for the lowest two brackets and raise the threshold for the two highest brackets.

This is a shift from the original stage 3 tax cuts proposed by the previous government, which did not include lowering the tax rate for the first two brackets and would have abolished the 37 per cent bracket entirely.

From 1 July, every taxpayer will see a cut.

For example, someone earning an average income of around $73,000 will receive a tax reduction of $1504.

The exact amount you'll save depends on your earnings, but the policy's cost to the budget is estimated to be around $105.7 billion by 2027–28.

Energy Bill Relief

Hints from the government suggest that energy bill relief will continue to be a theme in this year's budget.

An existing policy provides up to $500 off power bills for eligible families and up to $650 for eligible small businesses.

‘Our government understands that for small business—as for Australian families—energy bills remain a source of financial pressure,’ Prime Minister Anthony Albanese said.

‘That's why the energy bill relief package I negotiated with the states and territories delivered up to $650 in savings for around 1 million small businesses, along with 5 million families.’

‘And as we put together next month's budget, small businesses and families will again be front and centre in our thinking.’

With energy bills expected to decrease or stabilise from 1 July for much of the country, the current relief package might be extended for another year, providing continued support for those feeling the pinch.

The rest of the plans will be revealed on 14 May, 7:30 pm at budget.gov.au.

What are your hopes for the upcoming budget? Are there specific areas where you feel the government should focus its financial support? Share your thoughts in the comments below.

It's a time when the government lays out its financial plans for the year ahead, and it's crucial to understand how these decisions will affect everyone’s pockets.

With the cost of living continuing to be a hot topic nationwide, many are eager to see what measures will be introduced to ease the financial burden.

Treasurer Jim Chalmers has been managing expectations, clarifying that Australians shouldn't expect 'big cash splashes' this time.

However, with the cost of living eating into budgets, the 2024-25 budget is anticipated to include policies to alleviate pocket pressures many are feeling.

Here's what we can look forward to on 14 May—and how it might make life a little easier for you.

Stage 3 Tax Cuts

The government's revised tax policy is set to be a cornerstone of this year's budget.

Initially announced in January and passed by parliament shortly after, the policy aims to provide more tax relief to low- and middle-income earners while still offering benefits to those on higher salaries.

The tax cuts are designed to address cost-of-living pressures and bracket creep.

The changes will lower the tax rate for the lowest two brackets and raise the threshold for the two highest brackets.

This is a shift from the original stage 3 tax cuts proposed by the previous government, which did not include lowering the tax rate for the first two brackets and would have abolished the 37 per cent bracket entirely.

From 1 July, every taxpayer will see a cut.

For example, someone earning an average income of around $73,000 will receive a tax reduction of $1504.

The exact amount you'll save depends on your earnings, but the policy's cost to the budget is estimated to be around $105.7 billion by 2027–28.

Energy Bill Relief

Hints from the government suggest that energy bill relief will continue to be a theme in this year's budget.

An existing policy provides up to $500 off power bills for eligible families and up to $650 for eligible small businesses.

‘Our government understands that for small business—as for Australian families—energy bills remain a source of financial pressure,’ Prime Minister Anthony Albanese said.

‘That's why the energy bill relief package I negotiated with the states and territories delivered up to $650 in savings for around 1 million small businesses, along with 5 million families.’

‘And as we put together next month's budget, small businesses and families will again be front and centre in our thinking.’

With energy bills expected to decrease or stabilise from 1 July for much of the country, the current relief package might be extended for another year, providing continued support for those feeling the pinch.

The rest of the plans will be revealed on 14 May, 7:30 pm at budget.gov.au.

Key Takeaways

- The upcoming federal budget will address cost-of-living pressures with policies like Stage 3 tax cuts targeting low- and middle-income earners.

- The Stage 3 tax cuts passed by parliament will lower tax rates for the lowest two brackets and raise the threshold for the two highest brackets, benefiting all taxpayers.

- The government has hinted at continuing energy bill relief for families and small businesses in the forthcoming budget.

Last edited: