Would removing this cost fix the housing crisis for retirees? Experts weigh in

By

Maan

- Replies 2

Housing affordability and accessibility remain pressing issues, with policies like stamp duty playing a significant role in shaping the property market.

While moving to a new home should be a fresh start, for some, the financial barriers make it a difficult choice.

For one homeowner considering a move, the costs associated with stamp duty have turned a potential transition into a financial dilemma.

Lance Williams wanted a change.

His three-bedroom home in Sydney’s west was perfect for a young family, but he was ready for a quieter life under a sky full of stars.

The amateur backyard astronomer dreamed of moving to the NSW south coast, where he and his wife could enjoy their retirement away from the bright city lights.

Selling the house would also free up space for another family, just as he had raised his own children there.

But there was one problem—stamp duty.

The financial barrier to downsizing

Mr Williams believed the cost of stamp duty was too high and made it difficult for retirees like him to move.

‘I find it unbelievable that I have to pay the government to put a stamp on a piece of paper, just so they can make $30,000 to $40,000 off this, and then I have to worry about the costs of removals,’ he said.

‘The amount of money that you're going to have to spend, well as a pensioner, that's probably a year, maybe two years' worth of income.’

Even though his home would likely be in demand if put on the market, he hesitated to sell, knowing that much of his potential profit would be lost to fees.

‘Whatever I was going to make out of the house, simply to move, I'm going to lose at least 10 per cent,’ he said.

‘If they really want to free up these homes, then they have to give a stamp duty exemption for retirees.’

How stamp duty affects the market

Nick Garvin, from the economic research institute e61, argued that stamp duty discouraged homeowners from moving.

His research found that stamp duty deterred nearly a quarter of potential downsizers.

A study by his team examined the impact of a one percentage point rise in Queensland’s stamp duty rates, which increased from an average of 1.26 per cent to 2.27 per cent of a property’s purchase price.

It showed that a 1 per cent increase in stamp duty led to a 7.2 per cent drop in home purchases.

Using that data, Dr Garvin estimated that removing NSW’s average 3.5 per cent stamp duty could lead to 100,000 additional property moves—an increase of 25 per cent.

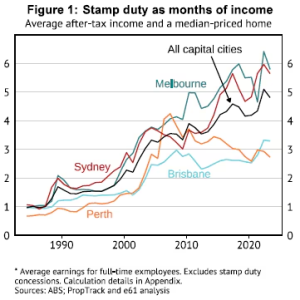

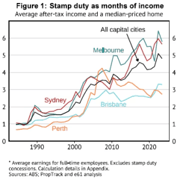

He also pointed out that stamp duty had increased significantly over time.

‘One payment of stamp duty is now around five times what it was about a generation ago,’ he said.

A report from e61 revealed that typical stamp duty payments now cost around five months of take-home income, double what they did in the 2000s.

Dr Garvin argued that abolishing stamp duty—at least for retirees—could benefit the entire market by increasing housing supply in high-demand areas.

‘Often, downsizers are moving from areas in which the housing supply is a bit short, relative to demand,’ he said.

‘So freeing up that housing supply in the high demand area has affordability benefits for everybody else.’

The government’s dilemma

For Mr Williams, stamp duty meant that buying a home on the south coast—where the average price was $572,000—would cost him an extra $21,139.

Some states, like Victoria and the ACT, had introduced stamp duty exemptions for pensioners purchasing properties below certain price thresholds, but NSW had yet to implement similar measures.

However, Dr Garvin acknowledged that removing stamp duty would create financial challenges for state governments.

‘Stamp duty is currently around a quarter of state government revenue … they would seek to get that revenue back elsewhere, maybe through other taxes,’ he said.

Would removing stamp duty make a difference?

Economist and author Dr Cameron Murray was sceptical about whether stamp duty exemptions would have a long-term impact on downsizing.

‘Everyone hates paying tax,’ he said.

‘For a lot of people it would be comical to say, “We don’t want to pay $30,000 to buy a million dollar property”…everyone is going to laugh.’

He argued that while exemptions might trigger a short-term increase in downsizing, they would not have a lasting effect since most people downsized eventually.

Dr Murray also pointed out that pensioners were already exempt from capital gains tax on their primary residence, making homeownership a favourable investment.

Dr Garvin, however, believed that even a one-off spike in downsizing could be significant.

‘If they want to reclaim stamp duty when the people have sold it or have died, well fine—that’s up to them,’ Mr Williams said.

But for now, he remained torn between staying put and dealing with the rising costs of regional property.

In a previous story, we explored how downsizing could impact homeowners financially—but for some, the concerns don’t end there.

Services Australia has warned that selling your home could affect your pension, adding another layer of uncertainty to the decision.

Read more to find out how downsizing might impact your retirement benefits.

