Struggling with a dispute? This new online service promises swift resolution!

By

- Replies 11

Dealing with customer service complaints and disputes can be a lengthy and frustrating process. Many Australians spend hours each year on the phone or going back and forth with companies trying to resolve issues like billing errors, poor service or faulty products.

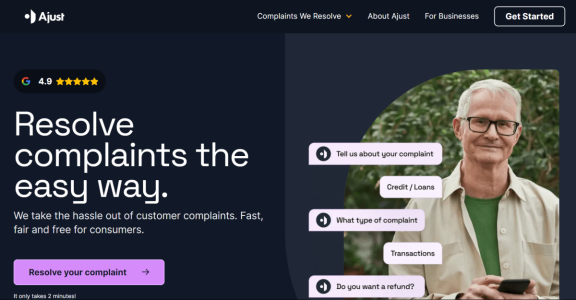

A new Australian startup called Ajust is stepping in to simplify this process and get results fast. Ajust acts as a middleman, taking consumer complaints and lodging them directly with the relevant business on their behalf.

Co-founder Tom Kaldor explains their aim is to 'take away the frustration, and the emotion, and give businesses the essential facts about what's happened for the consumer’. By streamlining the details of a dispute, Ajust allows companies to investigate and respond more efficiently.

The results so far seem promising. Ajust claims it has resolved over 100 cases with major companies across various industries. On average, cases lodged through their platform are settled within just one week—a big improvement over the hours or days many consumers spend trying to reach a resolution directly.

Customers who use Ajust and request compensation are also seeing better outcomes. Data shows the average payout through Ajust is $150, which is 20 per cent higher than what consumers typically ask for.

So, how does the process work? First, consumers simply fill out an online form detailing their complaints or disputes. Ajust's then analyses the information and provides recommendations through artificial intelligence (AI) on strengthening the case before submitting it to the company.

This might all sound too good—where’s the proof that backs it all up?

Enter 36-year-old father Tim Edmeades. When he discovered unexpected charges on his internet bill, he spent 30 minutes on hold with his provider trying to sort it out with his toddler distracting him. It was then that Tim turned to Ajust for a quicker resolution of his case—after all, there was no taking back that 30 minutes lost.

‘I was just annoyed, I was trying to cook dinner, I was trying to be on the phone,’ he said.

‘My three-year-old ran in, nabbed the phone, ran off and managed to hang up.’

When resolving a dispute with a company in Australia, consumers often feel like they’re thrown into a labyrinth of procedures and corporate jargon. The traditional path generally involves initial contact with the business, explaining the situation and hoping for a satisfactory resolution, often via multiple phone calls and email chains.

However, this stage can also be exhausting, sometimes involving many hours of calls and the drafting and sending of strategic, persuasive emails that aim to cut through the red tape and reach a favourable resolution. When this first step fails, individuals may be referred to internal dispute resolution (IDR) departments, which aim to independently evaluate the situation. Perceived as an industry’s chance to ‘clean up its own mess’, IDR departments can be both a lifeline and a further obstacle, depending on how determined and fair they are in resolving issues.

Yet, not all disputes are settled this way. If a customer remains unsatisfied, the next level often involves external dispute resolution schemes such as the Australian Financial Complaints Authority or the Telecommunications Industry Ombudsman. These options provide a higher level of oversight, but can take even longer to reach a decision—weeks or even months, depending upon the complexity of the situation. This process, with its customary pace and difficulty, is the precise time-eater and stress-generator that services like Ajust promise to alleviate.

In contrast to the traditional, slower and more complex path, Ajust caters to the digital age’s need for speed and simplicity. Following the consumer-first ethos, this innovation might be the shot in the arm that consumer dispute management needed.

For those curious about Ajust, their website is found here.

So, members—if you're currently stuck in a complaint or dispute, would you consider letting Ajust take over the reins? Or do you prefer staying on top of it every step of the way? Tell us your thoughts below!

A new Australian startup called Ajust is stepping in to simplify this process and get results fast. Ajust acts as a middleman, taking consumer complaints and lodging them directly with the relevant business on their behalf.

Co-founder Tom Kaldor explains their aim is to 'take away the frustration, and the emotion, and give businesses the essential facts about what's happened for the consumer’. By streamlining the details of a dispute, Ajust allows companies to investigate and respond more efficiently.

The results so far seem promising. Ajust claims it has resolved over 100 cases with major companies across various industries. On average, cases lodged through their platform are settled within just one week—a big improvement over the hours or days many consumers spend trying to reach a resolution directly.

Customers who use Ajust and request compensation are also seeing better outcomes. Data shows the average payout through Ajust is $150, which is 20 per cent higher than what consumers typically ask for.

So, how does the process work? First, consumers simply fill out an online form detailing their complaints or disputes. Ajust's then analyses the information and provides recommendations through artificial intelligence (AI) on strengthening the case before submitting it to the company.

This might all sound too good—where’s the proof that backs it all up?

Enter 36-year-old father Tim Edmeades. When he discovered unexpected charges on his internet bill, he spent 30 minutes on hold with his provider trying to sort it out with his toddler distracting him. It was then that Tim turned to Ajust for a quicker resolution of his case—after all, there was no taking back that 30 minutes lost.

‘I was just annoyed, I was trying to cook dinner, I was trying to be on the phone,’ he said.

‘My three-year-old ran in, nabbed the phone, ran off and managed to hang up.’

When resolving a dispute with a company in Australia, consumers often feel like they’re thrown into a labyrinth of procedures and corporate jargon. The traditional path generally involves initial contact with the business, explaining the situation and hoping for a satisfactory resolution, often via multiple phone calls and email chains.

However, this stage can also be exhausting, sometimes involving many hours of calls and the drafting and sending of strategic, persuasive emails that aim to cut through the red tape and reach a favourable resolution. When this first step fails, individuals may be referred to internal dispute resolution (IDR) departments, which aim to independently evaluate the situation. Perceived as an industry’s chance to ‘clean up its own mess’, IDR departments can be both a lifeline and a further obstacle, depending on how determined and fair they are in resolving issues.

Yet, not all disputes are settled this way. If a customer remains unsatisfied, the next level often involves external dispute resolution schemes such as the Australian Financial Complaints Authority or the Telecommunications Industry Ombudsman. These options provide a higher level of oversight, but can take even longer to reach a decision—weeks or even months, depending upon the complexity of the situation. This process, with its customary pace and difficulty, is the precise time-eater and stress-generator that services like Ajust promise to alleviate.

In contrast to the traditional, slower and more complex path, Ajust caters to the digital age’s need for speed and simplicity. Following the consumer-first ethos, this innovation might be the shot in the arm that consumer dispute management needed.

Key Takeaways

- A new online service, Ajust, promises to make complaints on behalf of customers for free, promising to resolve disputes on average within a week.

- Australians spent nearly 100 million hours speaking to customer service teams last year to solve various issues.

- Ajust uses artificial intelligence to suggest improving the complaint before it is submitted directly to the business.

- According to Tom Kaldor, founder of Ajust, consumers who use his platform to ask for compensation get back around 20 per cent more than they initially requested.

For those curious about Ajust, their website is found here.

So, members—if you're currently stuck in a complaint or dispute, would you consider letting Ajust take over the reins? Or do you prefer staying on top of it every step of the way? Tell us your thoughts below!