SDC Rewards Member

Upgrade yours now

You can’t beat the bank by paying $1 a day extra on your mortgage. Here’s how compound interest really work

By paying just $1 a day extra on your mortgage, you can hack the banking system and cut the time to repay your home loan from 20 years to just five years.

Sounds too good to be true? Of course it is. But that hasn’t stopped someone “good at finance” from claiming this in a TikTok video that’s garnered millions of views and spurred dozens of other “finfluencers” to amplify its claims.

According to the video: “The reason banks want you to pay interest monthly is because they rely on a thing called compound interest.” But if you pay the bank $1 every day you “will pay a big fat zero in interest”.

The video goes on to say “mortgage” is a Latin word, and the reason “they” stopped teaching Latin in schools is because “they” don’t want people understanding how the banking system works.

If this sounds like a conspiracy theory, it’s because it is. Like all conspiracy theories, this one is a falsehood built on a few grains of truth, taking advantage of people’s ignorance about complicated matters.

So let’s separate the facts from the fiction.

Effect of compound interest

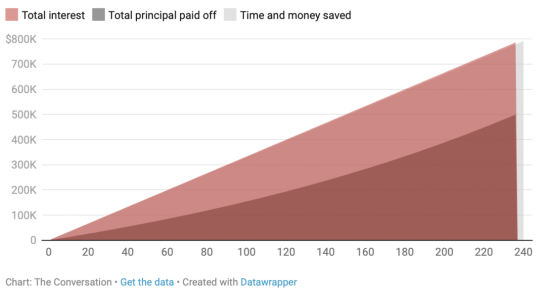

Paying off a $500,000 mortgage over 20 years (240 months) at 5% interest will require minimum monthly payment of about $3,300. It will cost almost $292,000 in interest.

Get the data Created with Datawrapper

Now let’s consider what would happen if, instead of paying $3,300 a month, you paid $1,650 a fortnight. At first glance that might seem like the same thing, but it isn’t.

In a year there are 12 months, but 26 fortnights (because only February is exactly four weeks’ long). Paying half your monthly repayment every fortnight will mean you pay $42,900 a year, instead of $39,600.

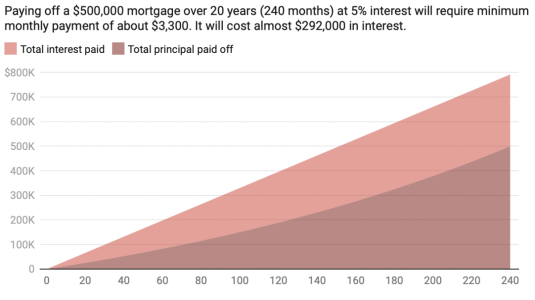

If you can afford to do that, it will take just 17 years and six months to repay the loan, and you will pay about $41,750 less interest. The following graph illustrates this.

Paying fortnightly instead of monthly

Paying $1,650 a fortnight instead of $3,300 a month will reduce repayment time by 2.5 years and interest paid by about $41,750.

Get the data Created with Datawrapper

So what about paying daily?

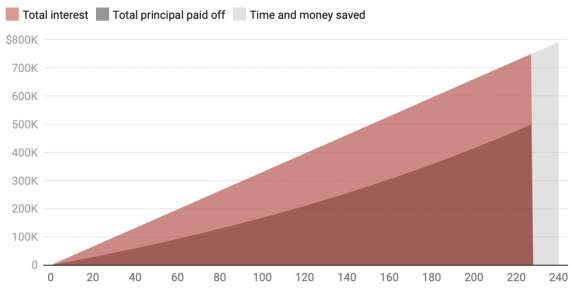

Paying more frequently, such as weekly or daily, won’t make any difference unless you’re paying more.There’s no magic trick to stopping compound interest. The following graph shows what an extra $1 a day would achieve with our hypothetical $500,000 loan.

Effect of paying an extra $1 a day

Paying an extra dollar a day on our hypothetical $500,000 mortgage will reduce repayment time by three months and save about $5,470 in interest.Rather than taking 20 years to repay the loan, it will take 19 years and nine months. You would save about $5,470 in interest (paying about $286,480 rather than $291,950).

To repay the loan in five years, as claimed, would require paying an extra $201 a day – or about $113,220 a year instead of $39,600.

There are no secret hacks

So there’s no magic hack to avoid compound interest.There are strategies to improve your loan conditions, such as refinancing when interest rates are declining, or using an offset account facility where these are offered.

The only real way to minimise compound interest on your mortgage is to pay off what you owe as quickly as you can.

But before you do, check with your bank if there are fees involved if you make additional payments towards your home loan.

For instance, if you have a partially or fully fixed mortgage, there may be a limit on how much extra you’re allowed to pay off each year without penalty.

These penalties are intended to compensate the bank for the loss of interest income it would have received if the borrower had continued to make regular payments over the full loan term.

This article was first published on The Conversation, and was written by Sagarika Mishra, Associate professor, Deakin University