Think the price you see at parking is the price you pay? Surprise—it’ll always cost more!

By

Maan

- Replies 0

Parking in big cities is already a wallet-drainer, but some Aussies believe one car park has taken things a step too far.

What looked like a standard list of fees turned out to include a sneaky catch hidden in the fine print.

Now, frustrated drivers are questioning whether the practice is even legal.

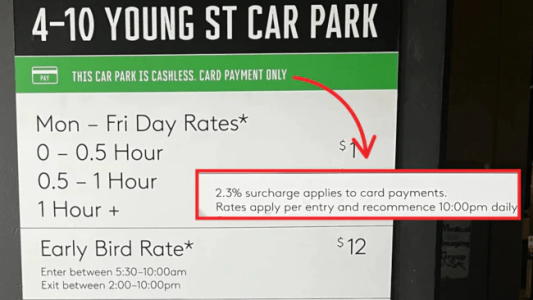

A Melbourne car park in Moonee Ponds had its prices listed clearly—ranging from $1 to $15.

But according to a sharp-eyed customer who shared their discovery on social media, those prices were never truly what people would pay.

At the very top of the display, the car park noted that it was cashless, meaning only card payments were accepted.

And buried in the fine print was another detail—a 2.3 per cent surcharge applied to every single transaction.

‘So sick of this crap,’ the poster wrote.

Their frustration quickly struck a chord with others, many of whom believed the fee was not just unfair but unlawful.

‘It's supposed to be illegal. Report it to the ACCC. By law if it's card only they can't do card surcharges,’ one commenter urged.

‘You can't advertise a price if there is no way to pay that price,’ another said.

A third added: ‘If it’s a mandatory fee they should include it in the price or make that part the same size font. Making it small text at the bottom could be argued as not making it clear.’

The Australian Competition and Consumer Commission (ACCC) weighed in on the matter, confirming that while businesses were allowed to operate cashless, their pricing still had to comply with the law.

‘There is no prohibition in the Competition and Consumer Act, or the Australian Consumer Law, against businesses applying surcharges to electronic payments where they don’t accept cash,’ a spokesperson said.

‘However, under the Australian Consumer Law all businesses must display clear and accurate prices and must not mislead consumers about their prices.

‘If there is no way for a consumer to pay without paying a surcharge, the business must include the minimum surcharge payable in the displayed price for its products or services. The business must also be clear and upfront about any higher surcharge amounts for other payment methods.’

The ACCC encouraged anyone concerned to first raise the matter directly with the operator—Giancorp—or else contact their local consumer affairs or fair trading agency.

Giancorp has been contacted for comment.

Hidden surcharges aren’t the only frustration drivers have been facing when it comes to parking costs.

In some areas, new proposals are targeting certain types of vehicles, sparking fresh debates about fairness and affordability.

It’s another example of how what seems like a simple fee can quickly become much more complicated.

Read more: Are parking fees for large cars about to skyrocket? You won't believe the reason why

Have you ever noticed hidden fees sneak onto your bill without you realising?

What looked like a standard list of fees turned out to include a sneaky catch hidden in the fine print.

Now, frustrated drivers are questioning whether the practice is even legal.

A Melbourne car park in Moonee Ponds had its prices listed clearly—ranging from $1 to $15.

But according to a sharp-eyed customer who shared their discovery on social media, those prices were never truly what people would pay.

At the very top of the display, the car park noted that it was cashless, meaning only card payments were accepted.

And buried in the fine print was another detail—a 2.3 per cent surcharge applied to every single transaction.

‘So sick of this crap,’ the poster wrote.

Their frustration quickly struck a chord with others, many of whom believed the fee was not just unfair but unlawful.

‘It's supposed to be illegal. Report it to the ACCC. By law if it's card only they can't do card surcharges,’ one commenter urged.

‘You can't advertise a price if there is no way to pay that price,’ another said.

A third added: ‘If it’s a mandatory fee they should include it in the price or make that part the same size font. Making it small text at the bottom could be argued as not making it clear.’

The Australian Competition and Consumer Commission (ACCC) weighed in on the matter, confirming that while businesses were allowed to operate cashless, their pricing still had to comply with the law.

‘There is no prohibition in the Competition and Consumer Act, or the Australian Consumer Law, against businesses applying surcharges to electronic payments where they don’t accept cash,’ a spokesperson said.

‘However, under the Australian Consumer Law all businesses must display clear and accurate prices and must not mislead consumers about their prices.

‘If there is no way for a consumer to pay without paying a surcharge, the business must include the minimum surcharge payable in the displayed price for its products or services. The business must also be clear and upfront about any higher surcharge amounts for other payment methods.’

The ACCC encouraged anyone concerned to first raise the matter directly with the operator—Giancorp—or else contact their local consumer affairs or fair trading agency.

Giancorp has been contacted for comment.

Hidden surcharges aren’t the only frustration drivers have been facing when it comes to parking costs.

In some areas, new proposals are targeting certain types of vehicles, sparking fresh debates about fairness and affordability.

It’s another example of how what seems like a simple fee can quickly become much more complicated.

Read more: Are parking fees for large cars about to skyrocket? You won't believe the reason why

Key Takeaways

- Drivers accused a Melbourne car park of hiding a surcharge in the fine print.

- A 2.3 per cent fee was applied to all card transactions, despite no cash option.

- Social media users claimed the practice could be illegal and urged reporting.

- The ACCC confirmed surcharges must be included in listed prices if unavoidable.

Have you ever noticed hidden fees sneak onto your bill without you realising?