The era of unexpected health insurance refunds was drawing to a close, but millions of Australians still had one last surprise waiting.

Medibank confirmed its final COVID-19 cash-back this month, marking the end of a five-year program shaped by extraordinary circumstances.

For many households, this farewell payment could not have arrived at a better time.

Medibank announced it would deposit $228 million into customers’ bank accounts during September 2025, bringing down the curtain on its pandemic-era support package.

This was no small gesture—over the past five years, the insurer had returned $1.71 billion to its four million customers through cash backs, premium delays, and other initiatives.

Annual payouts had steadily decreased as claims returned to normal, with $443 million in 2022, $408 million in 2023, and $305 million in 2024, before this final $228 million payment.

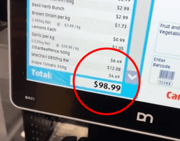

For policyholders, the amounts varied significantly.

Extras-only customers received around $55 on average, while those with both hospital and extras coverage collected about $190.

Some policyholders received as much as $375—a figure that could cover multiple months of gap payments or physiotherapy visits.

'We have returned it through various ways, including cash backs, delaying premium increases, extras roll overs, hardship support and Live Better points.'

This story was not limited to one company.

The Australian Competition and Consumer Commission found that insurers nationwide returned $2.1 billion of profits generated when elective surgeries and routine treatments were paused.

As of June 2022, permanent savings from missed claims had been estimated at $2.25 billion.

During the height of the pandemic, health funds paid 4.5 per cent less on average in hospital benefits per policyholder and 5.4 per cent less in extras benefits.

The end of these windfalls raised an important question—what came next for healthcare costs?

From 1 November 2025, the federal government would expand bulk billing incentive eligibility to cover the entire population.

This meant 15 million more Australians would qualify, with projections suggesting that nine out of ten GP visits would be bulk billed by 2030.

Government health insurance rebate changes

The private health insurance rebate remains available based on your income and age.

For 2025-26, singles earning $158,000 or less and families earning $316,000 or less remain eligible.

The rebate percentage increases with age—particularly beneficial for seniors—and decreases as income rises.

For those receiving Medibank’s final payment, the insurer encouraged customers to put it to good use.

Ideas included setting up an emergency health fund, prepaying delayed treatments, reviewing existing coverage, or exploring complementary services like podiatry and massage therapy.

Eligibility extended to all customers with active hospital and/or extras cover on 30 June 2025, excluding those on Ambulance Only, Overseas Visitors Cover, Overseas Workers Cover, Overseas Student Health Cover, and select corporate policies.

Payments were made directly to bank accounts already linked to claims or premiums, with cheques issued where no valid details were available.

The ACCC welcomed the industry’s return of profits, noting it expected all financial benefits from permanently missed claims to be handed back.

With this final payout, it appeared that obligation had been met, drawing a line under one of the most unusual chapters in Australian health insurance.

What This Means For You

Medibank issued its final COVID-era cash-back in September 2025, returning a total of $228 million to its customers. Depending on their level of cover, policyholders received different amounts—those with extras-only policies collected around $55, while hospital and extras customers could receive as much as $375.

Across the wider industry, health insurers handed back $2.1 billion in savings that came from postponed treatments during the pandemic. Now, with those windfalls completed, the focus shifts toward long-term affordability, with expanded bulk billing and rebate changes set to play a key role in shaping the future of healthcare costs.

For many Australians, these changes could mean real relief in managing medical expenses—especially at a time when every dollar saved matters.

While Medibank’s final cash-back marks the end of one chapter, it wasn’t the only insurer returning money saved during the pandemic.

Other funds also launched support programs, offering customers refunds and relief when claims and treatments were delayed.

Here’s another story that shows how one major health fund shared its pandemic windfall with members.

Read more: Get your money back from this insurer's pandemic support program!

Medibank issues final $228m COVID cash-back to customers — Medibank announced its last round of pandemic-era refunds, depositing payments into customer accounts in September 2025.

https://www.9news.com.au/national/m...-payment/f0102e7a-01d4-44e0-bb9e-62aa6c752609

COVID-19 Give Back | Medibank — Medibank outlined eligibility rules, payment methods, and timelines for its COVID-19 Give Back program.

https://www.medibank.com.au/health-insurance/info/coronavirus-update/covid-19-giveback/

Health funds continue to return profits to meet COVID-19 commitments | ACCC — The ACCC reported that health insurers returned $2.1 billion in profits to policyholders due to reduced claims during the pandemic.

https://www.accc.gov.au/media-relea...o-return-profits-to-meet-covid-19-commitments

Health | Budget 2025–26 — The federal government confirmed expanded bulk billing incentive eligibility from 1 November 2025, extending coverage to an additional 15 million people.

https://budget.gov.au/content/02-health.htm

Will this final payout be remembered as a rare gift of the pandemic years—or as the last breath of an era when insurers briefly shared their windfalls?