‘It’s already here’: Expert’s warning as Australia edges closer to a cashless future

By

Maan

- Replies 87

Australia’s relationship with cash is shifting in ways that could reshape everyday life in the coming decades.

What began as a slow and subtle change is now gaining momentum, with visible impacts already taking hold across the country.

But as the push towards digital payments accelerates, questions are mounting over what this means for the future of money access.

Australians could be facing a future without access to a single ATM if the current pace of removals continues.

Research by Merchant Machine revealed a steady drop in cash machine numbers across the past decade, and Australia was far from alone.

The country ranked 12th—alongside Estonia—in terms of how quickly it was moving towards an ATM-free future.

Norway and Ireland led the pack with just 11 years predicted before their machines vanish entirely, followed by Lithuania, the Netherlands, Cyprus, and Denmark.

Between 2012 and 2021, Australia recorded a more than 15 per cent drop in the number of ATMs per 100,000 people.

If that decline continues at the same rate, ATMs could disappear entirely from the country within 30 years.

Despite this trajectory, many Australians were deeply opposed to the idea of a cashless society.

A poll of over 25,000 Yahoo Finance readers showed that 93 per cent did not support the move away from cash.

Still, Finder's Graham Cooke told shared that: ‘a cashless society isn’t a future possibility—it’s already here’.

Cooke said ATM usage had steadily declined since 2009, dropping from around 75 million withdrawals per month to just 28 million.

Even during the past year, ATM withdrawal numbers remained below the year-on-year figures for 10 of the previous 12 months.

‘Despite a slight uptick after COVID lockdowns, ATM usage has hovered at under 30 million withdrawals per month,’ he said.

Australian Banking Association CEO Anna Bligh said cash payments were forecast to drop to just 4 per cent of all transactions by 2030.

That was a sharp fall from the 70 per cent recorded in 2007, according to Reserve Bank figures.

While the shift towards digital transactions was well underway, efforts were being made to preserve access to physical money.

Norway and Ireland, despite leading the charge towards a cashless model, recently introduced laws to protect access to cash.

Australia was expected to follow suit, with new legislation being drafted to guarantee cash acceptance for essential services by next year.

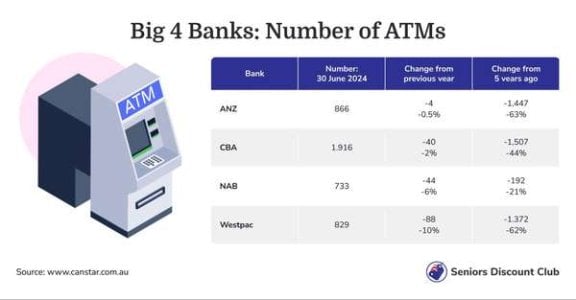

There were just 5,476 ATMs across Australia as of October, according to Canstar data.

That was a reduction of 6,084 compared to figures from 2019.

The Commonwealth Bank held the largest share, with nearly 2,000 machines, while ANZ had 866.

Private operators had tried to fill the gap, but withdrawals often came with a $3 fee or more, unlike free transactions at major bank-owned machines.

Back in 2017, banks removed fees for ATM use—something Armaguard, the cash transport provider, believed contributed to the sharp decline in machines.

Canstar confirmed over 6,000 machines had been removed in just five years.

Still, physical money held strong support among the public.

A Money.com.au survey found 68 per cent of Australians, roughly 14.8 million people, believed businesses should be required to accept cash.

Only 5 per cent supported a total shift to digital-only payments.

‘Cash remains the most reliable payment method—when the internet is down, the power is out, or there’s a tech glitch, it’s often the only way to pay,’ said Money.com.au’s Sean Callery.

‘It’s also the only way to dodge debit and credit card surcharges — the most hated fee among Aussies, with 39 per cent ranking it above even ATM withdrawal charges (14 per cent).’

Cash advocate Jason Bryce urged banks to maintain ATM access to ensure communities remained supported.

‘They have more than a social responsibility to deliver cash,’ he said.

‘They have an economic responsibility to maintain this national economic infrastructure. Banks must ensure that we can have easy, local, cheap, or preferably fee-free access to our cash.’

In a previous story, we looked at how a major payment shift has already nudged millions of Australians away from using cash.

