Scammers deploy ‘alarming new tactics’, target vulnerable Aussies

- Replies 2

Get ready for some shocking news, folks; according to a recent report, Australians lost over $3.1 billion to scammers last year! That's right; you read that correctly.

According to the Australian Competition and Consumer Commission's (ACCC) report, scammers are using 'alarming new tactics' to trick unsuspecting victims into handing over their hard-earned cash.

The report revealed that investment scams were the leading cause of financial loss, with a whopping $1.5 billion lost. Remote access scams followed with $229 million lost, while payment redirection scams caused $224 million in losses.

The ACCC compiled the report from data reported to various government agencies, including Scamwatch, ReportCyber, and the Australian Financial Crimes Exchange (AFCX), as well as IDCARE.

Although Scamwatch received 16.5% fewer reports in 2022, financial losses reported were up by a staggering 76%, totalling more than $569 million.

This means scammers are getting more sophisticated and convincing, making it more important than ever to stay vigilant and protect ourselves from these scams.

Despite the drop in reports to Scamwatch last year, the average losses experienced by each victim rose by more than 50%, to almost $20,000. That's a huge amount of money and a devastating blow for victims of these scams.

ACCC Deputy Chair, Catriona Lowe, says that the true cost of scams is not just financial but also emotional distress caused to victims, their families and businesses. It's a reminder that scams are not just a financial issue, but can also impact our mental and emotional well-being.

The ACCC's report highlights that scammers are using increasingly sophisticated tactics, including impersonating official phone numbers, email addresses, and websites of legitimate organisations.

They are even sending scam texts that appear in the same conversation thread as genuine messages. (Remember the story of that unsuspecting family who fell victim to a clever and sinister scam that cost them their entire life savings?)

One of the most alarming findings of the report is that reported losses to phishing scams, such as the 'Hi Mum' and Toll/Linkt text scams, increased by a whopping 469%, amounting to $24.6 million in 2022.

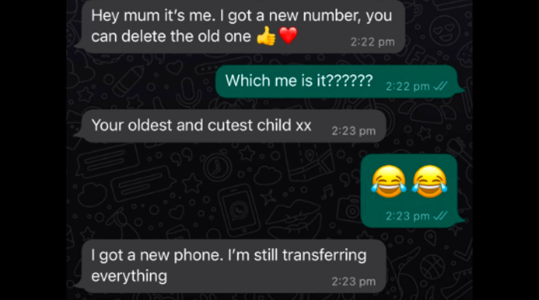

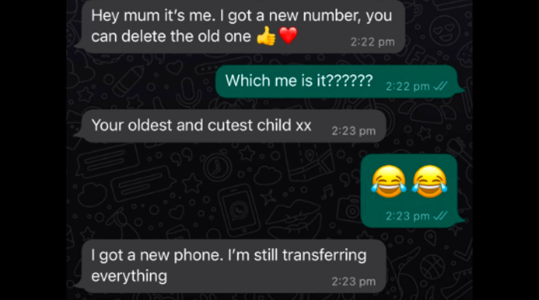

Last month, we shared the heartbreaking story of a mother who fell victim to a scam that cost her $11,000. The scam started with a message on WhatsApp that appeared to be from her daughter, who claimed to have a new phone number due to a broken phone. The scammers even added emojis to make the message seem more genuine.

The mother sent several payments before feeling uneasy and emailing her daughter, only to be contacted almost immediately by her daughter's old number. That's when she realised she had been scammed, and the feeling of losing her hard-earned money left her feeling physically sick.

Unfortunately, this is just one of many scams that target vulnerable individuals and exploit their trust. It's important to stay vigilant and sceptical of any messages or requests for money, especially if they come from unfamiliar sources. Always double-check with a trusted source before sending any money or personal information.

It's not just financial loss that's a concern when it comes to scams in Australia. The 'most vulnerable' members of society, including those experiencing hardship, are also being hit hard.

According to the latest report by the ACCC, people with disabilities reported a 71% increase in financial losses, with a staggering $33.7 million lost. Indigenous Australians also suffered losses of $5.1 million, a 5% rise from the previous year.

Culturally and linguistically diverse communities were also affected, with 11,418 reported scams resulting in losses of $56 million, up 36% from 2021. These figures are shocking.

To make matters worse, millions of Australians were made even more vulnerable to scams following large-scale data breaches last year. These high-profile breaches exposed sensitive information, making people more susceptible to scams that use this information to appear more legitimate.

Security experts also heard reports of fake compensation claims, SIM card replacement requests, verification prompts, and general threats to customers coming in from all over the country. As if being worried about our personal information getting into the wrong hands wasn't enough!

In today's digital age, we must be vigilant about scams and fraudulent activities that are becoming more common and sophisticated. Falling prey to these scams can be devastating, both emotionally and financially.

It's crucial to stay informed about the latest tactics being used by scammers and take steps to protect ourselves and our loved ones.

If you want to keep up-to-date with the latest scams and frauds, make sure to follow the Scam Watch forum on the SDC website. There, you can find similar stories and tips on how to protect yourself and your family from scams. Remember, it's always better to be safe than sorry.

