‘This place is a death trap’: One woman’s homebuying nightmare is a warning to us all

By

Maan

- Replies 0

Rebecca Welsh thought she had found her dream home—until the walls started weeping.

What began as a promising purchase in a beachside suburb turned into a nightmare of black mould, structural damage, and health problems.

Now she’s trapped in a house that experts say would cost over $330,000 to fix—and the builder has gone bust.

It was early 2021 when Rebecca Welsh secured the winning bid on a two-bedroom townhouse in Edithvale, Melbourne, paying $795,000 at auction.

‘It just had everything,’ the 52-year-old recalled.

‘I thought it was great location—it was close to my daughter’s school, close to public transport, close to the beach.’

She had been eager to move in quickly and skipped the building inspection, a choice that would later haunt her.

By the following year, the warning signs started to emerge.

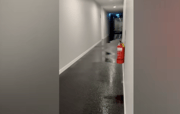

Water began leaking into her kitchen from multiple places—the ceiling, the window, even through the rangehood.

Image available here.

The air inside the home was thick and humid, and a persistent damp smell hung in the rooms.

What she found next was far worse.

Ms Welsh discovered that the wall cavities were saturated and filled with black mould.

Image available here.

Her health began to suffer alongside the house.

She experienced breathing issues and skin rashes, which coincided with the growing presence of mould inside the walls.

A professional environmental report confirmed the worst—the house had severe water ingress due to poor drainage and missing waterproofing around the floor slab.

The report concluded the mould levels were ‘likely to have significant health effects to occupants’ and estimated the cost of remediation at more than $130,000.

She later ordered a full building inspection, which uncovered a laundry list of additional issues.

There was poor waterproofing at the slab level, an incorrect roof pitch, faulty sarking and flashings, and cladding that had been installed incorrectly.

Those repairs would add another $200,000 on top of the mould remediation bill.

‘This place is a death trap,’ she said.

Ms Welsh contacted the developer, Arrow Building Group, only to be told that any defects were covered by a three-month liability period—which had long expired.

Though the company later agreed to send someone to conduct repairs, she said they only planned to ‘patch up’ the issues, not address their underlying causes.

She claimed she received no help from the strata manager, who had been appointed by the developer.

To make matters worse, the body corporate’s insurer said it did not cover building defects.

Now, she feels completely stuck.

‘What do you do? Where do you go and live?’ she said.

‘I can’t sell, because I wouldn’t get a cent for it. It would have to be bulldozed.’

‘Either way, for my own mental sanity, I’ve got to get the place repaired.’

The situation grew even more dire in April, when Arrow Building Group collapsed into voluntary administration.

The company administrator has been contacted for comments.

Ms Welsh is not alone.

A 2023 report from the Australian Housing and Urban Research Institute revealed that 70 per cent of Australia’s estimated 10.9 million homes had at least one major building defect.

These ranged from faulty plumbing and waterproofing to major structural problems and cracked foundations.

Architectural expert Associate Professor Lyrian Daniel, lead author of the report, said the findings shattered the myth that Australian homes are built to last.

‘For many years in Australia, we’ve had a fairly laissez-faire approach to regulation in the construction sector when it comes the quality of our housing,’ Dr Daniel said.

‘The notion that the free market will demand a certain level of quality—it will lead to high standards—simply doesn’t ring true.’

‘We need national leadership in this area—a strategy that ensures housing stock, whether it’s new, existing, owned or private rental, is of a good standard.’

If you thought Rebecca’s story was shocking, she’s not the only one who ended up with far more than she bargained for.

Another couple also believed they’d found their perfect home—until a hidden danger behind the walls turned their lives upside down.

Their experience offers a powerful reminder of what to check before signing on the dotted line.

Read more: Is Your Dream Home Hiding This Shocking Secret? One Couple’s Nightmare Could Save You Thousands!

How many others are silently living in homes that could be harming their health?

