Why can't most Aussies afford a home? Calculation reveals stark reality!

The cost of living has increased to staggering heights over the past few decades. One of the areas where this is most obvious is purchasing a home.

The dream of owning a home has become increasingly elusive for many, and a simple calculation has shed light on a grim reality that has left countless Aussies frustrated and furious.

A calculation revealed that many Australians could not borrow as much as they’re expected to pay in rent, exposing a vicious cycle that keeps the dream of homeownership out of reach.

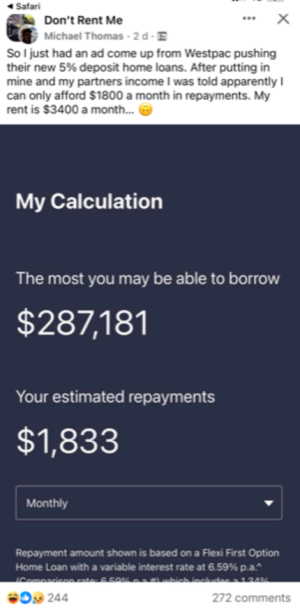

The issue came to light when a man shared a photo on a social media group dedicated to those who are struggling with the rental crisis.

Responding to an ad, he tried out a bank's home loan calculator and was stunned to find out that the most he could borrow was just $287,181 or $1,833 in repayments.

This was a real eye-opener, especially since he and his partner were already spending over $3,400 in rent each month, a figure that's almost twice the monthly payments they'd make for the loan he qualified for.

This discovery ignited a fiery debate over sky-high rental costs and property prices beyond what many people can afford to borrow.

The frustration was palpable among social media users. One commenter pointed out the situation's absurdity, stating, 'Your rent per month is almost double the mortgage payments, meaning your home loan will be paid off in almost half the loan life.'

‘Good thing only mortgage stress exists. How else are landlords going to afford to buy their 158th property if the renters leave the rental market?’ Another wrote.

‘I laughed at this post because it is so ridiculous! Most of us could probably afford a mortgage, but the lenders think we can’t because we rent,’ a third person shared.

Another shared their experience of having paid $500,000 in rent over two decades yet still unable to secure a mortgage.

‘Paid off a few landlords’ mortgages, but I can’t get [one],’ they said.

Financial expert Julian Finch explained that the discrepancy between what people can afford to pay in rent and what they can borrow is due to the different considerations of real estate agents and banks.

While real estate agents are primarily concerned with securing the best candidate, banks must consider what borrowers can realistically afford.

‘Those calculators use lots of assumptions, and I’d suggest lots of people don’t put the right numbers in. They should be seen as a reference and not as a rule,’ he explained.

Mr Finch claimed that banks use a buffer in their calculations, assessing affordability based on an interest rate typically 3 per cent higher than the actual rate. They also take into account household spending and only consider bonuses and overtime as guaranteed income on occasion.

Mr Finch assured, ‘A lot of banks will take your rental history and allocate that to your genuine savings.’

Despite the challenges, Finch advised not to lose hope of transitioning from renting to owning a home. He also cautioned that loan calculators should only be used as a guide.

The struggle of Australian renters is further highlighted by recent research from the Parliamentary Library, commissioned by the Greens.

The study revealed that Aussie tenants pay an average house deposit every five years in rent. Over a decade, this amounts to $209,908 per household.

The rental crisis is further exacerbated by the rising cost of living, with inflation hitting 7 per cent and wage growth lagging at 3.8 per cent in 2023.

According to Proptrack, rents in most Australian capital cities have risen drastically in 2023, with Sydney experiencing an 18 per cent increase, Melbourne 14 per cent, Brisbane 12 per cent, Adelaide 11 per cent, Perth 15 per cent, and Darwin 4 per cent.

Hobart and Canberra are the only cities where rent has stayed the same across the board. However, even in these cities, many residents feel the pinch as their incomes fail to keep pace with rising living costs.

