Super stars: Research reveals top superannuation funds making waves for your golden years!

- Replies 6

As Australians sail through the golden years of retirement or edge closer to them, the importance of a robust superannuation fund becomes ever more apparent.

It's the nest egg that they have been nurturing throughout their working lives, and it's crucial to ensure that it's working just as hard as they have.

With that in mind, it's time to pull back the curtain and reveal the top-performing superannuation funds that have been making waves in the financial world, and you can't afford to ignore them if you want to maximise your retirement savings.

According to the investment research group SuperRatings, it's been a banner year for super funds, with international technology and Australian banking shares driving ‘impressive’ returns throughout 2024.

Their research found that the average balanced investment super fund delivered a hearty 8.8 per cent return to members for the year ending June 30, while the top-performing funds achieved double-digit growth figures.

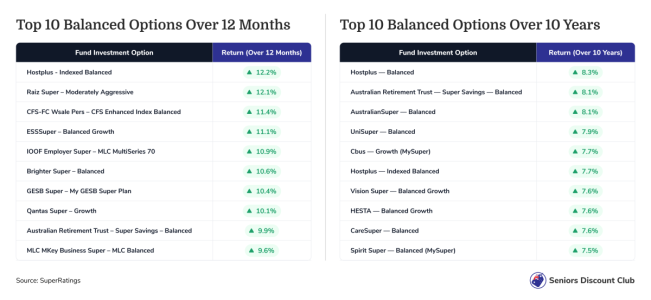

For those of you who are with Hostplus’ Indexed Balanced, you might be wearing a particularly broad smile, as this fund topped the balanced strategy charts with a 12.2 per cent return.

Not far behind were Raiz Super’s Moderately Aggressive option and Colonial First State’s Enhanced Index Balanced option, which boasted returns of 12.1 per cent and 11.4 per cent, respectively.

‘Funds with a higher exposure to shares and listed assets generally outperformed for the year, while those with greater exposure to unlisted property reported more subdued outcomes,’ SuperRatings stated in its findings.

Those in the MySuper Lifecycle category, particularly those born between 1975-79, Colonial First State Essential Super MySuper—Lifestage 1975-79 was the standout performer with a return of 14.6 per cent.

Lifecycle funds are designed to adjust your investment mix as you age, shifting from growth-oriented investments in your younger years to more conservative ones as you approach retirement.

Interestingly, according to Executive Director Kirby Rappell, SuperRatings researchers have observed a trend of lifecycle funds increasing their exposure to growth assets like shares.

‘While this has benefited members this year, higher exposure to these assets also comes with increased ups and downs, and we encourage members to learn how their fund’s investment strategy works so they are comfortable with annual and long-term performance outcomes,’ he advised.

Sustainable investments also shone brightly over the past year, with Raiz Super’s Emerald investment option leading the pack with a return of 14.8 per cent.

Mr Rappell stated that although reviewing annual results is helpful, it shouldn't be the sole factor when evaluating your superannuation.

‘The purpose of superannuation is maximising returns over the long term,’ he pointed out.

‘Most of us will have plenty of time until we retire and begin to access our superannuation, and therefore, it is important to block out as much of the noise as possible, and focus on how we are doing over the long term.’

In this instance, Hostplus's Balanced investment option was the top-performing balanced option over a decade, delivering an annual return of 8.3 per cent and ranking among the top 10 performers over the ten years to June.

As you review the latest performance of superannuation funds, it's also crucial to stay vigilant against rising fraud cases.

With scammers increasingly targeting superannuation savings, understanding the top-performing funds is just one part of securing your financial future.

Protecting your super from potential scams is equally important to ensure your hard-earned savings remain safe.

Have you checked your super fund's performance lately? Are you considering making a switch, or have you already done so? Share your experiences and tips in the comments below.

It's the nest egg that they have been nurturing throughout their working lives, and it's crucial to ensure that it's working just as hard as they have.

With that in mind, it's time to pull back the curtain and reveal the top-performing superannuation funds that have been making waves in the financial world, and you can't afford to ignore them if you want to maximise your retirement savings.

According to the investment research group SuperRatings, it's been a banner year for super funds, with international technology and Australian banking shares driving ‘impressive’ returns throughout 2024.

Their research found that the average balanced investment super fund delivered a hearty 8.8 per cent return to members for the year ending June 30, while the top-performing funds achieved double-digit growth figures.

SuperRatings’ latest research revealed Australia’s top-performing superannuation funds. Credit: Shutterstock

For those of you who are with Hostplus’ Indexed Balanced, you might be wearing a particularly broad smile, as this fund topped the balanced strategy charts with a 12.2 per cent return.

Not far behind were Raiz Super’s Moderately Aggressive option and Colonial First State’s Enhanced Index Balanced option, which boasted returns of 12.1 per cent and 11.4 per cent, respectively.

‘Funds with a higher exposure to shares and listed assets generally outperformed for the year, while those with greater exposure to unlisted property reported more subdued outcomes,’ SuperRatings stated in its findings.

Those in the MySuper Lifecycle category, particularly those born between 1975-79, Colonial First State Essential Super MySuper—Lifestage 1975-79 was the standout performer with a return of 14.6 per cent.

Lifecycle funds are designed to adjust your investment mix as you age, shifting from growth-oriented investments in your younger years to more conservative ones as you approach retirement.

Interestingly, according to Executive Director Kirby Rappell, SuperRatings researchers have observed a trend of lifecycle funds increasing their exposure to growth assets like shares.

‘While this has benefited members this year, higher exposure to these assets also comes with increased ups and downs, and we encourage members to learn how their fund’s investment strategy works so they are comfortable with annual and long-term performance outcomes,’ he advised.

Sustainable investments also shone brightly over the past year, with Raiz Super’s Emerald investment option leading the pack with a return of 14.8 per cent.

Mr Rappell stated that although reviewing annual results is helpful, it shouldn't be the sole factor when evaluating your superannuation.

‘The purpose of superannuation is maximising returns over the long term,’ he pointed out.

‘Most of us will have plenty of time until we retire and begin to access our superannuation, and therefore, it is important to block out as much of the noise as possible, and focus on how we are doing over the long term.’

In this instance, Hostplus's Balanced investment option was the top-performing balanced option over a decade, delivering an annual return of 8.3 per cent and ranking among the top 10 performers over the ten years to June.

As you review the latest performance of superannuation funds, it's also crucial to stay vigilant against rising fraud cases.

With scammers increasingly targeting superannuation savings, understanding the top-performing funds is just one part of securing your financial future.

Protecting your super from potential scams is equally important to ensure your hard-earned savings remain safe.

Key Takeaways

- Australia's top-performing superannuation funds have been identified, with some returning impressive profits due to high-performing technology and banking stocks.

- The average balanced investment super fund saw returns of 8.8 per cent over the year, with the best-performing funds hitting double-digit growth.

- Lifecycle superannuation options are shifting towards greater exposure to growth assets like shares, potentially increasing risk but also boosting short-term performance.

- Long-term investment strategies are emphasised as crucial for superannuation, with a focus on consistent returns over periods of ten years or more.

Last edited: