Picture this: you're standing in your local café, card in hand, ready to pay for your morning flat white. But when you tap to pay, that dreaded word flashes up on the terminal - 'DECLINED.' Your account's been blocked, and suddenly you're fumbling for cash while a queue builds behind you.

This embarrassing scenario happened to Melbourne content creator Chloe Ferrari, and it's becoming surprisingly common across Australia. The culprit? Being too good at spotting scams.

The scam awareness paradox

Australians lost $2 billion to scams in 2024, down 25.9 per cent from the previous year, which shows our collective wariness is paying off.

Text message scams alone generated almost 58,000 reports in the first half of 2024, making it perfectly reasonable to view any unexpected message from your bank with deep suspicion.

But here's the catch—banks genuinely do need to contact customers about updating their details. It's not a nice-to-have; it's required under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, known as 'Know Your Customer' or KYC requirements.

'The exact same thing happened to me. Totally thought a scam till I couldn't pay for my groceries. Called them and it really was them, been with them over 15 years and never had to before'

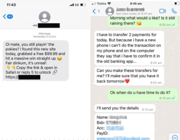

Ferrari, who's been an ANZ customer since she was 13, ignored multiple text messages asking her to confirm her details through internet banking.

'I was getting multiple text messages from ANZ saying if you don't click this link and confirm your details, then all withdrawals from your account are gonna be blocked,' she explained in her viral social media post.

When the promised restriction date arrived, her card was indeed declined for a $6.40 coffee purchase. 'Yeah, my account is fully blocked. It actually was ANZ, they did just wanna confirm my details. But anyways it was ANZ, my fault.'

Why banks need your information (and why now)

KYC procedures help banks collect and verify customer identity, making them aware of unusual or suspicious activity and reducing the risk of money laundering or terrorism financing. But the requirements are expanding rapidly.

Changes kicking in at the start of the 2025/2026 financial year will require legal service providers, among others, to conduct KYC checks.

This broader regulatory push means more businesses than ever need to verify customer information.

What banks might ask you to confirm

For individuals: Full name, date of birth, citizenship, residential address, occupation, and source of wealth

For businesses: Business name and entity details, business address, and industry information

Remember: You can be asked for this information even if you've been a customer for decades due to changing regulations

The consequences of ignoring these requests are real. Commonwealth Bank warns that customers who don't confirm details may not be able to open new products and may have access to digital banking and accounts restricted, with at least 30 days notice given.

The good news: Banks are fighting back smarter

While scam losses remain significant, there's encouraging progress. Commonwealth Bank reported a 76 per cent drop in customer scam losses since peak and invested over $900 million in FY25 to protect customers.

CommBank's anti-scam initiatives saw customer scam losses halve compared to the previous financial year, with NameCheck technology preventing scam payments worth more than an estimated $40 million.

Banks are rolling out sophisticated new tools to help customers distinguish legitimate communications from scams.

CommBank has unveiled a Gen AI scam detection tool that lets customers test suspicious text messages, while other banks are implementing similar verification technologies.

How to tell the difference: Legitimate vs scam messages

The challenge is real—scammers have become exceptionally good at impersonating banks. Phishing scams, where criminals impersonate government agencies or financial institutions, saw losses jump from $4.6 million to $13.7 million in early 2025.

Red flags for scam messages

- Urgent threats about immediate account closure

- Requests for passwords, PINs, or online banking details

- Links to websites that don't match your bank's official URL

- Requests to call back on mobile numbers rather than official bank numbers

- Demands for immediate action without explanation

Legitimate bank messages typically direct you to log into your normal internet banking or app, where you'll see a notification about updating details.

Banks like CommBank show notifications directly in NetBank or their app, and once you've confirmed your details, access is restored immediately.

What to do if you're unsure

The golden rule remains simple: when in doubt, don't click any links in the message. Instead, independently log into your internet banking or call your bank using the number on your card or their official website.

If you're unsure if contact is legitimate, hang up or delete the message. Contact the organisation using details you have found yourself.

This approach protects you whether the message is legitimate or a scam.

Your verification action plan

1. Receive unexpected message from bank? Don't click any links

2. Independently log into your internet banking or official app

3. Look for notifications about updating information

4. If nothing appears, call your bank on their official number

5. Keep records of any legitimate requests for future reference

The bigger picture: Why this matters for seniors

While older Australians aged 65 and over reported the highest total scam losses at $33.1 million, the irony is that this demographic's healthy scepticism of digital communications may actually be causing legitimate banking issues.

Remote access scams often deliberately target older Australians, making wariness entirely appropriate.

But legitimate KYC requests affect all age groups equally, creating a perfect storm where the most cautious customers may find themselves locked out of their accounts.

The solution isn't to become less cautious about scams—scammers remain sophisticated and highly motivated criminals, requiring continued vigilance. Instead, it's about developing better verification habits that protect against both scams and legitimate service disruptions.

Ferrari's experience, shared widely on social media, struck a chord because it highlighted this new reality of banking. Her quick resolution—simply calling ANZ and confirming her details—shows that while the initial inconvenience was real, fixing the issue was straightforward.

What This Means For You

As banking becomes increasingly digital and regulatory requirements continue to evolve, finding the balance between healthy scepticism and necessary compliance will remain crucial. The key is building verification habits that protect you regardless of whether that unexpected message is legitimate or a scam.

Have you ever been caught out by a legitimate bank message that looked suspicious? Or perhaps you've spotted an obvious banking scam? Share your experiences in the comments below—your story might help a fellow reader avoid their own $6.40 coffee moment.