What began as a promising purchase in a beachside suburb turned into a nightmare of black mould, structural damage, and health problems.

Now she’s trapped in a house that experts say would cost over $330,000 to fix—and the builder has gone bust.

It was early 2021 when Rebecca Welsh secured the winning bid on a two-bedroom townhouse in Edithvale, Melbourne, paying $795,000 at auction.

‘It just had everything,’ the 52-year-old recalled.

‘I thought it was great location—it was close to my daughter’s school, close to public transport, close to the beach.’

She had been eager to move in quickly and skipped the building inspection, a choice that would later haunt her.

By the following year, the warning signs started to emerge.

Water began leaking into her kitchen from multiple places—the ceiling, the window, even through the rangehood.

Image available here.

The air inside the home was thick and humid, and a persistent damp smell hung in the rooms.

What she found next was far worse.

Ms Welsh discovered that the wall cavities were saturated and filled with black mould.

Image available here.

Her health began to suffer alongside the house.

She experienced breathing issues and skin rashes, which coincided with the growing presence of mould inside the walls.

A professional environmental report confirmed the worst—the house had severe water ingress due to poor drainage and missing waterproofing around the floor slab.

The report concluded the mould levels were ‘likely to have significant health effects to occupants’ and estimated the cost of remediation at more than $130,000.

She later ordered a full building inspection, which uncovered a laundry list of additional issues.

There was poor waterproofing at the slab level, an incorrect roof pitch, faulty sarking and flashings, and cladding that had been installed incorrectly.

Those repairs would add another $200,000 on top of the mould remediation bill.

‘This place is a death trap,’ she said.

Ms Welsh contacted the developer, Arrow Building Group, only to be told that any defects were covered by a three-month liability period—which had long expired.

Though the company later agreed to send someone to conduct repairs, she said they only planned to ‘patch up’ the issues, not address their underlying causes.

She claimed she received no help from the strata manager, who had been appointed by the developer.

To make matters worse, the body corporate’s insurer said it did not cover building defects.

Now, she feels completely stuck.

‘What do you do? Where do you go and live?’ she said.

‘I can’t sell, because I wouldn’t get a cent for it. It would have to be bulldozed.’

‘Either way, for my own mental sanity, I’ve got to get the place repaired.’

The situation grew even more dire in April, when Arrow Building Group collapsed into voluntary administration.

The company administrator has been contacted for comments.

Ms Welsh is not alone.

A 2023 report from the Australian Housing and Urban Research Institute revealed that 70 per cent of Australia’s estimated 10.9 million homes had at least one major building defect.

These ranged from faulty plumbing and waterproofing to major structural problems and cracked foundations.

Architectural expert Associate Professor Lyrian Daniel, lead author of the report, said the findings shattered the myth that Australian homes are built to last.

‘For many years in Australia, we’ve had a fairly laissez-faire approach to regulation in the construction sector when it comes the quality of our housing,’ Dr Daniel said.

‘The notion that the free market will demand a certain level of quality—it will lead to high standards—simply doesn’t ring true.’

‘We need national leadership in this area—a strategy that ensures housing stock, whether it’s new, existing, owned or private rental, is of a good standard.’

If you thought Rebecca’s story was shocking, she’s not the only one who ended up with far more than she bargained for.

Another couple also believed they’d found their perfect home—until a hidden danger behind the walls turned their lives upside down.

Their experience offers a powerful reminder of what to check before signing on the dotted line.

Read more: Is Your Dream Home Hiding This Shocking Secret? One Couple’s Nightmare Could Save You Thousands!

Key Takeaways

- Rebecca Welsh bought her Edithvale home for $795,000 without a building inspection.

- She later discovered black mould, structural issues and water damage throughout the property.

- Repair costs have been estimated at over $330,000.

- The builder, Arrow Building Group, has since gone into voluntary administration.

How many others are silently living in homes that could be harming their health?