Disclaimer: The information in this article is general in nature and doesn’t consider your personal circumstances. Always seek professional financial and legal advice before making decisions about superannuation and estate planning. Rules may change; this is current as of August 2025.

In this Article

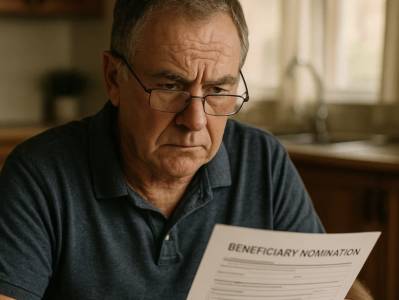

When “Margaret” from Brisbane carefully filled out her superannuation beneficiary form, she thought she was doing the right thing for her family.

She nominated her elderly parents and her brother as beneficiaries, believing her $450,000 super balance would provide them with much-needed financial security after her passing. What she didn’t realise was that she’d just triggered a little-known rule that could see her family slugged with a tax bill of up to $140,000.

This example illustrates a frustrating reality facing millions of Australians: nearly half of Australian super members haven’t nominated a beneficiary, but even those who have might be in for a nasty surprise. The superannuation system’s beneficiary rules are riddled with restrictions that catch even well-meaning families off guard, potentially costing them tens of thousands of dollars in unnecessary tax.

The Rule That Stumps Most Australians

Australia’s superannuation laws are clear about who you can and cannot directly nominate to receive your retirement savings. While you might assume you can leave your super to anyone you choose—just like other assets in your will—the reality is far more restrictive.

You can only directly nominate three groups as superannuation beneficiaries:

- Your spouse or de facto partner

- Your children (of any age)

- Someone with whom you have an interdependency relationship

This means siblings, parents, grandchildren, nieces, nephews, and friends are all off-limits for direct nominations—unless they meet the strict criteria for an interdependency relationship.

‘In many cases, if an invalid nomination is made, the super fund will simply accept it as a non-binding nomination without providing any warning or follow-up.’

This creates a dangerous situation where your carefully planned nomination might be worthless, leaving trustees to decide where your money goes—and potentially creating delays and disputes among family members.

Who Can’t Receive Your Super Directly

• Parents (unless interdependency relationship exists)

• Siblings (unless interdependency relationship exists)

• Grandchildren

• Nieces and nephews

• Friends

• Charities

• Anyone not classified as a ‘dependant’ under super law

The Interdependency Relationship: Not What You Think

The concept of an “interdependency relationship” sounds like it might provide a loophole for those wanting to leave super to parents or siblings. However, recent private ATO rulings since 2024 have mostly failed to demonstrate that interdependency relationships exist between parents and adult children, making this avenue increasingly difficult to navigate. Each case depends on specific facts and circumstances.

To establish an interdependency relationship, all four of these criteria must be met:

• You have a close personal relationship

• You live together

• One or both of you provides financial support to the other

• One or both of you provides domestic support and personal care

These requirements must exist at the date of death, and all four elements must be satisfied (with limited exceptions involving disability or special circumstances).

Did you know?

Living with your parents doesn’t automatically create an interdependency relationship. ATO rulings show that typical family arrangements—even when adult children live at home—often don’t meet the strict tests for mutual support and care beyond ordinary family relationships.

The Tax Penalty That Hits Hard

When your super ends up going to non-dependants—whether through invalid nominations or trustee decisions—the tax consequences can be severe. The taxable component of a death benefit paid to a non-dependent is subject to tax at 15% plus the 2% Medicare levy on the taxed element, and 30% plus the 2% Medicare levy on any untaxed element. The tax-free component is always received tax-free.

Example Scenario

Sarah, 58, has $600,000 in superannuation when she passes away unexpectedly. Her super consists of 70% taxable component ($420,000) and 30% tax-free component ($180,000). She nominates her brother James.

• Because James is not a dependant under tax law:

• Tax-free component: $180,000 (received tax-free)

• Taxable component: $420,000 × 17% = $71,400 tax

• James receives $528,600 instead of $600,000

• If Sarah had nominated her spouse, the entire $600,000 would have been received tax-free.

Understanding Your Nomination Options

The type of nomination you make significantly impacts how your super is distributed and taxed:

Binding nominations

• Must nominate only valid dependants or your legal personal representative

• Requires two independent adult witnesses

• Usually expires every three years (some funds now allow non-lapsing nominations)

• Trustees must follow if valid

Non-binding nominations

• Easier to complete—no witnesses needed

• Can nominate anyone (including non-dependants)

• Trustees use discretion and may not follow your wishes

Reversionary nominations

• Apply only to pension accounts

• Available for spouses or certain dependent children

• Allow payments to continue until balance reaches zero

Nomination Strategy Checklist

Review your current nominations annually, especially after major life events

Ensure binding nominations are witnessed correctly and renewed before expiry

Consider nominating your legal personal representative if you want non-dependants to benefit

Understand the tax implications for your chosen beneficiaries

Seek professional advice for complex family situations

The Workarounds That Actually Work

1. Legal Personal Representative Route

Nominate your legal personal representative (executor). This lets your will decide who receives your super, but non-dependants may still face 17-32% tax.