What are your thoughts on this issue, members? Have you experienced similar struggles in your journey towards homeownership? Share your experiences and thoughts in the comments below.

The dream of owning a home has become increasingly elusive for many, and a simple calculation has shed light on a grim reality that has left countless Aussies frustrated and furious.

A calculation revealed that many Australians could not borrow as much as they’re expected to pay in rent, exposing a vicious cycle that keeps the dream of homeownership out of reach.

The issue came to light when a man shared a photo on a social media group dedicated to those who are struggling with the rental crisis.

Responding to an ad, he tried out a bank's home loan calculator and was stunned to find out that the most he could borrow was just $287,181 or $1,833 in repayments.

This was a real eye-opener, especially since he and his partner were already spending over $3,400 in rent each month, a figure that's almost twice the monthly payments they'd make for the loan he qualified for.

This discovery ignited a fiery debate over sky-high rental costs and property prices beyond what many people can afford to borrow.

The frustration was palpable among social media users. One commenter pointed out the situation's absurdity, stating, 'Your rent per month is almost double the mortgage payments, meaning your home loan will be paid off in almost half the loan life.'

‘Good thing only mortgage stress exists. How else are landlords going to afford to buy their 158th property if the renters leave the rental market?’ Another wrote.

‘I laughed at this post because it is so ridiculous! Most of us could probably afford a mortgage, but the lenders think we can’t because we rent,’ a third person shared.

Another shared their experience of having paid $500,000 in rent over two decades yet still unable to secure a mortgage.

‘Paid off a few landlords’ mortgages, but I can’t get [one],’ they said.

Financial expert Julian Finch explained that the discrepancy between what people can afford to pay in rent and what they can borrow is due to the different considerations of real estate agents and banks.

While real estate agents are primarily concerned with securing the best candidate, banks must consider what borrowers can realistically afford.

‘Those calculators use lots of assumptions, and I’d suggest lots of people don’t put the right numbers in. They should be seen as a reference and not as a rule,’ he explained.

Mr Finch claimed that banks use a buffer in their calculations, assessing affordability based on an interest rate typically 3 per cent higher than the actual rate. They also take into account household spending and only consider bonuses and overtime as guaranteed income on occasion.

Mr Finch assured, ‘A lot of banks will take your rental history and allocate that to your genuine savings.’

Despite the challenges, Finch advised not to lose hope of transitioning from renting to owning a home. He also cautioned that loan calculators should only be used as a guide.

The struggle of Australian renters is further highlighted by recent research from the Parliamentary Library, commissioned by the Greens.

The study revealed that Aussie tenants pay an average house deposit every five years in rent. Over a decade, this amounts to $209,908 per household.

The rental crisis is further exacerbated by the rising cost of living, with inflation hitting 7 per cent and wage growth lagging at 3.8 per cent in 2023.

According to Proptrack, rents in most Australian capital cities have risen drastically in 2023, with Sydney experiencing an 18 per cent increase, Melbourne 14 per cent, Brisbane 12 per cent, Adelaide 11 per cent, Perth 15 per cent, and Darwin 4 per cent.

Hobart and Canberra are the only cities where rent has stayed the same across the board. However, even in these cities, many residents feel the pinch as their incomes fail to keep pace with rising living costs.

Key Takeaways

- A post has revealed that many Australians are paying more in rent than they could pay in mortgage but cannot borrow the amount needed to buy property.

- A calculation showed that a man could only borrow $287,181 even though he was spending $3,400 in rent, whereas the repayments would be $1,833.

- Many Australians are believed to be stuck in a cycle where they cannot save for a home deposit because of high rental costs.

- Financial expert Julian Finch explained that the calculations may seem unusual because real estate agents don't consider what people can realistically afford. However, he suggested taking the calculators with a grain of salt as they make many assumptions.

What are your thoughts on this issue, members? Have you experienced similar struggles in your journey towards homeownership? Share your experiences and thoughts in the comments below.