Credit: TikTok

Primary Source

https://au.finance.yahoo.com/news/b...fter-ignoring-message-declined-211912047.html

Australians better protected as reported scam losses fell by almost 26 per cent | National Anti-Scam Centre

Cited text: The National Anti-Scam Centre’s latest Targeting Scams Report found scam losses reported to key organisations fell by 25.9 per cent to $2 billion in 2...

Excerpt: Australians lost $2 billion to scams in 2024, down 25.9 per cent from the previous year

https://www.nasc.gov.au/news/austra...ported-scam-losses-fell-by-almost-26-per-cent

Australian Financial Scam Statistics 2024—Jacaranda Finance

Cited text: This trend has continued in 2024, with almost 58,000 reported text scams reported in January—June.

Excerpt: Text message scams alone generated almost 58,000 reports in the first half of 2024

https://www.jacarandafinance.com.au/general/financial-scam-statistics/

Know your Customer

Cited text: We are required to manage your account/s in line with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, which sets out that all bank...

Excerpt: it's required under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, known as 'Know Your Customer' or KYC requirements

https://www.commbank.com.au/latest/know-your-customer.html

Customer identification: Know your customer (KYC) | AUSTRAC

Cited text: An AML/CTF program must include KYC procedures to collect and verify a customer’s identity.KYC and being familiar with your customers’ typical financi...

Excerpt: KYC procedures help banks collect and verify customer identity, making them aware of unusual or suspicious activity and reducing the risk of money laundering or terrorism financing

https://www.austrac.gov.au/business...ustomer-identification-know-your-customer-kyc

Know Your Customer (KYC) Requirements Under Australia's AML/CTF Act—Lawpath

Cited text: · These changes kick in at the start of the 2025/2026 financial year. Legal service providers, among others, will be required to conduct KYC checks.

Excerpt: Changes kicking in at the start of the 2025/2026 financial year will require legal service providers, among others, to conduct KYC checks

https://lawpath.com.au/blog/kyc-requirements-australia-aml-ctf

Know your Customer

Cited text: If you don’t confirm your personal and/or business details, you may not be able to open any new products, and we may need to restrict access to your d...

Excerpt: Commonwealth Bank warns that customers who don't confirm details may not be able to open new products and may have access to digital banking and accounts restricted, with at least 30 days notice given

https://www.commbank.com.au/latest/know-your-customer.html

CBA sees customer scam losses fall by 76 per cent and adds two new forms of armour to help keep customers safe

Cited text: ... CommBank has seen a 76 per cent drop in customer scam losses since peak (2H25 vs. 1H23) CommBank invested over $900 million in FY25 to help protect its cu...

Excerpt: Commonwealth Bank reported a 76 per cent drop in customer scam losses since peak and invested over $900 million in FY25 to protect customers

https://www.commbank.com.au/articles/newsroom/2025/08/commbank-customer-scam-losses-fall-truyu.html

Australian Financial Scam Statistics 2024—Jacaranda Finance

Cited text: “CommBank’s anti-scam initiatives are having a meaningful impact. CommBank customer scam losses halved compared to the previous financial year, with C...

Excerpt: CommBank's anti-scam initiatives saw customer scam losses halve compared to the previous financial year, with NameCheck technology preventing scam payments worth more than an estimated $40 million

https://www.jacarandafinance.com.au/general/financial-scam-statistics/

National Anti-Scam Centre calls for stronger business role to disrupt scams | ACCC

Cited text: The biggest increase in reported losses in 2025 came from phishing scams, which involve scammers impersonating entities such as government agencies or...

Excerpt: Phishing scams, where criminals impersonate government agencies or financial institutions, saw losses jump from $4.6 million to $13.7 million in early 2025

https://www.accc.gov.au/media-relea...s-for-stronger-business-role-to-disrupt-scams

Know your Customer

Cited text: Log on to NetBank or the CommBank app, where you’ll see a notification from us to check and confirm your details. Once you’ve confirmed your details, ...

Excerpt: Banks like CommBank show notifications directly in NetBank or their app, and once you've confirmed your details, access is restored immediately

https://www.commbank.com.au/latest/know-your-customer.html

Explainer—five scams to watch in 2025

Cited text: If you aren’t sure if contact is legitimate, hang up or delete the text message or email. Contact the organisation using details you have found yourse...

Excerpt: If you're unsure if contact is legitimate, hang up or delete the message. Contact the organisation using details you have found yourself

https://news.nab.com.au/news/explainer-five-scams-to-watch-in-2025

National Anti-Scam Centre calls for stronger business role to disrupt scams | ACCC

Cited text: Older Australians aged 65 and over reported the highest total losses of any age group, totalling $33.1 million.

Excerpt: While older Australians aged 65 and over reported the highest total scam losses at $33.1 million

https://www.accc.gov.au/media-relea...s-for-stronger-business-role-to-disrupt-scams

Explainer—five scams to watch in 2025

Cited text: They often deliberately target older Australians.

Excerpt: Remote access scams often deliberately target older Australians

https://news.nab.com.au/news/explainer-five-scams-to-watch-in-2025

Australians better protected as reported scam losses fell by almost 26 per cent | National Anti-Scam Centre

Cited text: “While we are encouraged by the drop in reported financial losses, we acknowledge scammers are sophisticated and highly motivated criminals. We need t...

Excerpt: scammers remain sophisticated and highly motivated criminals, requiring continued vigilance

https://www.nasc.gov.au/news/austra...ported-scam-losses-fell-by-almost-26-per-cent