With stamp duty making downsizing a costly decision, should retirees receive exemptions to free up more housing?

Let us know your thoughts in the comments.

While moving to a new home should be a fresh start, for some, the financial barriers make it a difficult choice.

For one homeowner considering a move, the costs associated with stamp duty have turned a potential transition into a financial dilemma.

Lance Williams wanted a change.

His three-bedroom home in Sydney’s west was perfect for a young family, but he was ready for a quieter life under a sky full of stars.

The amateur backyard astronomer dreamed of moving to the NSW south coast, where he and his wife could enjoy their retirement away from the bright city lights.

Selling the house would also free up space for another family, just as he had raised his own children there.

But there was one problem—stamp duty.

The financial barrier to downsizing

Mr Williams believed the cost of stamp duty was too high and made it difficult for retirees like him to move.

‘I find it unbelievable that I have to pay the government to put a stamp on a piece of paper, just so they can make $30,000 to $40,000 off this, and then I have to worry about the costs of removals,’ he said.

‘The amount of money that you're going to have to spend, well as a pensioner, that's probably a year, maybe two years' worth of income.’

Even though his home would likely be in demand if put on the market, he hesitated to sell, knowing that much of his potential profit would be lost to fees.

‘Whatever I was going to make out of the house, simply to move, I'm going to lose at least 10 per cent,’ he said.

‘If they really want to free up these homes, then they have to give a stamp duty exemption for retirees.’

How stamp duty affects the market

Nick Garvin, from the economic research institute e61, argued that stamp duty discouraged homeowners from moving.

His research found that stamp duty deterred nearly a quarter of potential downsizers.

A study by his team examined the impact of a one percentage point rise in Queensland’s stamp duty rates, which increased from an average of 1.26 per cent to 2.27 per cent of a property’s purchase price.

It showed that a 1 per cent increase in stamp duty led to a 7.2 per cent drop in home purchases.

Using that data, Dr Garvin estimated that removing NSW’s average 3.5 per cent stamp duty could lead to 100,000 additional property moves—an increase of 25 per cent.

He also pointed out that stamp duty had increased significantly over time.

‘One payment of stamp duty is now around five times what it was about a generation ago,’ he said.

A report from e61 revealed that typical stamp duty payments now cost around five months of take-home income, double what they did in the 2000s.

Dr Garvin argued that abolishing stamp duty—at least for retirees—could benefit the entire market by increasing housing supply in high-demand areas.

‘Often, downsizers are moving from areas in which the housing supply is a bit short, relative to demand,’ he said.

‘So freeing up that housing supply in the high demand area has affordability benefits for everybody else.’

The government’s dilemma

For Mr Williams, stamp duty meant that buying a home on the south coast—where the average price was $572,000—would cost him an extra $21,139.

Some states, like Victoria and the ACT, had introduced stamp duty exemptions for pensioners purchasing properties below certain price thresholds, but NSW had yet to implement similar measures.

However, Dr Garvin acknowledged that removing stamp duty would create financial challenges for state governments.

‘Stamp duty is currently around a quarter of state government revenue … they would seek to get that revenue back elsewhere, maybe through other taxes,’ he said.

Would removing stamp duty make a difference?

Economist and author Dr Cameron Murray was sceptical about whether stamp duty exemptions would have a long-term impact on downsizing.

‘Everyone hates paying tax,’ he said.

‘For a lot of people it would be comical to say, “We don’t want to pay $30,000 to buy a million dollar property”…everyone is going to laugh.’

He argued that while exemptions might trigger a short-term increase in downsizing, they would not have a lasting effect since most people downsized eventually.

Dr Murray also pointed out that pensioners were already exempt from capital gains tax on their primary residence, making homeownership a favourable investment.

Dr Garvin, however, believed that even a one-off spike in downsizing could be significant.

‘If they want to reclaim stamp duty when the people have sold it or have died, well fine—that’s up to them,’ Mr Williams said.

But for now, he remained torn between staying put and dealing with the rising costs of regional property.

In a previous story, we explored how downsizing could impact homeowners financially—but for some, the concerns don’t end there.

Services Australia has warned that selling your home could affect your pension, adding another layer of uncertainty to the decision.

Read more to find out how downsizing might impact your retirement benefits.

Key Takeaways

- Lance Williams wanted to downsize but found stamp duty costs—up to $40,000—made moving financially unfeasible.

- Research showed stamp duty deters downsizing, and removing NSW’s 3.5 per cent rate could increase property moves by 25 per cent.

- Experts debated its impact—some saw benefits for housing affordability, while others argued most homeowners would downsize anyway.

- Victoria and the ACT offer pensioner exemptions, but NSW has not, as stamp duty makes up a quarter of state revenue.

With stamp duty making downsizing a costly decision, should retirees receive exemptions to free up more housing?

Let us know your thoughts in the comments.