'There needs to be some accountability': Man's 'horrible' mistake costs him $20,000

By

Danielle F.

- Replies 0

Navigating the digital world can be a minefield, especially when it comes to managing finances online.

Internet banking and online transactions have become a convenience embraced by many, but it also opened the door to sophisticated scams that could leave people out of pocket.

Yet, for one man, a simple act online turned into a financial nightmare.

Brett D'Souza, a 48-year-old filmmaker from Melbourne, experienced the shock of his life.

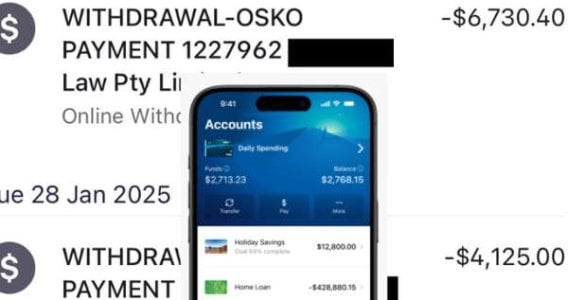

He recently discovered that he had lost $20,000 to an email interception scam.

The funds, which were proceeds from selling his house and earmarked for legal fees, vanished.

He made four transfers to allegedly updated account details of his law firm.

Two weeks later, he found out the full extent of the disaster.

Brett initially received what appeared to be a legitimate invoice from his law firm, complete with new banking details.

When he asked about the change via email, the reassurance he received was actually from scammers who had infiltrated the communication.

By the time Brett realised it was a fraud, it was too late.

The money had been transferred to a mule using an account from ANZ.

Brett D'Souza immediately contacted his bank, Westpac, about the fraudulent transactions.

However, they were unable to recover the stolen funds.

'I understand why Westpac isn't liable as it wasn't just taken out of my account as I approved it,' Brett said.

'The bit I have a problem with is the other end with ANZ. The bank allowed someone to create a bank account with potentially this business name.'

The situation left Brett in a 'horrible' situation as he questioned the security measures in place for opening bank accounts in Australia.

'Surely ANZ should be liable for allowing the fake account to be created,' Brett argued about transparency in banking processes.

In light of Brett's situation, ANZ stated that they do not discuss individual customer cases.

This incident prompted Brett to complain to the Australian Financial Complaints Authority (AFCA).

Recent changes announced by Assistant Treasurer Stephen Jones could offer a glimmer of hope for Brett D'Souza and future scam victims in the long run.

AFCA should now be authorised to investigate every bank involved in a scam.

For the first time, the receiving bank would also be held accountable during the investigation.

Although these changes came too late for Brett, they represented a significant win for consumer rights.

Stephanie Tonkin, the CEO of the Consumer Action Law Centre, welcomed the changes.

'It stands to reason that the receiving bank is a key link in the criminal chain and up to now AFCA hasn't been able to investigate its culpability or provide related redress to victims,' Ms Tonkin emphasised.

'With these important changes, I am hopeful that future victims will have a better chance to get the compensation they deserve.'

Moreover, implementing basic scam measures like account name matching could have prevented Brett's loss.

Despite a $100 million pledge from banks to introduce this technology across the country, it has yet to be fully rolled out.

The Australian Banking Association (ABA) also announced a significant investment to prevent money transfers when names do not match account details.

For our senior readers, this cautionary tale should be a reminder to always be on guard when conducting financial transactions online.

What do you think of Brett D'Souza's situation? How do you keep yourself safe from prevalent online scams? Share your thoughts and opinions about this issue in the comments section below.

Internet banking and online transactions have become a convenience embraced by many, but it also opened the door to sophisticated scams that could leave people out of pocket.

Yet, for one man, a simple act online turned into a financial nightmare.

Brett D'Souza, a 48-year-old filmmaker from Melbourne, experienced the shock of his life.

He recently discovered that he had lost $20,000 to an email interception scam.

The funds, which were proceeds from selling his house and earmarked for legal fees, vanished.

He made four transfers to allegedly updated account details of his law firm.

Two weeks later, he found out the full extent of the disaster.

Brett initially received what appeared to be a legitimate invoice from his law firm, complete with new banking details.

When he asked about the change via email, the reassurance he received was actually from scammers who had infiltrated the communication.

By the time Brett realised it was a fraud, it was too late.

The money had been transferred to a mule using an account from ANZ.

Brett D'Souza immediately contacted his bank, Westpac, about the fraudulent transactions.

However, they were unable to recover the stolen funds.

'I understand why Westpac isn't liable as it wasn't just taken out of my account as I approved it,' Brett said.

'The bit I have a problem with is the other end with ANZ. The bank allowed someone to create a bank account with potentially this business name.'

The situation left Brett in a 'horrible' situation as he questioned the security measures in place for opening bank accounts in Australia.

'Surely ANZ should be liable for allowing the fake account to be created,' Brett argued about transparency in banking processes.

In light of Brett's situation, ANZ stated that they do not discuss individual customer cases.

This incident prompted Brett to complain to the Australian Financial Complaints Authority (AFCA).

Recent changes announced by Assistant Treasurer Stephen Jones could offer a glimmer of hope for Brett D'Souza and future scam victims in the long run.

AFCA should now be authorised to investigate every bank involved in a scam.

For the first time, the receiving bank would also be held accountable during the investigation.

Although these changes came too late for Brett, they represented a significant win for consumer rights.

Stephanie Tonkin, the CEO of the Consumer Action Law Centre, welcomed the changes.

'It stands to reason that the receiving bank is a key link in the criminal chain and up to now AFCA hasn't been able to investigate its culpability or provide related redress to victims,' Ms Tonkin emphasised.

'With these important changes, I am hopeful that future victims will have a better chance to get the compensation they deserve.'

Moreover, implementing basic scam measures like account name matching could have prevented Brett's loss.

Despite a $100 million pledge from banks to introduce this technology across the country, it has yet to be fully rolled out.

The Australian Banking Association (ABA) also announced a significant investment to prevent money transfers when names do not match account details.

For our senior readers, this cautionary tale should be a reminder to always be on guard when conducting financial transactions online.

Key Takeaways

- A man lost $20,000 through a sophisticated email interception scam after selling his house.

- The victim questioned his law firm about a change in account details for payment, not realising that scammers had infiltrated their communications.

- The stolen funds ended up in an ANZ bank account, which the victim believed should not have been allowed.

- A significant change announced by the Assistant Treasurer should now allow the Australian Financial Complaints Authority (AFCA) to investigate banks involved in scams.