The rapid uptake of digital options is reshaping spending habits faster than many expected.

Read more to see how this trend is unfolding across the country.

With ATMs disappearing and digital payments on the rise, do you think Australia should be doing more to preserve access to cash? Let us know your thoughts in the comments.

What began as a slow and subtle change is now gaining momentum, with visible impacts already taking hold across the country.

But as the push towards digital payments accelerates, questions are mounting over what this means for the future of money access.

Australians could be facing a future without access to a single ATM if the current pace of removals continues.

Research by Merchant Machine revealed a steady drop in cash machine numbers across the past decade, and Australia was far from alone.

The country ranked 12th—alongside Estonia—in terms of how quickly it was moving towards an ATM-free future.

Norway and Ireland led the pack with just 11 years predicted before their machines vanish entirely, followed by Lithuania, the Netherlands, Cyprus, and Denmark.

Between 2012 and 2021, Australia recorded a more than 15 per cent drop in the number of ATMs per 100,000 people.

If that decline continues at the same rate, ATMs could disappear entirely from the country within 30 years.

Despite this trajectory, many Australians were deeply opposed to the idea of a cashless society.

A poll of over 25,000 Yahoo Finance readers showed that 93 per cent did not support the move away from cash.

Still, Finder's Graham Cooke told shared that: ‘a cashless society isn’t a future possibility—it’s already here’.

Cooke said ATM usage had steadily declined since 2009, dropping from around 75 million withdrawals per month to just 28 million.

Even during the past year, ATM withdrawal numbers remained below the year-on-year figures for 10 of the previous 12 months.

‘Despite a slight uptick after COVID lockdowns, ATM usage has hovered at under 30 million withdrawals per month,’ he said.

Australian Banking Association CEO Anna Bligh said cash payments were forecast to drop to just 4 per cent of all transactions by 2030.

That was a sharp fall from the 70 per cent recorded in 2007, according to Reserve Bank figures.

While the shift towards digital transactions was well underway, efforts were being made to preserve access to physical money.

Norway and Ireland, despite leading the charge towards a cashless model, recently introduced laws to protect access to cash.

Australia was expected to follow suit, with new legislation being drafted to guarantee cash acceptance for essential services by next year.

There were just 5,476 ATMs across Australia as of October, according to Canstar data.

That was a reduction of 6,084 compared to figures from 2019.

The Commonwealth Bank held the largest share, with nearly 2,000 machines, while ANZ had 866.

Private operators had tried to fill the gap, but withdrawals often came with a $3 fee or more, unlike free transactions at major bank-owned machines.

Back in 2017, banks removed fees for ATM use—something Armaguard, the cash transport provider, believed contributed to the sharp decline in machines.

Canstar confirmed over 6,000 machines had been removed in just five years.

Still, physical money held strong support among the public.

A Money.com.au survey found 68 per cent of Australians, roughly 14.8 million people, believed businesses should be required to accept cash.

Only 5 per cent supported a total shift to digital-only payments.

‘Cash remains the most reliable payment method—when the internet is down, the power is out, or there’s a tech glitch, it’s often the only way to pay,’ said Money.com.au’s Sean Callery.

‘It’s also the only way to dodge debit and credit card surcharges — the most hated fee among Aussies, with 39 per cent ranking it above even ATM withdrawal charges (14 per cent).’

Cash advocate Jason Bryce urged banks to maintain ATM access to ensure communities remained supported.

‘They have more than a social responsibility to deliver cash,’ he said.

‘They have an economic responsibility to maintain this national economic infrastructure. Banks must ensure that we can have easy, local, cheap, or preferably fee-free access to our cash.’

In a previous story, we looked at how a major payment shift has already nudged millions of Australians away from using cash.

The rapid uptake of digital options is reshaping spending habits faster than many expected.

Read more to see how this trend is unfolding across the country.

Key Takeaways

- Australia is on track to have no ATMs left by 2055 if current removal trends continue.

- Public support for cash remains strong, with 93 per cent opposing a fully cashless society.

- ATM use has dropped from 75 million monthly withdrawals in 2009 to under 30 million today.

- New laws are being introduced to protect access to cash, especially for essential services.

With ATMs disappearing and digital payments on the rise, do you think Australia should be doing more to preserve access to cash? Let us know your thoughts in the comments.