2. Withdrawal and Re-contribution

If you’re over 60 and can access your super, you can withdraw and re-contribute funds as after-tax contributions. This converts taxable components into tax-free. With the transfer balance cap now at $2 million (2025-26), this is powerful for larger balances.

3. Strategic Spending and Investment

Use super first in retirement and preserve other assets (which transfer tax-free) for your

intended beneficiaries. This way, you enjoy the tax advantages of super during your lifetime, while leaving assets outside super (like property or shares held personally) to flow through your estate without super’s restrictive rules.

Important Legal Considerations

Ensure your will is current and properly executed

Consider the impact on your age pension eligibility

Understand contribution caps and eligibility rules before re-contributing

Factor in life expectancy, retirement spending, and healthcare needs

Always seek professional legal and financial advice

Common Mistakes That Cost Families

Mistake 1: Set-and-Forget Mentality

Many people make a beneficiary nomination once and never review it. But marriages, divorces, births, or changing relationships mean a 20-year-old nomination could no longer match your wishes.

Mistake 2: Assuming Living Together Equals Dependence

Just because you live with your parents or children doesn’t automatically meet the ATO’s strict definition of an interdependency relationship. More than “sharing a roof” is required.

Mistake 3: Ignoring Tax Implications

Even valid nominations can sting. A spouse may receive super tax-free, but adult children—if financially independent—will face tax rates of up to 32% on the taxable portion.

Mistake 4: Overlooking Fund-Specific Rules

Not all funds offer binding nominations, and some impose unique rules about lapsing or witnessing. Always confirm the requirements with your specific super fund.

Source: @planyourpennies / Tiktok.

Taking Action: Your Next Steps

Immediate Actions (This Week)

1. Check your most recent super statement and confirm who your nominated beneficiaries are

2. Call your super fund to check if your nomination is binding, non-binding, or expired

Consider whether your current nominees are still valid and appropriate

Short-term Actions (Next Month)

1. Update any invalid or outdated nominations

2. Decide whether binding or non-binding nominations suit your situation

3. Ensure your will is current and considers superannuation

4. Estimate potential tax impacts for each beneficiary

Long-term Planning (Next Three Months)

1. Develop a full estate plan integrating super and non-super assets

2. Consider withdrawal/re-contribution strategies if over 60

3. Review your nominations after every major life event

4.Document your intentions clearly for family clarity

The Bottom Line for Australian Seniors

The superannuation beneficiary rules exist to ensure retirement savings support dependants—but in practice, they often create traps for families who don’t know the system. Nearly half of Australians still have no nominated beneficiaries, and many others unknowingly have invalid or lapsed nominations.

Unlike other assets, super doesn’t automatically pass under your will. If you want to make sure your retirement savings end up with the right people, you need to: review your nominations regularly, understand the tax rules, and seek professional advice. With proper planning, you can reduce tax leakage and ensure your loved ones benefit as you intended.

Don't let good intentions create bad outcomes for your family. Take the time to understand these rules, review your nominations regularly, and seek professional advice when needed. Your loved ones will thank you for it.

Final Checklist for Protecting Your Super

Don’t assume your will covers your super—check your fund rules

Review your beneficiaries every 1-3 years and after major life events

Understand that non-dependants may face up to 32% tax

Use strategies like LPR nominations or recontribution to reduce tax

Professional financial and legal advice is essential

Original article: Yahoo Finance – https://au.finance.yahoo.com/news/l...aussies-a-line-has-to-be-drawn-200058712.html

[1] Superannuation death benefits | Australian Taxation Office – https://www.ato.gov.au/individuals-...sing-your-super/superannuation-death-benefits

[2] Who is a 'dependant' under superannuation legislation? – Rigby Cooke Lawyers – https://www.rigbycooke.com.au/who-is-a-dependant-under-superannuation-legislation/

[3] Superannuation death benefit: Interdependency relationships not catch-all to be a dependant – SUPERCentral – https://www.supercentral.com.au/res...elationships-not-catch-all-to-be-a-dependant/

[4] Superannuation Death Tax – Legal Consolidated – https://legalconsolidated.com.au/super-death-tax/

[5] Superannuation Death Tax – Legal Consolidated – https://legalconsolidated.com.au/super-death-tax/

[6] Nominating a beneficiary | Family and Beneficiary – CSC – https://www.csc.gov.au/Members/Superannuation/Your-home-and-family/Nominate-a-beneficiary

[7] Superannuation rule changes from July 2025 – SuperGuide – https://www.superguide.com.au/how-super-works/superannuation-changes-rules-apply-current-year

What strategies have you used to ensure your super goes where you want? Have you discovered any surprises in your own beneficiary nominations? Share your experiences and questions in the comments below!