‘Cash only’: Shoppers flee Coles after reading sign

By

- Replies 35

In an unexpected turn of events, a Coles supermarket in Sydney became the unlikely catalyst for a broader conversation about Australia's reliance on digital transactions.

The store, typically bustling with customers, faced an abrupt exodus when a simple, handwritten sign was placed at its entrance.

The Coles store in question, located in Westfield Bondi Junction, experienced a system outage that prevented customers from paying via card transactions.

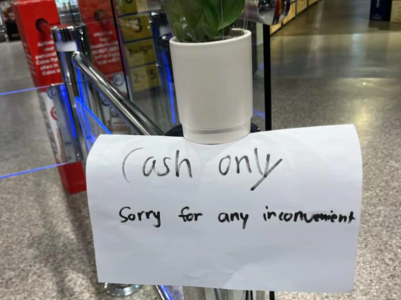

This led to the display of a handwritten sign stating, 'Cash only, sorry for any [inconvenience].'

The sight of this sign led to a significant number of customers abandoning their shopping and leaving the store, despite the presence of an ATM just a few metres away.

The incident was shared on social media, with one local posting on social media, '"Cash only” at Coles Bondi Junction tonight, as “the system is down”.’

‘A great reminder to everyone of the importance of keeping cash in the economy,’ said the shopper.

The post sparked a flurry of comments, with many expressing concern about Australia's shift towards a cashless society.

One person wrote: 'Imagine if we go to card only and hackers get into the banking systems they could cripple the retail and service industry. We have to keep two systems!'

Meanwhile, a nearby Harris Farm grocery store, which was accepting card payments, was bustling with customers.

Data from the Reserve Bank of Australia (RBA) shows that cash accounted for just 13 per cent of all payments made in 2022, down from 27 per cent in 2019.

Furthermore, more than a billion dollars worth of physical cash has disappeared from circulation in the last financial year.

Finance Specialist Sarah Wells predicts that Australia will effectively be cashless by 2026.

She told a news source: 'We’re very close to a cashless society…We can’t stop it. Our phones and watches are becoming our first choice [for purchases] now. There aren’t as many ATMs around any more, branches are closing down, and some retail shops can’t break money.'

However, the drop in physical cash in the economy could present challenges during network outages, as was the case with the Coles store in Bondi Junction.

Wells suggests that Australians need to change their behaviour and start withdrawing and using cash more frequently to reintroduce the demand.

‘We are in a situation that we have created ourselves,’ she said.

‘The challenges we have with moving towards a more cashless society, or what I call a less cash-dependent society, is if we’ve lost a billion dollars [of physical cash from circulation], so that means that there’s a billion dollars less going into ATMs for us to use,’ she explained.

‘So if we start to have more outages, or we have more challenges, people can go to an ATM, but the cash might not be there.’

Wells added: ‘All we have to do is change our behaviour. If every Australian went out and withdrew $100 a week instead of buying stuff. You know what? We’d end up with more cash in the system, kids will know about cash, stocks will start taking cash.’

‘If we don’t want to live like that, we have to inconvenience ourselves a little bit and change the supply and demand.’

What's your take on this, members? Have you ever faced a similar situation in a store where they only accept cash? Do you think we should maintain a balance between cash and digital transactions? Share your thoughts in the comments below.

The store, typically bustling with customers, faced an abrupt exodus when a simple, handwritten sign was placed at its entrance.

The Coles store in question, located in Westfield Bondi Junction, experienced a system outage that prevented customers from paying via card transactions.

This led to the display of a handwritten sign stating, 'Cash only, sorry for any [inconvenience].'

The sight of this sign led to a significant number of customers abandoning their shopping and leaving the store, despite the presence of an ATM just a few metres away.

The incident was shared on social media, with one local posting on social media, '"Cash only” at Coles Bondi Junction tonight, as “the system is down”.’

‘A great reminder to everyone of the importance of keeping cash in the economy,’ said the shopper.

The post sparked a flurry of comments, with many expressing concern about Australia's shift towards a cashless society.

One person wrote: 'Imagine if we go to card only and hackers get into the banking systems they could cripple the retail and service industry. We have to keep two systems!'

Meanwhile, a nearby Harris Farm grocery store, which was accepting card payments, was bustling with customers.

Data from the Reserve Bank of Australia (RBA) shows that cash accounted for just 13 per cent of all payments made in 2022, down from 27 per cent in 2019.

Furthermore, more than a billion dollars worth of physical cash has disappeared from circulation in the last financial year.

Finance Specialist Sarah Wells predicts that Australia will effectively be cashless by 2026.

She told a news source: 'We’re very close to a cashless society…We can’t stop it. Our phones and watches are becoming our first choice [for purchases] now. There aren’t as many ATMs around any more, branches are closing down, and some retail shops can’t break money.'

However, the drop in physical cash in the economy could present challenges during network outages, as was the case with the Coles store in Bondi Junction.

Wells suggests that Australians need to change their behaviour and start withdrawing and using cash more frequently to reintroduce the demand.

‘We are in a situation that we have created ourselves,’ she said.

‘The challenges we have with moving towards a more cashless society, or what I call a less cash-dependent society, is if we’ve lost a billion dollars [of physical cash from circulation], so that means that there’s a billion dollars less going into ATMs for us to use,’ she explained.

‘So if we start to have more outages, or we have more challenges, people can go to an ATM, but the cash might not be there.’

Wells added: ‘All we have to do is change our behaviour. If every Australian went out and withdrew $100 a week instead of buying stuff. You know what? We’d end up with more cash in the system, kids will know about cash, stocks will start taking cash.’

‘If we don’t want to live like that, we have to inconvenience ourselves a little bit and change the supply and demand.’

Key Takeaways

- Shoppers were observed leaving a Coles store after noticing a 'cash only' sign due to a system outage preventing card payments.

- The incident took place at the Coles store located in Westfield Bondi Junction and prompted discussions on the significance of cash in the economy.

- Australia is trending towards a cashless society, with cash transactions notably decreasing over recent years.

- Finance Specialist Sarah Wells commented on the potential challenges of a cashless society, especially during network outages, and suggested ways to reintroduce cash into circulation.

What's your take on this, members? Have you ever faced a similar situation in a store where they only accept cash? Do you think we should maintain a balance between cash and digital transactions? Share your thoughts in the comments below.