Financial relief or stress? Here's what the Reserve Bank of Australia's decision could mean for seniors

By

Danielle F.

- Replies 19

The Reserve Bank of Australia (RBA) has been the centre of attention and speculation over the past months.

As the cost of living crisis continues to affect many Australians, many eyes are locked in on their decision.

The RBA has decided on a move that could impact millions of Australians—especially seniors nationwide.

The RBA decided to cut the cash rate by 0.25 percentage points.

The cash rate cut effectively brought down the cash rates from 4.35 per cent to 4.10 per cent.

This rate cut was the first one in over four years and could have a ripple effect on the country's economy.

For Australians, this could affect everything—ranging from mortgage repayments and savings accounts to even weekly groceries.

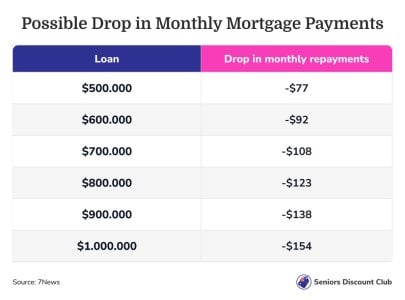

The RBA's decision could be a welcome reduction for Aussies with mortgages, as it could decrease monthly repayments.

For example, an owner-occupier with a $600,000 mortgage could see their minimum monthly repayments decrease by about $92.

With that in mind, homeowners may have some much-needed breathing room, especially after feeling the pinch of higher living costs and previous rate hikes.

The RBA's decision to lower the cash rate could be a significant shift in monetary policy.

In November 2023, Aussies saw another hike in interest rates, which has been evident in their wallets and savings.

This time, the central bank's move to cut rates was a response to various economic factors and should support sustainable economic growth.

The RBA had to consider several factors before deciding on the cut—which usually consists of inflation, employment rate, and the overall health of the economy.

For over half a million Australian households, this rate cut could be a new yet welcome experience.

'For a lot of borrowers who have been paddling hard to keep their mortgage repayments afloat, this could be a much-needed lifeline,' Data Insights Director Sally Tindall pointed out.

With this in mind, the full benefits of the rate cut could only be felt should the banks choose to pass on the savings to their customers.

Historically, the big four Australian banks have typically passed on the changes to their existing variable mortgage customers within 14 days.

Borrowers should keep a close eye on their banks' responses to the RBA's announcement and be prepared to contact their lenders.

Customers should also consider other refinancing options if their bank does not entirely pass on the rate cut.

On the other hand, savers may not see this rate cut as good news.

Interest rate cuts generally mean lower returns on savings accounts and term deposits.

Watch the full live update about the RBA's decision here:

Source: ABC News Australia/YouTube

RBA's update could be a good time to review savings strategies and look for alternative ways to make saving work harder in your favour.

As we navigate these changing financial waters, it's crucial to stay informed and proactive about managing finances.

Whether it's reassessing your mortgage, exploring new savings avenues, or simply understanding how these changes affect your financial situation, knowledge is power.

How will the RBA's rate cut affect you in the future? Have you already heard from your bank regarding changes to your mortgage or savings account? Share your thoughts about this news update in the comments section below.

As the cost of living crisis continues to affect many Australians, many eyes are locked in on their decision.

The RBA has decided on a move that could impact millions of Australians—especially seniors nationwide.

The RBA decided to cut the cash rate by 0.25 percentage points.

The cash rate cut effectively brought down the cash rates from 4.35 per cent to 4.10 per cent.

This rate cut was the first one in over four years and could have a ripple effect on the country's economy.

For Australians, this could affect everything—ranging from mortgage repayments and savings accounts to even weekly groceries.

The RBA's decision could be a welcome reduction for Aussies with mortgages, as it could decrease monthly repayments.

For example, an owner-occupier with a $600,000 mortgage could see their minimum monthly repayments decrease by about $92.

With that in mind, homeowners may have some much-needed breathing room, especially after feeling the pinch of higher living costs and previous rate hikes.

The RBA's decision to lower the cash rate could be a significant shift in monetary policy.

In November 2023, Aussies saw another hike in interest rates, which has been evident in their wallets and savings.

This time, the central bank's move to cut rates was a response to various economic factors and should support sustainable economic growth.

The RBA had to consider several factors before deciding on the cut—which usually consists of inflation, employment rate, and the overall health of the economy.

For over half a million Australian households, this rate cut could be a new yet welcome experience.

'For a lot of borrowers who have been paddling hard to keep their mortgage repayments afloat, this could be a much-needed lifeline,' Data Insights Director Sally Tindall pointed out.

With this in mind, the full benefits of the rate cut could only be felt should the banks choose to pass on the savings to their customers.

Historically, the big four Australian banks have typically passed on the changes to their existing variable mortgage customers within 14 days.

Borrowers should keep a close eye on their banks' responses to the RBA's announcement and be prepared to contact their lenders.

Customers should also consider other refinancing options if their bank does not entirely pass on the rate cut.

On the other hand, savers may not see this rate cut as good news.

Interest rate cuts generally mean lower returns on savings accounts and term deposits.

Watch the full live update about the RBA's decision here:

Source: ABC News Australia/YouTube

RBA's update could be a good time to review savings strategies and look for alternative ways to make saving work harder in your favour.

As we navigate these changing financial waters, it's crucial to stay informed and proactive about managing finances.

Whether it's reassessing your mortgage, exploring new savings avenues, or simply understanding how these changes affect your financial situation, knowledge is power.

Key Takeaways

- The Reserve Bank of Australia announced a cash rate cut by 0.25 percentage points, bringing interests down from 4.35 per cent to 4.10 per cent.

- This was the RBA's first rate cut since November 2020. The rate had been steady at 4.35 per cent since its previous hike in November 2023.

- The rate cut could reduce monthly repayments for owner-occupiers, assuming lenders and banks pass on the cut in full.

- Major banks should pass on the rate cuts to their variable mortgage customers within 14 days, in line with previous responses to cash rate changes.