Should you reduce your assets to be eligible for the Age Pension?

- Replies 13

If you’re one of the many Aussies who just miss out on being eligible for the aged pension due to being slightly over the asset-test requirements, you may have considered whether or not you should reduce your assets to become eligible for the pension or increase your payments. After all, with the increasing cost of living what helps the most is cash, not necessarily assets, right?

This week, a financial advice column sparked nationwide interest in this topic. Why? A couple with nearly $1 million in assets wrote in hoping to receive the age pension.

The original question is as follows:

‘My wife is 84 and I am 82. Our combined total assets of bank accounts and superannuation are $998,500. We do not receive any Centrelink benefits but would obviously like to receive some aged pension. We own our own home. Any suggestions?’

Sydney Morning Herald columnist, Noel Whittaker, for his part, offered in-depth advice. Whittaker is the author of Retirement Made Simple and numerous other books on personal finance.

While social media was largely in an uproar over the column, it does raise the question: should you ever reduce your assets to become eligible for the age pension or to increase your payments?

We know that getting used to the ins and outs of the pension can be tricky so let’s investigate.

If you’re looking to finalise your pension eligibility, there’s one thing you should know - the cut-off point for the assets test is $935,000 (for a homeowning couple seeking a part pension). That includes both financial investments such as money in the bank and superannuation, as well as items such as furniture and vehicles (which should be valued at the amount shown by Red Book).

It’s interesting to note that, in most cases, your home does not count towards your asset test. You must be living in the residence and there are land size restrictions but this is a significant benefit for homeowning seniors.

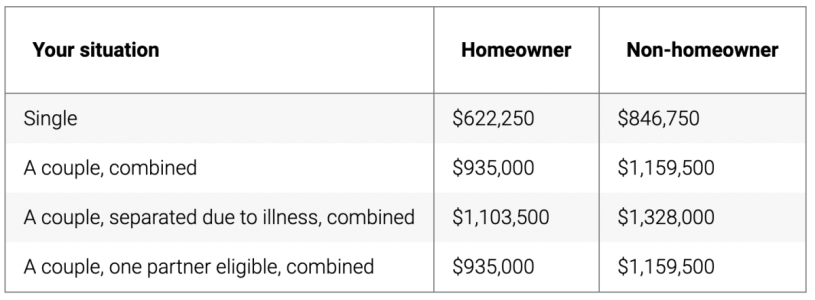

We’ve included the other cut-offs for part pension eligibility below:

If you receive Rent Assistance with your pension, your cut-off point may be higher.

If your assets are above the cut-off, you may be able to reduce your assets to become eligible for the pension or increase your payments, but is it really worth it?

In this example, a considerable reduction of $100,000 to their asset base would yield an annual pension of $7800, presenting a disheartening return on investment considering it would take almost 13 years to recoup the sum. Moreover, inflation and other market-related losses can adversely affect one’s income. This makes the financial decision a rather daunting prospect.

Although it could appear as a wise decision in the immediate term, it is essential to take into account long-term implications.

Other ways to restructure assets include:

‘Gifts’

You could make small annual gifts of up to $10,000 a year (max of $30,000 over 5 years) to reduce total assets, though it likely won’t be enough to help qualify for the pension. (Not in this example, at least.)

You should also note that, regarding ‘Gifts’, Services Australia states, ‘If you give away your income or assets, they may still count towards your income and assets tests. This also applies if you sell them for less than they’re worth.’

So, basically, they’re watching for any funny business.

Income streams

There are also certain income stream products (lifetime annuities) where only 60 per cent of the money counts towards the asset test. But even then, this couple would have to invest around $300,000 just to reduce their assessable assets by $120,000.

Not to mention, this drops to a minimum of 30% when you reach your 84th birthday or a minimum of 5 years from the asset assessment day.

Home renovations or upsizing

Since owner-occupied homes do not contribute to the asset test, you could choose to upsize and purchase a more expensive home. Alternatively, you could also complete renovations on your existing property.

Now, you might already be receiving pension payments but the same applies; the fewer the assets, the greater the age pension payment. While that may sound great, let’s look at the bigger picture.

For every $10,000 of assets above the allowable threshold, your pension rate reduces by $780 per year for individuals or $390 per year each for a couple ($3 a fortnight for every $1000 over asset cut-off). At the end of the day, $10,000 is always worth more than $780.

So is it worth it? While we’re not qualified financial advisors, it’s certainly not something to jump into without ample prior research and Sydney Morning Herald columnist and personal finance author Noel Whittaker came to the same conclusion. Careful restructuring of assets may be advantageous to a small group already on the age pension and looking to increase their payments, however, that will not be the case for everyone.

Everyone's financial position is different, so it's important to discuss with a professional to determine if the financial steps needed to become eligible for the pension are worth it. This list is not exhaustive and should not be considered financial advice.

Seniors, while this is not what you may have been hoping to hear, there are still other options out there.

