Westpac reveals the most scammed areas in Australia—is your postcode on the list?

By

Seia Ibanez

- Replies 6

The convenience of online transactions and communications today has been overshadowed by the growing threat of cybercrime.

In 2023, Australians were hit hard, with a staggering $2.74 billion lost to scams. This is a sobering reminder that no one is immune to cybercriminals' cunning tactics.

However, as Westpac's latest data reveals, some Australians are more at risk than others, and geography seems to play a pivotal role.

The bank's comprehensive analysis, which tracked scam reports from customers between January 2022 and April 2024, has pinpointed the most affected postcodes across the nation.

These aren't just numbers; they represent communities where individuals have felt the sting of deception more acutely than others.

Topping the list are postcodes such as 2170 in Liverpool, New South Wales, and 3029 in Tarneit, VIC, followed closely by 2250 in Gosford, NSW, 2560 in Campbelltown, NSW, and 3030 in Werribee, VIC.

In Queensland, the charming locales of Toowoomba (4350) and Cairns (4870) have seen a surge in scam cases.

South Australians in Morphett Vale (5162) and Happy Valley (5159) have also been heavily targeted.

While larger states naturally report higher numbers of scams, Westpac's data indicated that the rate of scams is alarmingly high in WA and Queensland, with 3.6 and 3.5 scams reported per 1000 customers, respectively.

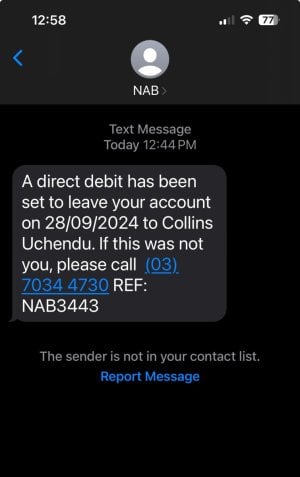

The types of scams causing the most financial damage to Australians are diverse, ranging from investment scams to business email compromise, remote access scams, romance scams, and impersonation scams.

Alarmingly, the data shows that individuals aged 61 to 75 are the most susceptible to scams, accounting for almost 32 per cent of all reported cases.

Ben Young, Westpac's head of fraud prevention, emphasised that scammers are not constrained by geography.

‘Our data shows scammers aren’t letting location limit what they do, with impacts seen in all corners of the country,’ he said.

‘The current scamdemic we’re facing is widespread.’

‘We’re finding scammers are having the biggest impact in communities with increasing economic activity, or those with ageing populations.’

So, what can you do to protect yourself and your hard-earned savings?

Westpac advised never to give out personal or financial information to someone you don't know. Be sceptical of unsolicited emails or text messages, and avoid clicking on any links they contain. If an offer seems too good to be true, it probably is.

When in doubt, reach out to a trusted family member or friend for a second opinion.

Have you or someone you know been affected by a scam recently? Share your experiences in the comments below!

Have you or someone you know been affected by a scam recently? Share your experiences in the comments below!

In 2023, Australians were hit hard, with a staggering $2.74 billion lost to scams. This is a sobering reminder that no one is immune to cybercriminals' cunning tactics.

However, as Westpac's latest data reveals, some Australians are more at risk than others, and geography seems to play a pivotal role.

The bank's comprehensive analysis, which tracked scam reports from customers between January 2022 and April 2024, has pinpointed the most affected postcodes across the nation.

These aren't just numbers; they represent communities where individuals have felt the sting of deception more acutely than others.

Topping the list are postcodes such as 2170 in Liverpool, New South Wales, and 3029 in Tarneit, VIC, followed closely by 2250 in Gosford, NSW, 2560 in Campbelltown, NSW, and 3030 in Werribee, VIC.

In Queensland, the charming locales of Toowoomba (4350) and Cairns (4870) have seen a surge in scam cases.

South Australians in Morphett Vale (5162) and Happy Valley (5159) have also been heavily targeted.

While larger states naturally report higher numbers of scams, Westpac's data indicated that the rate of scams is alarmingly high in WA and Queensland, with 3.6 and 3.5 scams reported per 1000 customers, respectively.

The types of scams causing the most financial damage to Australians are diverse, ranging from investment scams to business email compromise, remote access scams, romance scams, and impersonation scams.

Alarmingly, the data shows that individuals aged 61 to 75 are the most susceptible to scams, accounting for almost 32 per cent of all reported cases.

Ben Young, Westpac's head of fraud prevention, emphasised that scammers are not constrained by geography.

‘Our data shows scammers aren’t letting location limit what they do, with impacts seen in all corners of the country,’ he said.

‘The current scamdemic we’re facing is widespread.’

‘We’re finding scammers are having the biggest impact in communities with increasing economic activity, or those with ageing populations.’

So, what can you do to protect yourself and your hard-earned savings?

Westpac advised never to give out personal or financial information to someone you don't know. Be sceptical of unsolicited emails or text messages, and avoid clicking on any links they contain. If an offer seems too good to be true, it probably is.

When in doubt, reach out to a trusted family member or friend for a second opinion.

Key Takeaways

- Australians lost $2.74 billion to scams in 2023, and certain postcodes are more affected than others.

- Westpac has identified the postcodes with the most scam cases, with Liverpool (2170), Tarneit (3029), and Gosford (2250) being some of the top affected areas across Australia.

- Individuals aged between 61 and 75 are the most targeted by scammers, making up nearly 32 per cent of all reported cases.

- To protect against scams, Westpac advises never sharing personal or financial information with unknown entities, avoiding clicking on unsolicited links, and being sceptical of offers that appear too good to be true.