Members, have you or someone you know fallen prey to a scam on social media? Share your experience in the comments and let us know how you dealt with it. Your story might help others avoid similar situations.

Don't forget to give advice on how to stay protected from scams and fraudulent activities. Together, we can help each other stay safe online.

According to the Australian Competition and Consumer Commission's (ACCC) report, scammers are using 'alarming new tactics' to trick unsuspecting victims into handing over their hard-earned cash.

The report revealed that investment scams were the leading cause of financial loss, with a whopping $1.5 billion lost. Remote access scams followed with $229 million lost, while payment redirection scams caused $224 million in losses.

The ACCC compiled the report from data reported to various government agencies, including Scamwatch, ReportCyber, and the Australian Financial Crimes Exchange (AFCX), as well as IDCARE.

Australians lost a record $3.1 billion to scammers in 2022, an 80% increase compared to 2021. Credit: Unsplash/Lindsey Lamont.

Although Scamwatch received 16.5% fewer reports in 2022, financial losses reported were up by a staggering 76%, totalling more than $569 million.

This means scammers are getting more sophisticated and convincing, making it more important than ever to stay vigilant and protect ourselves from these scams.

Despite the drop in reports to Scamwatch last year, the average losses experienced by each victim rose by more than 50%, to almost $20,000. That's a huge amount of money and a devastating blow for victims of these scams.

ACCC Deputy Chair, Catriona Lowe, says that the true cost of scams is not just financial but also emotional distress caused to victims, their families and businesses. It's a reminder that scams are not just a financial issue, but can also impact our mental and emotional well-being.

The ACCC's report highlights that scammers are using increasingly sophisticated tactics, including impersonating official phone numbers, email addresses, and websites of legitimate organisations.

They are even sending scam texts that appear in the same conversation thread as genuine messages. (Remember the story of that unsuspecting family who fell victim to a clever and sinister scam that cost them their entire life savings?)

The ACCC warned that scammers were using 'alarming new tactics', making their crimes harder to detect, such as impersonating official contacts and using phishing texts. Credit: NSW Police.

One of the most alarming findings of the report is that reported losses to phishing scams, such as the 'Hi Mum' and Toll/Linkt text scams, increased by a whopping 469%, amounting to $24.6 million in 2022.

Last month, we shared the heartbreaking story of a mother who fell victim to a scam that cost her $11,000. The scam started with a message on WhatsApp that appeared to be from her daughter, who claimed to have a new phone number due to a broken phone. The scammers even added emojis to make the message seem more genuine.

The mother sent several payments before feeling uneasy and emailing her daughter, only to be contacted almost immediately by her daughter's old number. That's when she realised she had been scammed, and the feeling of losing her hard-earned money left her feeling physically sick.

Unfortunately, this is just one of many scams that target vulnerable individuals and exploit their trust. It's important to stay vigilant and sceptical of any messages or requests for money, especially if they come from unfamiliar sources. Always double-check with a trusted source before sending any money or personal information.

It's not just financial loss that's a concern when it comes to scams in Australia. The 'most vulnerable' members of society, including those experiencing hardship, are also being hit hard.

According to the latest report by the ACCC, people with disabilities reported a 71% increase in financial losses, with a staggering $33.7 million lost. Indigenous Australians also suffered losses of $5.1 million, a 5% rise from the previous year.

Culturally and linguistically diverse communities were also affected, with 11,418 reported scams resulting in losses of $56 million, up 36% from 2021. These figures are shocking.

To make matters worse, millions of Australians were made even more vulnerable to scams following large-scale data breaches last year. These high-profile breaches exposed sensitive information, making people more susceptible to scams that use this information to appear more legitimate.

Security experts also heard reports of fake compensation claims, SIM card replacement requests, verification prompts, and general threats to customers coming in from all over the country. As if being worried about our personal information getting into the wrong hands wasn't enough!

Key Takeaways

- Last year, Australians lost over $3.1 billion to scammers who employed increasingly sophisticated tactics, including impersonating official phone numbers and legitimate websites.

- Investment scams led to the largest financial loss, followed by remote access and payment redirection scams.

- Vulnerable Australians, such as those with disabilities and those from culturally and linguistically diverse communities, were among the most impacted.

In today's digital age, we must be vigilant about scams and fraudulent activities that are becoming more common and sophisticated. Falling prey to these scams can be devastating, both emotionally and financially.

It's crucial to stay informed about the latest tactics being used by scammers and take steps to protect ourselves and our loved ones.

If you want to keep up-to-date with the latest scams and frauds, make sure to follow the Scam Watch forum on the SDC website. There, you can find similar stories and tips on how to protect yourself and your family from scams. Remember, it's always better to be safe than sorry.

Members, have you or someone you know fallen prey to a scam on social media? Share your experience in the comments and let us know how you dealt with it. Your story might help others avoid similar situations.

Don't forget to give advice on how to stay protected from scams and fraudulent activities. Together, we can help each other stay safe online.