If you’re looking for more financial security, then you may be eligible for the Commonwealth Seniors Health Card. This can offer you some of the same concessions and benefits as the pension does, depending on your state or territory, and also has much looser eligibility criteria.

If you’re a pensioner, partially, or fully self-funded retiree, we recently wrote about the Government cards you can get to assist with specific expenses. You can read more here.

Bottom line, members? Before you decide to dip into your savings to reduce your assets and become eligible for the pension or increase your pension payments, look into all of your options and do the maths, so you can make an informed decision.

Do you have experience with this? Let us know in the comments below!

This week, a financial advice column sparked nationwide interest in this topic. Why? A couple with nearly $1 million in assets wrote in hoping to receive the age pension.

The original question is as follows:

‘My wife is 84 and I am 82. Our combined total assets of bank accounts and superannuation are $998,500. We do not receive any Centrelink benefits but would obviously like to receive some aged pension. We own our own home. Any suggestions?’

Sydney Morning Herald columnist, Noel Whittaker, for his part, offered in-depth advice. Whittaker is the author of Retirement Made Simple and numerous other books on personal finance.

While social media was largely in an uproar over the column, it does raise the question: should you ever reduce your assets to become eligible for the age pension or to increase your payments?

We know that getting used to the ins and outs of the pension can be tricky so let’s investigate.

If you’re looking to finalise your pension eligibility, there’s one thing you should know - the cut-off point for the assets test is $935,000 (for a homeowning couple seeking a part pension). That includes both financial investments such as money in the bank and superannuation, as well as items such as furniture and vehicles (which should be valued at the amount shown by Red Book).

It’s interesting to note that, in most cases, your home does not count towards your asset test. You must be living in the residence and there are land size restrictions but this is a significant benefit for homeowning seniors.

We’ve included the other cut-offs for part pension eligibility below:

If you receive Rent Assistance with your pension, your cut-off point may be higher.

If your assets are above the cut-off, you may be able to reduce your assets to become eligible for the pension or increase your payments, but is it really worth it?

In this example, a considerable reduction of $100,000 to their asset base would yield an annual pension of $7800, presenting a disheartening return on investment considering it would take almost 13 years to recoup the sum. Moreover, inflation and other market-related losses can adversely affect one’s income. This makes the financial decision a rather daunting prospect.

Although it could appear as a wise decision in the immediate term, it is essential to take into account long-term implications.

Other ways to restructure assets include:

‘Gifts’

You could make small annual gifts of up to $10,000 a year (max of $30,000 over 5 years) to reduce total assets, though it likely won’t be enough to help qualify for the pension. (Not in this example, at least.)

You should also note that, regarding ‘Gifts’, Services Australia states, ‘If you give away your income or assets, they may still count towards your income and assets tests. This also applies if you sell them for less than they’re worth.’

So, basically, they’re watching for any funny business.

Income streams

There are also certain income stream products (lifetime annuities) where only 60 per cent of the money counts towards the asset test. But even then, this couple would have to invest around $300,000 just to reduce their assessable assets by $120,000.

Not to mention, this drops to a minimum of 30% when you reach your 84th birthday or a minimum of 5 years from the asset assessment day.

Home renovations or upsizing

Since owner-occupied homes do not contribute to the asset test, you could choose to upsize and purchase a more expensive home. Alternatively, you could also complete renovations on your existing property.

Now, you might already be receiving pension payments but the same applies; the fewer the assets, the greater the age pension payment. While that may sound great, let’s look at the bigger picture.

For every $10,000 of assets above the allowable threshold, your pension rate reduces by $780 per year for individuals or $390 per year each for a couple ($3 a fortnight for every $1000 over asset cut-off). At the end of the day, $10,000 is always worth more than $780.

So is it worth it? While we’re not qualified financial advisors, it’s certainly not something to jump into without ample prior research and Sydney Morning Herald columnist and personal finance author Noel Whittaker came to the same conclusion. Careful restructuring of assets may be advantageous to a small group already on the age pension and looking to increase their payments, however, that will not be the case for everyone.

Everyone's financial position is different, so it's important to discuss with a professional to determine if the financial steps needed to become eligible for the pension are worth it. This list is not exhaustive and should not be considered financial advice.

Seniors, while this is not what you may have been hoping to hear, there are still other options out there.

If you’re looking for more financial security, then you may be eligible for the Commonwealth Seniors Health Card. This can offer you some of the same concessions and benefits as the pension does, depending on your state or territory, and also has much looser eligibility criteria.

If you’re a pensioner, partially, or fully self-funded retiree, we recently wrote about the Government cards you can get to assist with specific expenses. You can read more here.

Bottom line, members? Before you decide to dip into your savings to reduce your assets and become eligible for the pension or increase your pension payments, look into all of your options and do the maths, so you can make an informed decision.

Do you have experience with this? Let us know in the comments below!